Accountants Alton: Filling in your self-assessment form every year can really put your head in a spin. Other small businesses and sole traders in the Alton area are faced with the same challenge. The obvious solution would be to pay a reliable Alton accountant to tackle this task instead. Do you just find self-assessment too challenging to do on your own? This sort of service will usually cost about £200-£300 if you use a regular accountant in Alton. It's possible to get it done more cheaply than this, and using an online service might be worth considering.

There are a number of different branches of accounting. Consequently, it is vital to identify an accountant who can fulfil your requirements. You will have to choose between an accountant working independently or one that is associated with an established accounting company. Having several accounting experts together within a single practice can have many advantages. Usually accounting companies will employ: investment accountants, accounting technicians, forensic accountants, management accountants, tax accountants, auditors, chartered accountants, actuaries, bookkeepers, financial accountants and costing accountants.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. You will of course get a tax deduction on the costs involved in preparing your tax returns. For smaller businesses in Alton, a qualified bookkeeper may well be adequate.

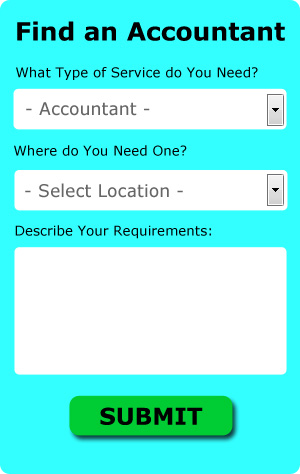

There is an online company called Bark who will do much of the work for you in finding an accountant in Alton. Filling in a clear and simple form is all that you need to do to set the process in motion. All you have to do then is wait for some responses. Why not give Bark a try since there is no charge for this useful service.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. For many self-employed people this is a convenient and time-effective solution. Even if you do decide to go down this route, take some time in singling out a trustworthy company. Have a good look at customer testimonials and reviews both on the company website and on independent review websites.

At the other extreme of the accounting spectrum are chartered accountants, these highly trained professional are at the top of their game. These powerhouses know all the ins and out of the financial world and generally represent large large companies and conglomerates. So, these are your possible options.

At the end of the day you could always do it yourself and it will cost you nothing but time. Software is also available to make doing your self-assessment even easier. Some of the best ones include Keytime, Andica, Capium, Absolute Topup, Ablegatio, 123 e-Filing, Taxforward, Ajaccts, Taxfiler, GoSimple, ACCTAX, Forbes, Xero, Gbooks, BTCSoftware, Basetax, Taxshield, Nomisma, Sage, TaxCalc and CalCal. You'll receive a fine if your self-assessment is late. You will receive a fine of £100 if you are up to three months late with your tax return.

Practicing Better Money Management to Help Your Business Succeed

If you've just launched your business, you'll find out soon enough that properly using money management strategies is not that easy to learn. Some people think that money management is a skill that should be already learned or mastered. However, there is a huge difference between managing your personal finances and managing your business finances, although it can help if you've got some experience in the former. Your confidence can take a hard hit if you ruin your finances on accident. Keep reading to learn some of the things that you can do to practice better money management for your business.

Your invoices must be numbered. You may not think that this simple tactic of keeping your invoices numbered is a big deal but wait till your business has grown. When your invoices are numbered, you won't have a difficult time tracking things down. You're able to track people who still owe you and for how much and even quickly find out who have already paid. There are going to come times when a client will insist that he has paid you and having a numbered invoice to look up can be very helpful in that situation. Errors can happen in business too and if you've got your invoices numbered, it makes it easy for you to find those mistakes.

You may be your own boss, but it's still a good idea to give yourself a regular paycheck. This can make it easier to keep track of your accounting both in your personal life and your professional life. All payments you get from selling goods or offering services should go straight to your business account. Every two weeks or every month, write yourself a paycheck and then deposit that to your personal account. It's up to you how much salary you want to give yourself. Your salary can be a portion of how much your business brought in for the month or it can be based on how many hours you worked.

Keep a tight lid on your spending. It's understandable that now you've got money coming in, you'll want to start spending money on things you were never able to afford in the past. It's best if you spend money on things that will benefit your business. Put your money in your business savings account so that if unexpected business expenses come up, you'll have the means to deal with it in a prompt manner. You should also try buying your business supplies in bulk. For your office equipment, it's much better if you spend a little more on quality rather than on equipment that you will have to replace often. Avoid spending too much on your entertainment as well; be moderate instead.

Proper money management is something that everyone should develop, no matter if they own a business or not. When you know exactly what's happening with your money -- where you're spending it, how much is coming in, and so on -- it can be a big boost to your self-confidence and increases the chances of your business becoming profitable. So keep in mind the tips we've shared. If you want your business to be a success, it's important that you develop money management skills.

Forensic Accounting Alton

When you're on the lookout for an accountant in Alton you will doubtless notice the expression "forensic accounting" and wonder what the differences are between a regular accountant and a forensic accountant. The clue for this is the actual word 'forensic', which basically means "appropriate for use in a court of law." Using accounting, auditing and investigative skills to discover irregularities in financial accounts which have been involved in theft or fraud, it's also often called 'forensic accountancy' or 'financial forensics'. There are a few bigger accountants firms throughout Hampshire who've got specialised divisions for forensic accounting, addressing personal injury claims, professional negligence, insolvency, insurance claims, bankruptcy, money laundering and tax fraud. (Tags: Forensic Accounting Alton, Forensic Accountant Alton, Forensic Accountants Alton)

Alton accountants will help with compliance and audit reports Alton, accounting services for media companies, corporation tax Alton, mergers and acquisitions, consulting services, limited company accounting Alton, business acquisition and disposal, double entry accounting, cash flow, small business accounting in Alton, self-employed registration, business outsourcing Alton, employment law, year end accounts in Alton, corporate finance Alton, personal tax, financial and accounting advice in Alton, business advisory services in Alton, general accounting services in Alton, bureau payroll services, National Insurance numbers Alton, business support and planning Alton, sole traders, payroll accounting, litigation support in Alton, VAT registrations, inheritance tax Alton, pension forecasts, workplace pensions, tax returns in Alton, accounting services for property rentals, PAYE and other accounting services in Alton, Hampshire. These are just some of the activities that are performed by nearby accountants. Alton providers will let you know their entire range of accountancy services.

When you're searching for advice and inspiration for personal tax assistance, accounting & auditing, self-assessment help and small business accounting, you don't need to look any further than the world wide web to find all the information that you need. With such a wide range of meticulously written blog posts and webpages to select from, you will pretty quickly be deluged with ideas and concepts for your forthcoming project. Just recently we spotted this illuminating article on the subject of choosing an accountant for your business.

Alton Accounting Services

- Alton Forensic Accounting

- Alton Chartered Accountants

- Alton Bookkeeping

- Alton Financial Advice

- Alton Personal Taxation

- Alton Payroll Management

- Alton Tax Investigations

- Alton Self-Assessment

- Alton VAT Returns

- Alton Tax Advice

- Alton Debt Recovery

- Alton Specialist Tax

- Alton Bookkeeping Healthchecks

- Alton Auditing Services

Also find accountants in: Sherfield English, Freefolk, Ashford Hill, Leckford, Bramshott, Hythe, Barton Stacey, Hartley Wintney, Pamber Green, Southington, Langrish, Andover Down, Harbridge, Sopley, Dean, Stoke Charity, Easton, Fareham, Monxton, Alton, North Baddesley, Northam, Bramdean, Woolston, Coldrey, Brown Candover, Portsmouth, Swanmore, Charter Alley, Upton, Colden Common, Martyr Worthy, Bank, Shipton Bellinger, Ibthorpe and more.

Accountant Alton

Accountant Alton Accountants Near Me

Accountants Near Me Accountants Alton

Accountants AltonMore Hampshire Accountants: Southampton, Eastleigh, Alton, Aldershot, Yateley, Emsworth, Waterlooville, Fareham, Basingstoke, Hythe, Winchester, Andover, Fleet, Hedge End, New Milton, Farnborough, Southsea, Havant, Stubbington, Portsmouth, Totton, Gosport and Horndean.

TOP - Accountants Alton - Financial Advisers

Online Accounting Alton - Financial Advice Alton - Tax Return Preparation Alton - Tax Accountants Alton - Auditing Alton - Self-Assessments Alton - Financial Accountants Alton - Chartered Accountants Alton - Affordable Accountant Alton