Accountants Consett: If you are a sole trader, are running a small business or are otherwise self-employed in Consett, you will find certain advantages to having your own accountant. Among the many benefits are the fact that you'll have more time to focus on core business activities while routine and time consuming bookkeeping can be confidently handled by your accountant. For those new to business it can be a good idea to do a bit of bookwork yourself however don't be frightened to ask for some extra assistance.

So, what do you get for your hard earned money and what's the best way to locate an accountant in Consett, County Durham? A few potential candidates can soon be located by conducting a quick search on the internet. But, which of these candidates will you be able to put your trust in? You should never forget that anyone in Consett can claim to be an accountant. They do not even have to hold any qualifications such as BTEC's or A Levels. Which does seem a bit crazy.

For completing your self-assessment forms in Consett you should find a properly qualified accountant. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent.

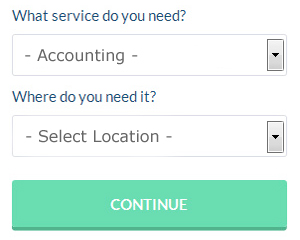

By using an online service such as Bark.com you could be put in touch with a number of local accountants. Tick a few boxes on their form and submit it in minutes. Then you just have to wait for some prospective accountants to contact you. Make the most of this service because it is free.

If you prefer the cheaper option of using an online tax returns service there are several available. While not recommended in every case, it could be the ideal solution for you. Choose a company with a history of good service. Have a good look at customer testimonials and reviews both on the company website and on independent review websites. We prefer not to recommend any particular online accounting company here.

At the top of the tree are chartered accountants, these professionals have all the qualifications and are experts in their field. These powerhouses know all the ins and out of the financial world and generally represent large large companies and conglomerates. So, at the end of the day the choice is yours.

Of course, completing and sending in your own self-assessment form is the cheapest solution. A lot of software programs have been developed in recent years to help people do their own self assessment returns. Among the best known are Taxforward, Ablegatio, Gbooks, Xero, Ajaccts, Basetax, Capium, ACCTAX, BTCSoftware, Forbes, Taxshield, Nomisma, 123 e-Filing, Andica, TaxCalc, Sage, Absolute Topup, Keytime, GoSimple, Taxfiler and CalCal. Getting your self-assessment form submitted on time is the most important thing. Self-assessment submissions up to three months late receive a £100 fine, with further fines for extended periods.

Forensic Accounting Consett

When you're looking to find an accountant in Consett you will doubtless come across the expression "forensic accounting" and be curious about what the differences are between a forensic accountant and a standard accountant. The hint for this is the word 'forensic', which basically means "appropriate for use in a law court." Also often known as 'forensic accountancy' or 'financial forensics', it uses accounting, investigative skills and auditing to detect inaccuracies in financial accounts which have resulted in theft or fraud. There are even several bigger accountants firms in County Durham who've got specialised sections for forensic accounting, addressing insolvency, tax fraud, insurance claims, professional negligence, personal injury claims, bankruptcy and money laundering.

Actuary Consett

An actuary manages, advises on and evaluates finance related risks. Such risks can impact on both sides of the balance sheet and require valuation, asset management and liability management skills. An actuary uses math and statistics to appraise the fiscal effect of uncertainty and help their customers minimise risk. (Tags: Actuaries Consett, Financial Actuaries Consett, Actuary Consett)

Tips for Better Money Management

Many new business owners have a hard time managing money the right away, especially when they're still trying to figure out most of the things they need to do to run a business. When you're managing your finances poorly, your confidence in yourself might go down, especially when your business isn't being as profitable as you'd hope. This could actually make you feel like giving up and returning to your old job. This, believe it or not, can keep you from reaching the level of success that you want to reach. Use the following tips to help you manage your money better.

Find yourself an accountant who's competent. This is a business expense that will pay for itself a hundredfold because you know your books will be in order. Your accountant will be keeping track of the money that your business is bringing in and the money that goes on your expenditures. She will also help you figure out just how much you should pay yourself as well as how much money you need to pay for taxes. The best part is that you won't have to deal with the paperwork because your accountant will take care of that for you. You, then, are free to concentrate on the other areas of building your business, like taking care of your clients, marketing, etc. An accountant can save you days of time and quite a lot of headaches.

Set a salary and pay yourself on a regular basis even though you're running your own business and you may be the only "employee" you have This will actually help you organize and manage your business and personal finances better. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. You can decide how much you should pay yourself. Your salary can be an hourly rate or a portion of your business income.

Make sure you deposit any money you receive at the end of the day if your business deals with cash on a fairly regular basis. This will help you eliminate the temptation of using money for non-business related things. It's so easy to take a couple of dollars here and there when you're short on cash and just say you'll put back in however much you took. But it's not hard at all to forget that you "owe" money to your business and if you do this often enough, your books are going to get all screwed up and you'll be wondering why the numbers don't add up. You'll be better off putting your money in the bank at the end of each work day.

Not only does learning how to properly manage your money help you improve yourself, it helps improve your business too. You'll benefit a great deal if you remember and put these tips we've shared to use. You're in a much better position for business and personal success when you know how to manage your finances better.

Small Business Accountants Consett

Company accounting and bookkeeping can be a fairly stress-filled experience for any owner of a small business in Consett. If your accounts are getting the better of you and VAT and tax return issues are causing sleepless nights, it is wise to employ a small business accountant in Consett.

Giving guidance, ensuring that your business follows the optimum fiscal practices and providing ways to help your business reach its full potential, are just some of the responsibilities of an honest small business accountant in Consett. A good accounting firm in Consett should be able to offer you proactive small business advice to maximise your tax efficiency while minimising business costs; vital in the sometimes shady sphere of business taxation.

It is also vital that you explain your future plans, your business structure and your company's financial situation truthfully to your small business accountant.

Payroll Services Consett

For any company in Consett, from large scale organisations down to independent contractors, staff payrolls can be stressful. Coping with staff payrolls demands that all legal obligations in relation to their timing, exactness and openness are observed to the minutest detail.

A small business might not have the luxury of its own financial expert and the simplest way to deal with the issue of staff payrolls is to employ an outside accountant in Consett. A managed payroll service accountant will work alongside HMRC, with pensions schemes and take care of BACS payments to ensure that your personnel are paid promptly, and that all mandatory deductions are accurate.

It will also be necessary for a certified payroll accountant in Consett to prepare an accurate P60 declaration for each employee after the end of the financial year (by 31st May). A P45 should also be presented to any member of staff who finishes working for your business, as outlined by current legislation.

Consett accountants will help with pension forecasts, small business accounting Consett, business planning and support, audit and compliance reports, self-employed registration in Consett, double entry accounting, partnership accounts, National Insurance numbers in Consett, accounting support services in Consett, accounting services for the construction sector, workplace pensions, business outsourcing Consett, payslips Consett, capital gains tax, sole traders, inheritance tax, contractor accounts, auditing and accounting, year end accounts in Consett, limited company accounting in Consett, bureau payroll services Consett, taxation accounting services, investment reviews in Consett, self-assessment tax returns Consett, partnership registrations, cashflow projections, company secretarial services, management accounts in Consett, mergers and acquisitions, consulting services in Consett, VAT returns, HMRC liaison in Consett and other professional accounting services in Consett, County Durham. These are just a few of the tasks that are performed by nearby accountants. Consett providers will be happy to tell you about their full range of services.

With the internet as an unlimited resource it is extremely easy to uncover plenty of invaluable ideas and inspiration about auditing & accounting, small business accounting, self-assessment help and personal tax assistance. To illustrate, with a brief search we found this compelling article on the subject of choosing an accountant for your business.

Consett Accounting Services

- Consett VAT Returns

- Consett Audits

- Consett Personal Taxation

- Consett Financial Advice

- Consett PAYE Healthchecks

- Consett Bookkeeping Healthchecks

- Consett Tax Planning

- Consett Specialist Tax

- Consett Business Planning

- Consett Debt Recovery

- Consett Bookkeepers

- Consett Forensic Accounting

- Consett Tax Refunds

- Consett Payroll Management

Also find accountants in: Newton Bewley, Iveston, Cornsay Colliery, Crawleyside, Staindrop, Foxton, Low Redford, Tantobie, Blackwell, Mordon, Barnard Castle, Eastgate, Brandon, Grange Villa, West Rainton, Walworth, Seaton Carew, Trimdon, Shotley Bridge, Healeyfield, Waskerley, Cleatlam, Consett, Crimdon Park, Frosterley, High Leven, Bolam, Brignall, Little Stainton, Bradbury, High Grange, Howden Le Wear, Greta Bridge, Billingham, Morley and more.

Accountant Consett

Accountant Consett Accountants Near Consett

Accountants Near Consett Accountants Consett

Accountants ConsettMore County Durham Accountants: Peterlee, Durham, Newton Aycliffe, Bishop Auckland, Consett, Billingham, Hartlepool, Seaham, Chester-le-Street, Stockton-on-Tees, Darlington and Stanley.

TOP - Accountants Consett - Financial Advisers

Small Business Accountants Consett - Online Accounting Consett - Auditors Consett - Chartered Accountant Consett - Tax Preparation Consett - Tax Advice Consett - Investment Accounting Consett - Financial Accountants Consett - Financial Advice Consett