Accountants Beverley: Do you get nothing but a headache when you are filling out your yearly self-assessment form? Lots of self-employed people in Beverley feel much the same as you. You might instead choose to hire an experienced Beverley accountant to take the load off your back. Perhaps it is simply the case that self-assessment is too complex for you to do by yourself. £200-£300 is the average cost for such a service when using Beverley High St accountants. If this seems like a lot to you, then consider using an online service.

So, exactly what should you expect to pay for this service and what should you get for your money? At one time the local newspaper or Yellow Pages would have been the first place to head, but nowadays the internet is much more popular. But, precisely who can you trust? It is always worthwhile considering that it's possible for practically any Beverley individual to advertise themselves as a bookkeeper or accountant. They do not need to have any specific qualifications. Which, like me, you may find incredible.

Find yourself a properly qualified one and don't take any chances. An AAT qualified accountant should be adequate for sole traders and small businesses. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction. A bookkeeper may be qualified enough to do your tax returns unless you are a large Limited Company.

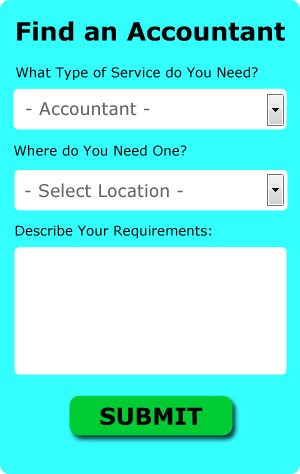

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Beverley accountant. Tick a few boxes on their form and submit it in minutes. It is then simply a case of waiting for some suitable responses. Try this free service because you've got nothing to lose.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. This may save time and be more cost-effective for self-employed people in Beverley. You still need to pick out a company offering a reliable and professional service. Study reviews and customer feedback.

There is always the option of using a chartered accountant, but expect to pay top wack for these high flyers. These people are financial experts and are more commonly used by bigger companies. We have now outlined all of your available choices.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. It is also a good idea to make use of some self-assessment software such as GoSimple, Ajaccts, 123 e-Filing, TaxCalc, Absolute Topup, CalCal, Nomisma, Xero, Sage, Gbooks, Forbes, Ablegatio, Keytime, Taxforward, ACCTAX, BTCSoftware, Basetax, Taxfiler, Taxshield, Andica or Capium to simplify the process. Getting your self-assessment form submitted on time is the most important thing.

Actuaries Beverley

Actuaries and analysts are professionals in the management of risk. They apply their in-depth knowledge of economics and business, along with their understanding of statistics, investment theory and probability theory, to provide financial, commercial and strategic guidance. Actuaries provide assessments of financial security systems, with an emphasis on their mathematics, mechanisms and complexity. (Tags: Actuaries Beverley, Actuary Beverley, Financial Actuaries Beverley)

Proper Money Management for Improving Your Business and Yourself

Want to put up your own business? Making the decision is quite easy. However, knowing exactly how to start it is a different matter altogether, and actually getting the business up and running can be a huge challenge. It is most difficult to make your business profitable because there are so many things that can take place along the way that will not just negatively affect your business but your confidence level as well. For example, failure on your part to properly manage your finances will contribute to this. In the beginning, you might think that money management isn't something you should focus on because you can easily figure out your earning and expenses. However, as the business grows, its finances will become complicated, so keep these tips in mind for when you need them.

It can be tempting to wait to pay your taxes until they are due, but if you are not good at managing your money, you may not have the funds on hand to actually pay your estimated tax payments and other fees. To prevent yourself from coming up short, set money aside with every payment your receive. This is a good strategy because when your taxes come due every quarter, you've already got money set aside and you won't be forced to take money out from your current earnings. It sounds lame, but it can be really satisfying to be able to pay your taxes in full and on time.

You may be your own boss, but it's still a good idea to give yourself a regular paycheck. This makes the process of accounting your personal and business life so much easier. All payments you get from selling goods or offering services should go straight to your business account. Every two weeks or every month, write yourself a paycheck and then deposit that to your personal account. Just how much money you pay yourself is completely up to you. You can pay yourself by billable hours or a portion of your business income for that month.

Take control of your spending. It's certainly very tempting to start buying things you've always wanted when the money is coming in. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. You should also try buying your business supplies in bulk. For your office equipment, it's much better if you spend a little more on quality rather than on equipment that you will have to replace often. While it's a good idea to spend on your entertainment, be careful that you spend too much on it.

When you know the right way to manage your finances, you can expect not just your business to improve but yourself overall as well. These are a few of the tips and tricks that will help you better keep track of your financial situation. You're much more likely to experience business and personal success when you have your finances under control.

Auditors Beverley

An auditor is a person or a firm appointed by a company or organisation to execute an audit, which is an official evaluation of an organisation's accounts, typically by an unbiased entity. Auditors examine the financial procedures of the company that employs them to make certain of the constant operation of the business. To act as an auditor, a person should be certified by the regulating authority of auditing and accounting or have specified qualifications. (Tags: Auditing Beverley, Auditor Beverley, Auditors Beverley)

Beverley accountants will help with assurance services, business acquisition and disposal, company secretarial services, accounting services for the construction industry, accounting and financial advice, taxation accounting services, corporate finance, PAYE, payroll accounting Beverley, investment reviews, audit and auditing, consultancy and systems advice, contractor accounts, general accounting services Beverley, National Insurance numbers, HMRC submissions Beverley, financial statements, small business accounting, consulting services, business start-ups, litigation support, estate planning, self-employed registration, year end accounts Beverley, cash flow, HMRC liaison, workplace pensions, self-assessment tax returns Beverley, pension planning, inheritance tax Beverley, debt recovery, management accounts and other accounting related services in Beverley, East Yorkshire. These are just a handful of the activities that are performed by local accountants. Beverley providers will let you know their whole range of services.

Beverley Accounting Services

- Beverley Tax Planning

- Beverley VAT Returns

- Beverley Business Accounting

- Beverley PAYE Healthchecks

- Beverley Specialist Tax

- Beverley Tax Refunds

- Beverley Self-Assessment

- Beverley Bookkeepers

- Beverley Auditing Services

- Beverley Tax Returns

- Beverley Debt Recovery

- Beverley Financial Advice

- Beverley Forensic Accounting

- Beverley Account Management

Also find accountants in: Laxton, Walkington, Bellasize, Kelleythorpe, Paull, Hotham, Nunburnholme, Little Driffield, Melbourne, Burton Agnes, Swine, Wetwang, Sutton Upon Derwent, Towthorpe, Great Driffield, Newton Upon Derwent, Sproatley, Lowthorpe, Burnby, Hedon, Laytham, Winestead, Kirk Ella, North Frodingham, Huggate, Londesborough, Riplingham, Coniston, Beswick, Bishop Burton, Barmby Moor, Holmpton, Aldbrough, Leconfield, South Newbald and more.

Accountant Beverley

Accountant Beverley Accountants Near Beverley

Accountants Near Beverley Accountants Beverley

Accountants BeverleyMore East Yorkshire Accountants: Hessle, Cottingham, Goole, Driffield, Beverley, Hull and Bridlington.

TOP - Accountants Beverley - Financial Advisers

Small Business Accountant Beverley - Investment Accountant Beverley - Online Accounting Beverley - Financial Advice Beverley - Cheap Accountant Beverley - Chartered Accountant Beverley - Bookkeeping Beverley - Financial Accountants Beverley - Self-Assessments Beverley