Accountants Calne: Few will argue that if you are a self-employed person or run a small business in Calne, getting an accountant to do your books, brings a variety of positive benefits. Among the many benefits are the fact that you will have more time to concentrate on core business operations whilst time consuming and routine bookkeeping can be expertly handled by your accountant. This form of financial help is essential for any business, but is particularly helpful for start-up businesses. The wellbeing and prosperity of your company in Calne could be influenced by you getting the proper help and guidance.

When searching for a local Calne accountant, you will notice that there are lots of different types available. Therefore, it is vital to identify an accountant who can fulfil your requirements exactly. It isn't unusual for Calne accountants to work independently, others favour being part of a larger accountancy company. Having several accounting experts together within a single office can have many benefits. The level of expertise within a practice might include management accountants, investment accountants, tax accountants, auditors, chartered accountants, financial accountants, accounting technicians, forensic accountants, bookkeepers, actuaries and costing accountants.

You should take care to find a properly qualified accountant in Calne to complete your self-assessment forms correctly and professionally. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. You can then be sure your tax returns are done correctly. The cost of preparing your self-assessment form can be claimed back as a business expense.

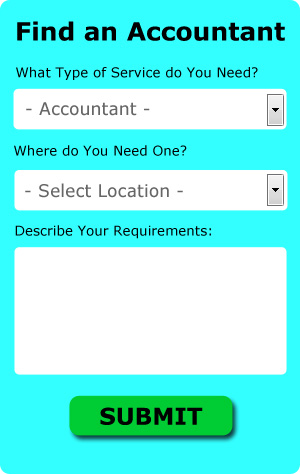

There is now a service available known as Bark, where you can look for local professionals including accountants. It is just a case of ticking some boxes on a form. All you have to do then is wait for some responses.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. The popularity of these services has been increasing in recent years. You still need to pick out a company offering a reliable and professional service. Check out some customer testimonials for companies you are considering.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. A lot of software programs have been developed in recent years to help people do their own self assessment returns. Among the best known are Ablegatio, Taxfiler, Nomisma, Taxforward, Sage, Ajaccts, GoSimple, Absolute Topup, ACCTAX, Keytime, Capium, Basetax, 123 e-Filing, BTCSoftware, CalCal, Taxshield, Xero, TaxCalc, Andica, Forbes and Gbooks. Make sure your tax returns are sent off promptly to avoid getting a penalty fine. Self-assessment submissions up to three months late receive a £100 fine, with further fines for extended periods.

How to Manage Your Finances Better If Your a Small Business Owner

It's not so hard to make a decision to start your own business. However, it's not so easy to start it up if you don't know how to, and it's even harder to get it up and running actually. It isn't that simple nor painless to get your business at a profitable level because there are things that will affect both your business and self-confidence. Failing to manage your money properly is one of the things that can contribute to this. During the initial stages of your business, managing your money may be a simple task. Over time, though, as you earn more money, it can become quite complicated, so use these tips to help you out.

In case you're paying many business expenses on a regular basis, you may find it easier to charge them on your credit card. With this method, you don't need to make multiple payment and risk forgetting to pay any one of them on time. But beware of credit cards. If you keep a balance there every month, you're going to be paying interest and it can actually cost you more than if you just went ahead and paid for your expenses directly from your bank account. So if you want to keep it all on your bank account, you need to make sure that you pay off your credit card in full each month. When you do this, you streamline your process and not have to pay interest. Your credit rating will get a boost in the process.

Try to learn bookkeeping. You need to have a system set up for your money -- both personally and professionally. You can either use basic spreadsheet or software such as QuickBooks. In addition, you can make use of personal budgeting tools such as Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. Your books are the key to you knowing precisely how and where your money (personal and business) is being spent. It won't hurt if you take a class or two on basic bookkeeping and accounting, as this could prove helpful to you especially if you don't think you can afford to hire a professional to manage your books.

Do you receive cash payments regularly in your business? It may be a good idea to deposit money at the end of the day or as soon as possible. This will minimize the temptation of having money available that you can easily spend. You might need a few extra bucks to pay for lunch and you might think, "oh I'll put this back in a couple of days." But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. You'll be better off putting your money in the bank at the end of each work day.

Whether you're a business owner or not, it's important that you learn proper money management. Knowing what you have coming in, what you have going out, and what exactly is going on with your money can be a huge boost to your confidence and success. Use the tips in this article to help you get started. In truth, if you want to improve yourself as you relate to your business, learning proper money management is crucial.

Auditors Calne

An auditor is a person or company appointed by an organisation or firm to perform an audit, which is the official evaluation of the financial accounts, normally by an unbiased entity. Auditors evaluate the fiscal behaviour of the company that hires them and make certain of the steady functioning of the business. Auditors need to be certified by the regulating body for auditing and accounting and have the required qualifications.

Payroll Services Calne

Payrolls for staff can be a stressful area of running a company in Calne, irrespective of its size. Handling staff payrolls requires that all legal obligations in relation to their timings, openness and exactness are observed to the minutest detail.

All small businesses don't have their own in-house financial specialists, and an easy way to take care of employee payrolls is to retain the services of an external Calne accounting company. Working along with HMRC and pension schemes, a payroll service accountant will also handle BACS payments to employees, ensuring that they're paid promptly every month, and that all deductions are done accurately.

A qualified payroll accountant in Calne will also, in accordance with the current legislation, organise P60's after the end of the financial year for every one of your workers. At the end of a staff member's contract, the payroll company will also supply a current P45 form relating to the tax paid in the previous financial period.

Small Business Accountants Calne

Doing the accounts and bookkeeping can be a stress-filled experience for anybody running a small business in Calne. A decent small business accountant in Calne will offer you a hassle-free method to keep your VAT, tax returns and annual accounts in perfect order.

Offering advice, ensuring your business follows the best fiscal practices and providing techniques to help your business reach its full potential, are just a sample of the responsibilities of an honest small business accountant in Calne. An effective accounting firm in Calne will offer you proactive small business advice to maximise your tax efficiency while lowering expense; crucial in the sometimes murky field of business taxation.

It is vital that you clarify the structure of your business, your current financial circumstances and your plans for the future truthfully to your small business accountant. (Tags: Small Business Accounting Calne, Small Business Accountants Calne, Small Business Accountant Calne).

Actuaries Calne

Actuaries work alongside businesses and government departments, to help them in anticipating long-term financial expenditure and investment risks. They use their mathematical knowledge to gauge the probability and risk of future happenings and to estimate their effect on a business. Actuaries provide reviews of financial security systems, with a focus on their mathematics, their mechanisms and their complexity.

Calne accountants will help with accounting support services, contractor accounts, consultancy and systems advice Calne, limited company accounting in Calne, mergers and acquisitions Calne, PAYE in Calne, partnership accounts, self-employed registration, partnership registrations, accounting services for media companies, business planning and support in Calne, investment reviews, small business accounting, accounting and financial advice, taxation accounting services, employment law in Calne, estate planning, financial planning, sole traders, business outsourcing in Calne, VAT registration, business disposal and acquisition Calne, tax preparation, capital gains tax, bookkeeping Calne, HMRC liaison, financial statements Calne, general accounting services in Calne, double entry accounting, corporate tax, tax returns, charities and other professional accounting services in Calne, Wiltshire. These are just some of the activities that are conducted by nearby accountants. Calne providers will keep you informed about their entire range of services.

You do, in fact have the best possible resource close at hand in the shape of the world wide web. There's such a lot of information and inspiration readily available online for stuff like accounting for small businesses, personal tax assistance, accounting & auditing and self-assessment help, that you will very quickly be deluged with ideas for your accounting requirements. An example might be this compelling article on the subject of choosing an accountant for your business.

Calne Accounting Services

- Calne Forensic Accounting

- Calne Chartered Accountants

- Calne Self-Assessment

- Calne Bookkeeping Healthchecks

- Calne Tax Returns

- Calne Debt Recovery

- Calne Taxation Advice

- Calne Tax Services

- Calne Tax Refunds

- Calne Bookkeepers

- Calne Payroll Services

- Calne Auditing Services

- Calne Business Accounting

- Calne Business Planning

Also find accountants in: Perham Down, Colerne, Mead End, Eastcott, Avebury, Wick, Berwick St James, Chedglow, Collingbourne Kingston, Bradenstoke, Marston Meysey, Latton, Milton Lilbourne, Clevancy, Chute Standen, Sutton Mandeville, St Ediths Marsh, Upavon, Cadley, Leigh, Chittoe, Broad Blunsdon, Shaw, Mere, West Amesbury, Bulford, Broughton Gifford, Trowbridge, Edington, Wilcot, Chiseldon, Fovant, Sherston, Middle Winterslow, Shrewton and more.

Accountant Calne

Accountant Calne Accountants Near Calne

Accountants Near Calne Accountants Calne

Accountants CalneMore Wiltshire Accountants: Amesbury, Devizes, Bradford-on-Avon, Calne, Corsham, Wootton Bassett, Swindon, Chippenham, Trowbridge, Warminster, Salisbury, Melksham, Tidworth, Marlborough and Westbury.

TOP - Accountants Calne - Financial Advisers

Bookkeeping Calne - Self-Assessments Calne - Online Accounting Calne - Tax Preparation Calne - Financial Advice Calne - Auditing Calne - Small Business Accountants Calne - Financial Accountants Calne - Chartered Accountant Calne