Accountants Burslem: For those of you who are self-employed or running a business in the Burslem area, using the expert services of an accountant can have numerous benefits. Among the many benefits are the fact that you should have more time to focus your attention on core business operations whilst time consuming and routine bookkeeping can be expertly dealt with by your accountant. Being able to access expert financial advice is even more vital for new businesses. A lot of Burslem businesses have been able to prosper due to having this kind of professional help.

So, what should you expect to pay for this service and what do you get for your money? Most Burslem accountants have their own dedicated websites, therefore browsing round the internet is an excellent starting point for your search. But, how do you know who to trust? You must always remember that it is possible for anybody in Burslem to state that they're an accountant. Qualifications aren't even a prerequisite. Which, when considering the importance of the work would seem a tad peculiar.

You should take care to find a properly qualified accountant in Burslem to complete your self-assessment forms correctly and professionally. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. You can then be sure your tax returns are done correctly. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form. Local Burslem bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

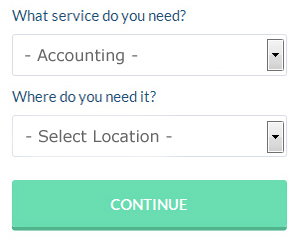

You could use an online service like Bark who will help you find an accountant. Filling in a clear and simple form is all that you need to do to set the process in motion. You should start getting responses from local Burslem accountants within the next 24 hours. This service is free of charge.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. An increasing number of self-employed people are plumping for this option. There is no reason why this type of service will not prove to be as good as your average High Street accountant. Be sure to study customer reviews and testimonials. Apologies, but we do not endorse, recommend or advocate any specific company.

If you are prepared to slash out and really get the best, you would be looking at using a chartered accountant for your finances. Accountants must be members of the ICAEW (or ICAS in Scotland) to work as a chartered accountant. With a chartered accountant you will certainly have the best on your side.

At the end of the day you could always do it yourself and it will cost you nothing but time. Using accounting software like TaxCalc, Ajaccts, Taxfiler, GoSimple, Sage, Absolute Topup, Andica, Capium, ACCTAX, Basetax, Ablegatio, Gbooks, Taxshield, Keytime, Taxforward, Forbes, BTCSoftware, Nomisma, CalCal, Xero or 123 e-Filing will make it even simpler to do yourself. You'll receive a fine if your self-assessment is late.

Auditors Burslem

Auditors are specialists who evaluate the fiscal accounts of organisations and businesses to verify the legality and validity of their financial reports. They also often act as advisors to suggest potential risk prevention measures and the application of cost efficiency. Auditors should be accredited by the regulatory body for auditing and accounting and have the necessary accounting qualifications.

Forensic Accounting Burslem

When you're looking to find an accountant in Burslem you'll probably encounter the term "forensic accounting" and wonder what the difference is between a standard accountant and a forensic accountant. The clue for this is the word 'forensic', which basically means "suitable for use in a law court." Also known as 'forensic accountancy' or 'financial forensics', it uses accounting, auditing and investigative skills to discover inconsistencies in financial accounts which have contributed to fraud or theft. Some larger accounting companies in the Burslem area may even have specialist forensic accounting divisions with forensic accountants targeting particular kinds of fraud, and might be dealing with insolvency, professional negligence, false insurance claims, money laundering, bankruptcy, personal injury claims and tax fraud. (Tags: Forensic Accounting Burslem, Forensic Accountants Burslem, Forensic Accountant Burslem)

Improving Yourself and Your Business with the Help of the Top Money Management Techniques

Proper money management is something that many small business owners have to struggle with, especially when they are still trying to get their feet wet as a business owner. These struggles can affect your confidence and if you're having financial problems with your business, the idea of quitting and going back to your old 9-to-5 job becomes more appealing. This, believe it or not, can keep you from reaching the level of success that you want to reach. Keep reading to learn a few tips you can use to help you manage your finances better.

It can be tempting to wait to pay your taxes until they are due, but if you are not good at managing your money, you may not have the funds on hand to actually pay your estimated tax payments and other fees. You can save yourself the headache by putting a portion of each payment you get in a separate account. This way, when it comes time to pay your taxes for the quarter, you'll already have the money on hand and won't have to worry about coming up with it on time. As a business owner, you'll be able to breathe easily each time knowing that you're able to pay your taxes fully and promptly.

Track both your personal and business expenses down to the last penny. It's actually helpful when you know where each penny is being spent. This way, you'll be able to see your spending habits. Nobody likes that feeling of "I know I'm earning money, where is it going?" This is helpful when you're on a tight budget because you'll be able to see exactly which expenditures you can cut back on so you can save money. You're also streamlining things when you're completing your tax forms when you have a complete, detailed record of your business and personal expenditures.

It's a good idea to keep your receipts. If the IRS ever demands proof of your business expenses, receipts will come in handy. For another, they act as a record of all of your expenditures. It's a good idea to have one place where you keep your receipt. This will make it easy for you to track down certain amounts for expenditures you may not recognize in your bank account because you didn't write them down. The best way to store your receipts is in an accordion file and then have this file in a drawer in your desk so you can easily go through your receipts if you need to.

When it comes to improving yourself and your business, proper money management is one of the most essential things you can learn. These are a few of the tips and tricks that will help you better keep track of your financial situation. When you've got your finances under control, you can expect your business and personal life to be a success.

Burslem accountants will help with pension planning, partnership accounts in Burslem, year end accounts, accounting support services, payslips, corporation tax, payroll accounting, financial statements, accounting services for start-ups, National Insurance numbers, compliance and audit issues Burslem, business disposal and acquisition, tax preparation, personal tax, mergers and acquisitions in Burslem, corporate finance in Burslem, estate planning, financial planning, bureau payroll services, limited company accounting, company secretarial services, employment law in Burslem, business outsourcing, capital gains tax, double entry accounting, bookkeeping Burslem, HMRC liaison, assurance services, contractor accounts Burslem, sole traders in Burslem, charities, self-employed registrations and other accounting services in Burslem, Staffordshire. Listed are just an example of the duties that are performed by nearby accountants. Burslem companies will tell you about their full range of accountancy services.

Burslem Accounting Services

- Burslem Specialist Tax

- Burslem Account Management

- Burslem Tax Planning

- Burslem Self-Assessment

- Burslem Auditing

- Burslem Business Accounting

- Burslem Tax Refunds

- Burslem Tax Returns

- Burslem Forensic Accounting

- Burslem Bookkeepers

- Burslem PAYE Healthchecks

- Burslem Chartered Accountants

- Burslem Personal Taxation

- Burslem Taxation Advice

Also find accountants in: Burslem, Draycott In The Clay, Beamhurst, Fulford, Ilam, Chorley, Croxton, Chesterfield, Fradswell, Denstone, Red Street, Weeford, Millmeece, Colwich, Newborough, Smallthorne, Brund, Newchapel, Ashley, Horsebrook, Haughton, Weston Under Lizard, Pershall, Bonehill, Baddeley Green, Hednesford, Abbey Hulton, Yoxall, Stafford, Shut Heath, Fole, Orslow, Little Haywood, Hulme End, Calton and more.

Accountant Burslem

Accountant Burslem Accountants Near Me

Accountants Near Me Accountants Burslem

Accountants BurslemMore Staffordshire Accountants: Newcastle-under-Lyme, Lichfield, Stoke-on-Trent, Stafford, Burntwood, Hanley, Leek, Kidsgrove, Tamworth, Burslem, Wombourne, Biddulph, Hednesford, Rugeley, Cannock, Stone, Uttoxeter, Heath Hayes, Fenton, Longton and Burton-upon-Trent.

TOP - Accountants Burslem - Financial Advisers

Online Accounting Burslem - Auditors Burslem - Self-Assessments Burslem - Tax Advice Burslem - Bookkeeping Burslem - Tax Preparation Burslem - Investment Accountant Burslem - Small Business Accountants Burslem - Financial Accountants Burslem