Accountants Basingstoke: There are many benefits to be gained from hiring the professional services of an accountant if you are running a business or are self-employed in the Basingstoke area. One of the main advantages will be that with your accountant managing the routine financial paperwork and bookkeeping, you should have a lot more free time to spend on what you do best, the actual running of your core business. This sort of financial help is crucial for any business, but is especially beneficial for start-up businesses. Having access to professional financial advice will help your Basingstoke business to grow and prosper.

With various different types of accountants advertising in Basingstoke it can be baffling. Finding one who dovetails neatly with your business is crucial. You may choose to pick one who works independently or one within a company or practice. Accounting practices will usually have different divisions each dealing with a specific discipline of accounting. Most accountancy firms will be able to offer: forensic accountants, bookkeepers, chartered accountants, financial accountants, investment accountants, management accountants, cost accountants, tax accountants, actuaries, accounting technicians and auditors.

Therefore you should check that your chosen Basingstoke accountant has the appropriate qualifications to do the job competently. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. Qualified accountants in Basingstoke might cost more but they will do a proper job. It should go without saying that accountants fees are tax deductable.

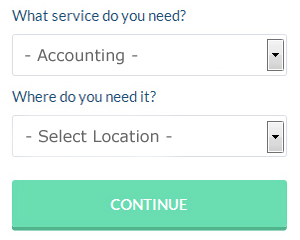

One online service which helps people like you find an accountant is Bark. You just have to fill in a simple form and answer some basic questions. Accountants in your local area will be sent your details, and if they are interested in doing the work will contact you shortly.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. Services like this are convenient and cost effective. If you decide to go with this method, pick a company with a decent reputation. It should be a simple task to find some online reviews to help you make your choice. Sorry but we cannot recommend any individual service on this website.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! Software is also available to make doing your self-assessment even easier. Some of the best ones include Taxfiler, Xero, 123 e-Filing, GoSimple, Absolute Topup, Sage, Nomisma, Gbooks, Ablegatio, Ajaccts, Taxforward, TaxCalc, Capium, Keytime, Forbes, ACCTAX, Andica, Basetax, Taxshield, BTCSoftware and CalCal. In any event the most important thing is to get your self-assessment set in before the deadline.

Small Business Accountants Basingstoke

Making certain that your accounts are accurate can be a challenging job for anyone running a small business in Basingstoke. A focused small business accountant in Basingstoke will offer you a stress free solution to keep your VAT, tax returns and annual accounts in the best possible order.

Offering guidance, ensuring your business follows the best financial practices and suggesting methods to help your business to reach its full potential, are just a sample of the duties of an honest small business accountant in Basingstoke. An accountancy firm in Basingstoke will provide an assigned small business accountant and mentor who will clear away the fog that shrouds the world of business taxation, so as to optimise your tax efficiency.

It is essential that you explain your business structure, your company's circumstances and your plans for the future accurately to your small business accountant. (Tags: Small Business Accountants Basingstoke, Small Business Accountant Basingstoke, Small Business Accounting Basingstoke).

Forensic Accounting Basingstoke

You may well run into the expression "forensic accounting" when you are trying to find an accountant in Basingstoke, and will probably be interested to learn about the difference between forensic accounting and regular accounting. The clue for this is the word 'forensic', which essentially means "relating to or denoting the application of scientific techniques and methods to the investigation of crime." Using investigative skills, accounting and auditing to identify inconsistencies in financial accounts which have resulted in fraud or theft, it's also sometimes called 'financial forensics' or 'forensic accountancy'. There are a few larger accountants firms in Hampshire who've got specialised divisions for forensic accounting, addressing personal injury claims, professional negligence, tax fraud, insolvency, money laundering, falsified insurance claims and bankruptcy. (Tags: Forensic Accountant Basingstoke, Forensic Accounting Basingstoke, Forensic Accountants Basingstoke)

The Best Money Management Techniques for Business Self Improvement

Deciding to start your own business is easy, but knowing how to start your own business is hard and actually getting your small business up and running is even harder. For many new business owners, it's hardest to make their business profitable mainly because of the things that can happen during the process that can adversely impact the business and their self-confidence. Take for example your finances. If you don't learn proper money management, you and your business will be facing tough times. During the initial stages of your business, managing your money may be a simple task. Over time, though, as you earn more money, it can become quite complicated, so use these tips to help you out.

Have an account that's just for your business expenses and another for your personal expenses. It may be simple to keep track of everything in the beginning, but over time, you'll find it's so much easier to track your expenses if you have separate accounts. For one, it's a lot harder to prove your income when your business expenses are running through a personal account. When it's time for you to file your taxes, it'll be a nightmare to sort through your financial records and identifying just which expenses went to your business and which ones went for personal things like groceries, utilities, and such. Having separate accounts for your personal and business finances will save you a lot of headaches in the long run.

You can help yourself by finding out how to keep your books. Make sure you've got a system set up for your money, whether it's business or personal. You can either use basic spreadsheet or software such as QuickBooks. In addition, you can make use of personal budgeting tools such as Mint.com. There are also many no-cost resources for those who own a small business to help them properly manage their bookkeeping. You'll know exactly what's happening to your business and personal finances when you've got your books in order. And if you just can't afford to pay for a full-time bookkeeper for your small business, it'll serve you well to take a basic accounting and bookkeeping class at your community college.

If you receive cash payments, it's a good idea to deposit it to your bank account daily or as soon as you can to eliminate the temptation. You might need a few extra bucks to pay for lunch and you might think, "oh I'll put this back in a couple of days." It's actually very easy to forget to put the money back in and if you keep doing this, you'll soon screw up your books. You can avoid this problem by putting your cash in your bank account at the end of the day.

A lot of things go into proper money management. Managing your money is not a basic skill or easy thing to learn. It's really a complicated process that requires constant learning and practicing, especially by small business owners. The tips we've shared should help you get started in managing your finances properly. If you want your business to be profitable, you need to stay on top of your finances.

Basingstoke accountants will help with VAT payer registration Basingstoke, assurance services, small business accounting, corporate finance in Basingstoke, self-assessment tax returns, auditing and accounting, partnership registrations, contractor accounts Basingstoke, litigation support, PAYE, investment reviews, management accounts in Basingstoke, workplace pensions, limited company accounting, VAT returns in Basingstoke, tax investigations, business advisory, general accounting services, accounting services for the construction industry, pension planning, audit and compliance reports, inheritance tax, double entry accounting Basingstoke, bookkeeping, employment law, cash flow, partnership accounts, capital gains tax, business outsourcing in Basingstoke, accounting services for buy to let landlords, National Insurance numbers, taxation accounting services and other types of accounting in Basingstoke, Hampshire. These are just an example of the activities that are handled by local accountants. Basingstoke providers will be happy to inform you of their full range of accounting services.

Basingstoke Accounting Services

- Basingstoke Tax Advice

- Basingstoke Tax Returns

- Basingstoke Bookkeeping

- Basingstoke Financial Advice

- Basingstoke PAYE Healthchecks

- Basingstoke Self-Assessment

- Basingstoke Financial Audits

- Basingstoke Tax Refunds

- Basingstoke Bookkeeping Healthchecks

- Basingstoke Chartered Accountants

- Basingstoke Forensic Accounting

- Basingstoke Payroll Management

- Basingstoke Business Accounting

- Basingstoke Debt Recovery

Also find accountants in: Hatherden, Fyfield, Everton, Ashurst, Soberton Heath, Hound Green, Medstead, Portswood, Little London, Curdridge, East Tytherley, Weyhill, Wyck, Godshill, Fordingbridge, Blackmoor, Clanfield, Horton Heath, Exton, Cowplain, Penton Mewsey, Brook, Hook, Portsea, Eastney, Compton, Newtown, Bradley, Hedge End, Hambledon, Walhampton, Heath End, High Cross, Eversley, West Town and more.

Accountant Basingstoke

Accountant Basingstoke Accountants Near Basingstoke

Accountants Near Basingstoke Accountants Basingstoke

Accountants BasingstokeMore Hampshire Accountants: Emsworth, Gosport, Waterlooville, Farnborough, Southampton, Aldershot, Fareham, Andover, Havant, Hythe, Eastleigh, Hedge End, Winchester, Basingstoke, Horndean, Alton, New Milton, Portsmouth, Southsea, Totton, Stubbington, Fleet and Yateley.

TOP - Accountants Basingstoke - Financial Advisers

Financial Advice Basingstoke - Online Accounting Basingstoke - Tax Return Preparation Basingstoke - Auditors Basingstoke - Self-Assessments Basingstoke - Financial Accountants Basingstoke - Affordable Accountant Basingstoke - Small Business Accountants Basingstoke - Tax Advice Basingstoke