Accountants Abbots Langley: Filling in your self-assessment form year after year can really give you a headache. This can be challenging for you and a multitude of other Abbots Langley people in self-employment. But how straightforward is it to obtain a local Abbots Langley professional who can do it on your behalf? If self-assessment is too complex for you, this may be the way forward. Regular accountants in Abbots Langley will typically charge about £200-£300 for this sort of service. By utilizing an online service rather than a local Abbots Langley accountant you can save quite a bit of cash.

So, where's the best place to locate a professional Abbots Langley accountant and what type of service should you expect to receive? The internet is undoubtedly the "in" place to look nowadays, so that would be an excellent place to begin. However, it's not always that easy to spot the good guys from the bad. You must realise that there are no legal restrictions relating to who in Abbots Langley can promote accounting services. They don't even have to hold any qualifications such as BTEC's or A Levels.

Finding a properly qualified Abbots Langley accountant should be your priority. The AAT qualification is the minimum you should look for. Qualified accountants may come with higher costs but may also save you more tax. Accounting fees are of course a business expense and can be included as such on your tax return. Many qualified bookkeepers offer tax returns services for smaller businesses and sole traders.

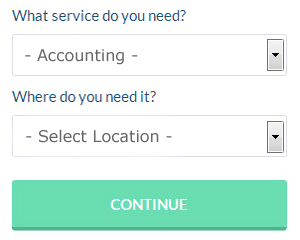

There is now a service available known as Bark, where you can look for local professionals including accountants. You just have to fill in a simple form and answer some basic questions. It is then simply a case of waiting for some suitable responses. You might as well try it because it's free.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. Services like this are convenient and cost effective. Choose a company with a history of good service. Be sure to study customer reviews and testimonials.

At the other extreme of the accounting spectrum are chartered accountants, these highly trained professional are at the top of their game. These people are financial experts and are more commonly used by bigger companies. With a chartered accountant you will certainly have the best on your side.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. To make life even easier there is some intuitive software that you can use. Including Ajaccts, Forbes, Sage, CalCal, Andica, Xero, Taxforward, Taxfiler, Capium, BTCSoftware, TaxCalc, GoSimple, Ablegatio, 123 e-Filing, Keytime, Gbooks, Absolute Topup, ACCTAX, Nomisma, Basetax and Taxshield. In any event the most important thing is to get your self-assessment set in before the deadline.

Tips to Help You Manage Your Business Finances Better

There are many things you can do in life that are exciting, and one of them is starting up your own online or offline business. You're your own boss and you're in control of how much you make. Well, you're basically in charge of everything! That sounds a little scary, doesn't it? In addition to the excitement of being your own boss, it can be a bit intimidating particularly if you have no business experience. In this case, you'll benefit a great deal from knowing a few simple techniques like managing your business finances properly. Today, we've got a few suggestions on how you can keep your finances in order.

If you have a lot of regular expenditures, such as hosting account bills, recurring membership dues, etc, you might be tempted to put them all on a credit card. This certainly makes it easy for you to pay them because you only have to make one payment every month instead. Of course, credit cards are tricky things, and if you let yourself carry a balance, the interest charges could make you pay a lot more money than you would have spent by simply paying the fees straight out of your bank account. You can continue using your credit card to make it easier on you to pay your bills, but make sure you don't carry a balance on your card to avoid accruing interest charges. Not only will this help you deal with just one payment and not have to pay interest charges, this will help boost your credit score as well.

Be aware of where every last cent of your money is being spent, both in your business and personal life. You might balk at the idea of this but it does present a number of advantages. With this money management strategy, you can have a clear picture of just what your spending habits are. Many people are earning decent money but they have poor money management skills that they often find themselves wondering where all their money has gone. Writing it down helps you see exactly where it is going, and if you are on a tight budget, it can help you identify areas in which you have the potential to save quite a lot. Then there's the benefit of streamlining things when you're completing tax forms.

Make sure you deposit any money you receive at the end of the day if your business deals with cash on a fairly regular basis. This will help you eliminate the temptation of using money for non-business related things. For example, if you're out for lunch and you're short on cash, you might be tempted to dip in to the cash in your register and tell yourself you'll return the money the next day or two. It's actually very easy to forget to put the money back in and if you keep doing this, you'll soon screw up your books. You'll be better off putting your money in the bank at the end of each work day.

Proper money management is a skill that every adult needs to develop. When you know exactly what's happening with your money -- where you're spending it, how much is coming in, and so on -- it can be a big boost to your self-confidence and increases the chances of your business becoming profitable. So make sure you use the tips on proper money management that we mentioned in this article. In truth, if you want to improve yourself as you relate to your business, learning proper money management is crucial.

Payroll Services Abbots Langley

Staff payrolls can be a complicated aspect of running a business enterprise in Abbots Langley, irrespective of its size. The regulations regarding payrolls and the legal requirements for accuracy and transparency means that dealing with a business's payroll can be a daunting task.

All small businesses don't have their own in-house financial experts, and the best way to manage employee pay is to retain the services of an independent Abbots Langley payroll service. A payroll service accountant will work along with HMRC, with pensions schemes and deal with BACS payments to make sure that your employees are paid on time, and all required deductions are correct.

It will also be necessary for a qualified payroll management accountant in Abbots Langley to provide an accurate P60 tax form for all employees at the conclusion of the financial year (by May 31st). They will also provide P45 tax forms at the end of a staff member's working contract. (Tags: Payroll Services Abbots Langley, Payroll Companies Abbots Langley, Payroll Accountants Abbots Langley).

Abbots Langley accountants will help with company secretarial services, self-employed registrations Abbots Langley, general accounting services, business support and planning, tax returns, small business accounting, capital gains tax, bookkeeping Abbots Langley, assurance services, audit and auditing Abbots Langley, audit and compliance issues, inheritance tax, cashflow projections, management accounts, financial planning in Abbots Langley, consulting services, workplace pensions Abbots Langley, business advisory services, personal tax in Abbots Langley, double entry accounting in Abbots Langley, National Insurance numbers, accounting support services, accounting services for media companies Abbots Langley, corporate tax, employment law, litigation support in Abbots Langley, payslips, corporate finance Abbots Langley, business outsourcing in Abbots Langley, mergers and acquisitions, tax investigations, debt recovery and other forms of accounting in Abbots Langley, Hertfordshire. These are just a few of the duties that are carried out by local accountants. Abbots Langley providers will inform you of their entire range of accounting services.

Abbots Langley Accounting Services

- Abbots Langley Personal Taxation

- Abbots Langley Business Planning

- Abbots Langley Tax Planning

- Abbots Langley VAT Returns

- Abbots Langley Tax Refunds

- Abbots Langley Forensic Accounting

- Abbots Langley Tax Services

- Abbots Langley Self-Assessment

- Abbots Langley Bookkeeping

- Abbots Langley Tax Advice

- Abbots Langley Tax Returns

- Abbots Langley Account Management

- Abbots Langley Audits

- Abbots Langley Payroll Management

Also find accountants in: Felden, Bovingdon, Perry Green, Nettleden, Welham Green, Flamstead End, Chipping, Broadwater, Therfield, Letchmore Heath, Radlett, Reed, Chapmore End, Weston, Cole Green, South Oxhey, Stevenage, Goffs Oak, Clothall, Stapleford, Letty Green, Harmer Green, Colney Street, Standon, Sandon, High Cross, Wheathampstead, Pirton, Chiswell Green, Caldecote, Great Gaddesden, Digswell, Watton At Stone, St Stephens, Blackmore End and more.

Accountant Abbots Langley

Accountant Abbots Langley Accountants Near Abbots Langley

Accountants Near Abbots Langley Accountants Abbots Langley

Accountants Abbots LangleyMore Hertfordshire Accountants: St Albans, Welwyn Garden City, Bushey, Tring, Abbots Langley, Hatfield, Broxbourne, Hoddesdon, Potters Bar, Berkhamsted, Rickmansworth, Bishops Stortford, Letchworth, Harpenden, Watford, Hertford, Ware, Borehamwood, Hemel Hempstead, Royston, Hitchin, Stevenage and Cheshunt.

TOP - Accountants Abbots Langley - Financial Advisers

Tax Return Preparation Abbots Langley - Self-Assessments Abbots Langley - Online Accounting Abbots Langley - Chartered Accountants Abbots Langley - Financial Accountants Abbots Langley - Auditing Abbots Langley - Tax Advice Abbots Langley - Financial Advice Abbots Langley - Investment Accountant Abbots Langley