Accountants Corby: Does filling in your self-assessment tax form give you a headache every year? Lots of self-employed people in Corby feel much the same as you. Is the answer to find yourself a local Corby professional to do it on your behalf? Do you find self-assessment simply too taxing to tackle by yourself? The cost of completing and sending in your self-assessment form is approximately £200-£300 if done by a typical Corby accountant. Online accounting services are available more cheaply than this.

You will find various types of accountants in the Corby area. Take the time to track down an accountant that matches your specific needs. It's not unusual for Corby accountants to operate independently, others prefer being part of an accounting firm. A practice will employ a number of accountants, each specialising in different areas of accountancy. The level of specialization within an accountancy company could include accounting technicians, financial accountants, investment accountants, forensic accountants, actuaries, bookkeepers, auditors, management accountants, tax preparation accountants, chartered accountants and cost accountants.

Finding an accountant in Corby who is qualified is generally advisable. Ask if they at least have an AAT qualification or higher. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. A qualified bookkeeper will probably be just as suitable for sole traders and smaller businesses in Corby.

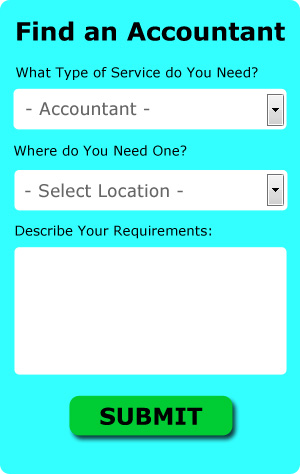

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. With Bark it is simply a process of ticking a few boxes and submitting a form. Within a few hours you should hear from some local accountants who are willing to help you. You might as well try it because it's free.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. This kind of service may not suit everyone but could be the answer for your needs. Some of these companies are more reputable than others. Check out some customer testimonials for companies you are considering. It is beyond the scope of this article to recommend any specific service.

Chartered accountants are the most qualified and highly trained individuals within the profession. While such specialists can deal with all aspects of finance, they may be over qualified for your modest needs. You will certainly be hiring the best if you do choose one of these.

The most cost effective method of all is to do it yourself. There is also lots of software available to help you with your returns. These include Sage, Capium, Forbes, BTCSoftware, Basetax, Taxfiler, Ajaccts, Nomisma, Xero, Keytime, CalCal, Andica, GoSimple, 123 e-Filing, Ablegatio, Absolute Topup, ACCTAX, TaxCalc, Gbooks, Taxforward and Taxshield. In any event the most important thing is to get your self-assessment set in before the deadline. You can expect a fine of £100 if your assessment is in even 1 day late.

Tips to Help You Manage Your Business Finances Better

If you've just launched your business, you'll find out soon enough that properly using money management strategies is not that easy to learn. You may be thinking that money management is something that you should already be able to do. But managing your business finances is a lot different from managing your personal finances. It will help, though, if you are already experienced in the latter. Your self-confidence could very well take a huge dive should you accidentally ruin your business finances. In this article, we'll share a few tips you can apply to help you be a better money manager for your business.

Hire an accountant. An accountant is well worth the business expense because she can manage your books for you full time. There are many things that an accountant can help you with, including keeping track of your cash flow, paying yourself, and meeting your tax obligations. The best part is that you won't have to deal with the paperwork because your accountant will take care of that for you. You, then, are free to concentrate on the other areas of building your business, like taking care of your clients, marketing, etc. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

Give your clients the choice to pay in installments. This isn't just a good idea for your business in terms of landing more clients, it's a good idea for your finances because it means that you will have money coming in regularly. It's certainly a lot easier than having money coming in irregularly and you've got long, dry spells. Basically, you can easily make a budget and pay your bills promptly if you've got reliable income. This can actually help build your confidence.

Keep a complete accounting of how much business you generate down to the last penny. Every single time you receive a payment, write down that you have been paid and how much. You know who has already paid and who hasn't. In addition, you know exactly how much money you've got at any given time. It also makes it easy to figure out what you owe in taxes and how much you should pay yourself for that week or month.

There are many things involved in the proper management of your money. It doesn't just involve listing the amount you spent and when you spent it. As a business owner, you've got numerous things you need to keep track of when it comes to your money. The tips we have shared will help you track your money more easily. Continue learning proper money management and you can expect improvement in yourself and in your business.

Forensic Accountant Corby

You may well run into the expression "forensic accounting" when you are searching for an accountant in Corby, and will probably be wondering what is the distinction between forensic accounting and normal accounting. The actual word 'forensic' is the thing that gives it away, meaning literally "denoting or relating to the application of scientific techniques and methods for the investigation of criminal activity." Sometimes also called 'financial forensics' or 'forensic accountancy', it uses investigative skills, accounting and auditing to sift through financial accounts so as to identify criminal activity and fraud. Some of the larger accounting companies in the Corby area might even have independent forensic accounting divisions with forensic accountants concentrating on specific sorts of fraud, and could be addressing professional negligence, tax fraud, insolvency, bankruptcy, personal injury claims, false insurance claims and money laundering. (Tags: Forensic Accountants Corby, Forensic Accounting Corby, Forensic Accountant Corby)

Financial Actuaries Corby

Analysts and actuaries are specialists in risk management. Such risks can impact both sides of the balance sheet and require valuation, asset management and liability management skills. An actuary uses mathematics and statistics to appraise the fiscal effect of uncertainty and help clients reduce potential risks.

Corby accountants will help with financial planning, VAT registration Corby, litigation support, limited company accounting, accounting support services, tax returns in Corby, small business accounting, PAYE, investment reviews Corby, business acquisition and disposal, contractor accounts Corby, estate planning Corby, business advisory services, capital gains tax in Corby, accounting services for the construction sector Corby, partnership accounts, workplace pensions Corby, mergers and acquisitions, business support and planning, self-employed registrations, business outsourcing Corby, bookkeeping, sole traders in Corby, company formations, year end accounts, business start-ups, employment law, debt recovery Corby, monthly payroll, accounting services for landlords, corporate finance in Corby, payslips and other forms of accounting in Corby, Northamptonshire. These are just a small portion of the activities that are performed by nearby accountants. Corby companies will be delighted to keep you abreast of their whole range of accountancy services.

Corby Accounting Services

- Corby Chartered Accountants

- Corby Account Management

- Corby Self-Assessment

- Corby Business Accounting

- Corby Payroll Services

- Corby Tax Services

- Corby Financial Advice

- Corby Audits

- Corby VAT Returns

- Corby Bookkeeping Healthchecks

- Corby Tax Planning

- Corby Debt Recovery

- Corby Tax Refunds

- Corby Forensic Accounting

Also find accountants in: Warmington, Flore, West Haddon, Chapel Brampton, Cottingham, Kings Sutton, Aldwincle, Stoke Bruerne, Raunds, Yardley Hastings, Hardwick, Rockingham, Middleton, Hardingstone, Little Harrowden, Little Billing, Collingtree, Wicken, Luddington In The Brook, Adstone, Broughton, Weston Favell, Charlton, Lamport, Irchester, Weston By Welland, Thurning, Grafton Underwood, Irthlingborough, Winwick, Hinton In The Hedges, Thornby, Middleton Cheney, Thorpe Waterville, Pilton and more.

Accountant Corby

Accountant Corby Accountants Near Corby

Accountants Near Corby Accountants Corby

Accountants CorbyMore Northamptonshire Accountants: Daventry, Corby, Northampton, Kettering, Brackley, Wellingborough and Rushden.

TOP - Accountants Corby - Financial Advisers

Investment Accountant Corby - Tax Preparation Corby - Affordable Accountant Corby - Tax Accountants Corby - Online Accounting Corby - Financial Advice Corby - Small Business Accountants Corby - Financial Accountants Corby - Self-Assessments Corby