Accountants Burgess Hill: Do you find it a bit of a headache filling in your self-assessment form year after year? This is an issue for you and countless other folks in Burgess Hill. You may instead opt to hire a qualified Burgess Hill accountant to take the load off your shoulders. Is self-assessment a tad too complicated for you to do by yourself? A typical Burgess Hill accountant will probably charge around £200-£300 for submitting these forms. If this seems like a lot to you, then look at using an online service.

But which accounting service is best for your needs and how might you go about locating it? Nowadays the go to place for finding local services is the internet, and accountants are certainly no exception, with plenty marketing their services online. But, are they all trustworthy? You should bear in mind that practically anyone in Burgess Hill can advertise themselves as a bookkeeper or accountant. Qualifications are not even a prerequisite. Which to many people would seem rather crazy.

Finding an accountant in Burgess Hill who is qualified is generally advisable. Your minimum requirement should be an AAT qualified accountant. Qualified accountants in Burgess Hill might cost more but they will do a proper job. It should go without saying that accountants fees are tax deductable. Local Burgess Hill bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

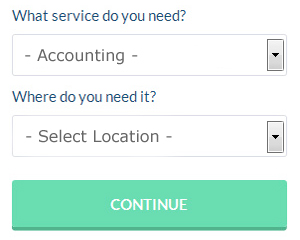

One online service which helps people like you find an accountant is Bark. You will quickly be able to complete the form and your search will begin. Your requirements will be distributed to accountants in the Burgess Hill area and they will be in touch with you directly.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. This kind of service may not suit everyone but could be the answer for your needs. Should you decide to go down this route, take care in choosing a legitimate company. A quick browse through some reviews online should give you an idea of the best and worse services.

Going from the cheapest service to the most expensive, you could always use a chartered accountant if you are prepared to pay the price. These people are financial experts and are more commonly used by bigger companies. Hiring the services of a chartered accountant means you will have the best that money can buy.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. Available software that will also help includes TaxCalc, Taxshield, Gbooks, Ajaccts, Ablegatio, Sage, 123 e-Filing, Capium, Keytime, Forbes, ACCTAX, Andica, BTCSoftware, Xero, Taxfiler, CalCal, Basetax, Nomisma, Absolute Topup, GoSimple and Taxforward. If you don't get your self-assessment in on time you will get fined by HMRC.

Boost Your Confidence and Your Business By Learning Better Money Management

Whether you're starting up an online or offline business, it can be one of the most exciting things you'd ever do. You're your own boss and you're in control of how much you make. Well, you're basically in charge of everything! It's a bit scary, isn't it? Truly, while exhilarating, starting your own business is also quite intimidating because it can be quite difficult to find your feet. In this case, you'll benefit a great deal from knowing a few simple techniques like managing your business finances properly. Keep reading this article to learn how to correctly manage your money.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. Sure, it may seem easy to manage your finances, personal and business, if you just have one account right now, but when your business really takes off, you're going to wish you had a separate account. For one thing, proving your income is much more difficult when you run your business expenses through a personal account. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. You'll be able to manage your finances better if you separate the business expenses from the personal expenses.

Learn how to keep your books. Make sure you've got a system set up for your money, whether it's business or personal. For this, you can use a basic spreadsheet or go with software like Quicken. There are also other online tools you can use, like Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. It's crucial that you keep your books in order because they provide you a clear picture of what your finances (both personal and business) look like. And if you just can't afford to pay for a full-time bookkeeper for your small business, it'll serve you well to take a basic accounting and bookkeeping class at your community college.

Do not forget to pay your taxes on time. Small businesses typically pay file taxes quarterly. It's crucial that you have the most current and accurate information when it comes to small business taxes. For this, it's best that you get your information from the IRS or from the local small business center. Additionally, you can have a professional set up a payment plan for you to ensure that you're paying your taxes promptly and that you're meeting all your business obligation as required by the law. It's not at all a pleasant experience having the IRS chasing after you for tax evasion.

You can improve yourself in many ways when you're managing your own business. Having a business can help you hone your money management skills. Everyone can use help in learning how to manage money better. When you know how to properly manage your money, your self-confidence will improve in the process. You'll also be able to organize many aspects of your business and personal life. Managing your money for your business shouldn't be a difficult or overwhelming task. Try to use the tips we've shared in this article.

Small Business Accountants Burgess Hill

Ensuring that your accounts are accurate can be a demanding job for any small business owner in Burgess Hill. A decent small business accountant in Burgess Hill will provide you with a hassle-free means to keep your annual accounts, tax returns and VAT in perfect order.

An experienced small business accountant in Burgess Hill will regard it as their responsibility to help develop your business, and provide you with reliable financial guidance for peace of mind and security in your particular circumstances. An accountancy firm in Burgess Hill will provide you with an assigned small business accountant and mentor who will remove the fog that shrouds business taxation, in order to optimise your tax efficiency.

You also ought to be provided with a dedicated accountancy manager who has a deep understanding of your plans for the future, your company's circumstances and the structure of your business. (Tags: Small Business Accountant Burgess Hill, Small Business Accounting Burgess Hill, Small Business Accountants Burgess Hill).

Burgess Hill accountants will help with HMRC submissions Burgess Hill, management accounts, PAYE, small business accounting, business outsourcing, consulting services in Burgess Hill, capital gains tax, accounting services for media companies in Burgess Hill, business disposal and acquisition, tax preparation in Burgess Hill, sole traders in Burgess Hill, accounting and financial advice, bureau payroll services, annual tax returns Burgess Hill, business advisory services, consultancy and systems advice, business planning and support in Burgess Hill, taxation accounting services, company formations, investment reviews, charities, auditing and accounting, employment law Burgess Hill, accounting support services Burgess Hill, partnership registration in Burgess Hill, company secretarial services Burgess Hill, corporate finance, payslips, business start-ups, VAT returns, mergers and acquisitions in Burgess Hill, bookkeeping and other forms of accounting in Burgess Hill, West Sussex. These are just a handful of the activities that are performed by nearby accountants. Burgess Hill companies will keep you informed about their entire range of accountancy services.

Burgess Hill Accounting Services

- Burgess Hill Self-Assessment

- Burgess Hill Bookkeeping

- Burgess Hill Tax Planning

- Burgess Hill Taxation Advice

- Burgess Hill PAYE Healthchecks

- Burgess Hill VAT Returns

- Burgess Hill Tax Returns

- Burgess Hill Personal Taxation

- Burgess Hill Chartered Accountants

- Burgess Hill Financial Advice

- Burgess Hill Tax Refunds

- Burgess Hill Debt Recovery

- Burgess Hill Tax Services

- Burgess Hill Bookkeeping Healthchecks

Also find accountants in: Selsey, Lowfield Heath, Hassocks, Charlton, Sullington, Monks Gate, Pulborough, Earnley, Runcton, Twineham, Coombes, Partridge Green, Washington, The Bar, Nyton, Faygate, Broomers Corner, Bolney, Strettington, Henley, Rudgwick, Bilsham, East Grinstead, Fernhurst, Brockhurst, Lindfield, Mannings Heath, Didling, Elsted, Woodgate, Bucks Green, Balls Cross, Woolbeding, West Dean, Barns Green and more.

Accountant Burgess Hill

Accountant Burgess Hill Accountants Near Burgess Hill

Accountants Near Burgess Hill Accountants Burgess Hill

Accountants Burgess HillMore West Sussex Accountants: Crawley, Southwater, Lancing, Shoreham-by-Sea, Horsham, Rustington, Bognor Regis, Chichester, Burgess Hill, Worthing, Haywards Heath, Southwick, Hurstpierpoint, East Grinstead and Littlehampton.

TOP - Accountants Burgess Hill - Financial Advisers

Online Accounting Burgess Hill - Auditing Burgess Hill - Small Business Accountants Burgess Hill - Bookkeeping Burgess Hill - Tax Preparation Burgess Hill - Affordable Accountant Burgess Hill - Self-Assessments Burgess Hill - Tax Advice Burgess Hill - Financial Accountants Burgess Hill