Accountants Carlton: For those of you who are self-employed in Carlton, a major headache each year is filling in your annual self-assessment form. You, along with plenty of others who are self-employed in Carlton, face this annual trauma. But is there an easy way to find a local Carlton accountant to accomplish this task for you? If you find that doing your self-assessment tax return is too stressful, this may be the best alternative. The average Carlton accountant or bookkeeper will charge about £200-£300 for doing your tax returns. People who consider this too expensive have the added option of using an online tax return service.

When searching for a nearby Carlton accountant, you'll find there are lots of different kinds available. A local accountant who perfectly satisfies your requirements is the one you should be searching for. It's not unusual for Carlton accountants to work independently, others prefer being part of a larger accountancy firm. In the case of accountancy practices, there'll be several accountants, each having their own specialities. Among the key accounting jobs are: forensic accountants, tax accountants, management accountants, financial accountants, chartered accountants, actuaries, accounting technicians, costing accountants, auditors, bookkeepers and investment accountants.

You should take care to find a properly qualified accountant in Carlton to complete your self-assessment forms correctly and professionally. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. You will of course get a tax deduction on the costs involved in preparing your tax returns. Carlton sole traders often opt to use bookkeeper rather than accountants for their tax returns.

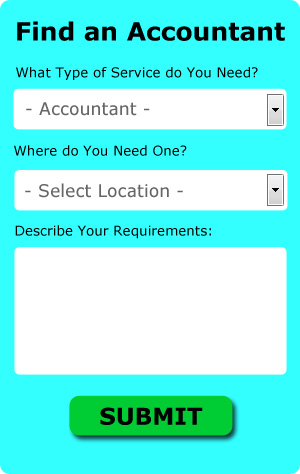

Though you may not have heard of them before there is an online service called Bark who can help you in your search. Tick a few boxes on their form and submit it in minutes. You should start getting responses from local Carlton accountants within the next 24 hours. There is no fee for this service.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. More accountants are offering this modern alternative. Picking a reputable company is important if you choose to go with this option. Have a good look at customer testimonials and reviews both on the company website and on independent review websites.

If you decide to bite the bullet and tackle the process by yourself there is lots of help on offer. It is also a good idea to make use of some self-assessment software such as Gbooks, Absolute Topup, Taxshield, TaxCalc, ACCTAX, Keytime, Basetax, Nomisma, Capium, Andica, 123 e-Filing, CalCal, BTCSoftware, Taxfiler, Ajaccts, Sage, Forbes, Ablegatio, Taxforward, Xero or GoSimple to simplify the process. Whatever happens you need to get your self-assessment form in on time. The fine for late submissions (up to 3 months) is £100.

Forensic Accountant Carlton

While engaged on your search for a certified accountant in Carlton there's a fair chance that you'll happen on the term "forensic accounting" and be curious about what that is, and how it is different from normal accounting. The clue for this is the actual word 'forensic', which essentially means "relating to or denoting the application of scientific methods and techniques to the investigation of a crime." Using investigative skills, auditing and accounting to discover inaccuracies in financial accounts which have contributed to theft or fraud, it is also often called 'forensic accountancy' or 'financial forensics'. Some of the bigger accountancy companies in and around Carlton even have specialised divisions investigating professional negligence, insolvency, bankruptcy, insurance claims, money laundering, personal injury claims and tax fraud.

Actuaries Carlton

Analysts and actuaries are experts in risk management. An actuary uses statistical and financial practices to ascertain the probability of a specific event occurring and its potential monetary ramifications. Actuaries provide judgements of financial security systems, with an emphasis on their mathematics, mechanisms and complexity.

Payroll Services Carlton

For any business enterprise in Carlton, from large scale organisations down to independent contractors, staff payrolls can be challenging. The legislation regarding payroll for openness and accuracy mean that processing a company's staff payroll can be a daunting task for those not trained in this discipline.

A small business might not have the advantage of an in-house financial expert and the easiest way to cope with employee payrolls is to hire an independent payroll company in Carlton. Your payroll company will manage accurate BACS payments to your staff, as well as working with any pension scheme administrators your company might have, and use current HMRC regulations for deductions and NI contributions.

It will also be necessary for a payroll management company in Carlton to prepare an accurate P60 declaration for each staff member at the end of the financial year (by 31st May). Upon the termination of a staff member's contract with your business, the payroll company should also provide an updated P45 outlining what tax has been paid in the previous financial period.

Auditors Carlton

An auditor is an individual or a firm appointed by a company to execute an audit, which is an official inspection of an organisation's financial accounts, typically by an unbiased body. Auditors assess the financial procedures of the firm that employs them and make certain of the unwavering operation of the business. For anybody to become an auditor they should have certain specific qualifications and be licensed by the regulatory body for auditing and accounting.

Improve Your Business and Yourself By Learning Better Money Management

If you've just launched your business, you'll find out soon enough that properly using money management strategies is not that easy to learn. Being able to manage money may seem like a skill you should already possess before you go into business. The reality, however, is that budgeting and financial planning for your business is a lot different from budgeting and financial planning for your personal life. It does help a lot if you have some experience in the latter. Your confidence can take a hard hit if you ruin your finances on accident. Keep reading to learn some of the things that you can do to practice better money management for your business.

Get yourself an accountant. Don't neglect the importance of having an accountant managing your books full time. An accountant can easily monitor your business cash flow, help you pay yourself, and even determine the right amount of taxes you should be paying and when. What's more, she'll deal with all of the paperwork that is associated with those things. This frees you up and lets you concentrate on other aspects of your business. With an accountant, you'll save many hours (or even days) figuring out your books.

Offer your clients payment plans. This isn't just a good idea for your business in terms of landing more clients, it's a good idea for your finances because it means that you will have money coming in regularly. Having payments come in regularly even if they aren't in huge amounts is certainly so much better than getting big payments irregularly. If you have steady income coming in, you're in a better position to plan your budget, get your bills paid on time, and properly manage your money in general. This can certainly boost your self-confidence.

Be a prompt tax payer. Typically, small businesses must pay taxes every quarter. When it comes to taxes, you want to make sure you have accurate information, so it's a good idea to consult with someone at the small business center in your town, city, or county or even with someone from the IRS. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. It's not at all a pleasant experience having the IRS chasing after you for tax evasion.

Whether you're a business owner or not, it's important that you learn proper money management. When you know how your money is being used, where it is going, how much is coming in, and so on, you're going to be able to run a more successful business and your confidence level will be high. Try implementing the above tips in your business. If you want your business to be a success, it's important that you develop money management skills.

Carlton accountants will help with self-assessment tax returns in Carlton, cash flow, bureau payroll services, business outsourcing in Carlton, company formations in Carlton, debt recovery, accounting services for the construction sector, payroll accounting, business support and planning Carlton, corporate finance, corporation tax, sole traders, limited company accounting, charities in Carlton, management accounts in Carlton, business start-ups in Carlton, company secretarial services Carlton, consultancy and systems advice, personal tax in Carlton, employment law, assurance services, mergers and acquisitions, self-employed registrations, year end accounts, pension planning, accounting services for media companies, investment reviews in Carlton, payslips, capital gains tax, litigation support, VAT registrations, consulting services and other accounting related services in Carlton, Nottinghamshire. Listed are just a selection of the tasks that are accomplished by nearby accountants. Carlton companies will be delighted to keep you abreast of their whole range of accounting services.

With the world wide web as an unlimited resource it is of course surprisingly easy to find lots of valuable ideas and inspiration about self-assessment help, accounting & auditing, personal tax assistance and accounting for small businesses. As an example, with a quick search we found this intriguing article on choosing the right accountant for your business.

Carlton Accounting Services

- Carlton Specialist Tax

- Carlton Bookkeeping

- Carlton Tax Returns

- Carlton Tax Planning

- Carlton Auditing Services

- Carlton Business Accounting

- Carlton Bookkeeping Healthchecks

- Carlton Forensic Accounting

- Carlton Tax Services

- Carlton Chartered Accountants

- Carlton Account Management

- Carlton PAYE Healthchecks

- Carlton VAT Returns

- Carlton Payroll Services

Also find accountants in: Hawksworth, Easthorpe, Woodthorpe, Mansfield Woodhouse, West Bridgford, Kimberley, Sutton Bonington, Rampton, Sutton In Ashfield, Moorhouse, Lowdham, Annesley Woodhouse, Barnby Moor, Orston, Wilford, Coddington, Balderton, Ordsall, Girton, Toton, Laxton, Fiskerton, Brough, Willoughby On The Wolds, Cotham, Bole, Headon, Styrrup, Epperstone, Thoresby, Upper Broughton, Thurgarton, Halloughton, Askham, New Brinsley and more.

Accountant Carlton

Accountant Carlton Accountants Near Me

Accountants Near Me Accountants Carlton

Accountants CarltonMore Nottinghamshire Accountants: Worksop, Stapleford, Newark-on-Trent, Carlton, Sutton-in-Ashfield, West Bridgford, Beeston, Eastwood, Arnold, Hucknall, Nottingham, Retford and Mansfield.

TOP - Accountants Carlton - Financial Advisers

Investment Accountant Carlton - Financial Accountants Carlton - Chartered Accountant Carlton - Financial Advice Carlton - Affordable Accountant Carlton - Online Accounting Carlton - Auditors Carlton - Tax Preparation Carlton - Small Business Accountant Carlton