Accountants Didcot: Does filling out your yearly self-assessment form give you a headache? This is a common problem for many others in Didcot, Oxfordshire. Is the answer perhaps to find yourself a local Didcot professional to do this task on your behalf? Perhaps it is simply the case that self-assessment is too complex for you to do on your own. The cost of completing and sending in your self-assessment form is approximately £200-£300 if carried out by a regular Didcot accountant. It is possible to get it done more cheaply than this, and using an online service might be worth considering.

So, where is the best place to locate a professional Didcot accountant and what sort of service might you expect to receive? Tracking down a shortlist of local Didcot accountants should be fairly easy by doing a a short search on the net. But, are they all trustworthy? Always bear in mind that pretty much any individual in Didcot can call themselves an accountant. Remarkably, there isn't even a requirement for them to hold any type of qualification.

If you want your tax returns to be correct and error free it might be better to opt for a professional Didcot accountant who is appropriately qualified. Membership of the AAT shows that they hold the minimum recommended qualification. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. Accounting fees are of course a business expense and can be included as such on your tax return. Local Didcot bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

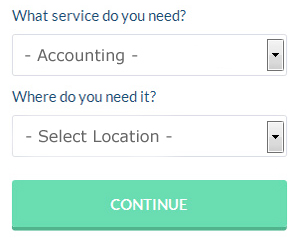

There is an online company called Bark who will do much of the work for you in finding an accountant in Didcot. Filling in a clear and simple form is all that you need to do to set the process in motion. Then you just have to wait for some prospective accountants to contact you. You can use Bark to find accountants and other similar services.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. While not recommended in every case, it could be the ideal solution for you. Do some homework to single out a company with a good reputation. Have a good look at customer testimonials and reviews both on the company website and on independent review websites. Sorry, but we cannot give any recommendations in this respect.

Maybe when you have looked all the options you will still decide to do your own tax returns. You can take much of the hard graft out of this procedure by using a software program such as Ajaccts, Taxfiler, Basetax, Ablegatio, 123 e-Filing, Andica, Capium, TaxCalc, Taxforward, Taxshield, ACCTAX, Absolute Topup, Keytime, BTCSoftware, Sage, GoSimple, Nomisma, Xero, Gbooks, Forbes or CalCal. Whichever service you use your tax returns will need to be in on time to avoid penalties.

Actuaries Didcot

Actuaries work within government departments, businesses and organisations, to help them predict long-term investment risks and financial expenditure. An actuary employs statistical and financial practices to evaluate the odds of a certain event occurring and the potential financial costs. To be an actuary it is essential to possess a statistical, economic and mathematical knowledge of day to day scenarios in the financial world. (Tags: Financial Actuaries Didcot, Actuaries Didcot, Actuary Didcot)

You can Improve Yourself and Your Business by Learning How to Manage Your Money Better

Proper money management is something that many small business owners have to struggle with, especially when they are still trying to get their feet wet as a business owner. When you're managing your finances poorly, your confidence in yourself might go down, especially when your business isn't being as profitable as you'd hope. This could actually make you feel like giving up and returning to your old job. When this happens, it stops you from achieving the kind of success you want for yourself and your business. Below are a few tips that will help manage your business finances better.

Avoid combining your business expenses and personal expenses in one account. It may be simple to keep track of everything in the beginning, but over time, you'll find it's so much easier to track your expenses if you have separate accounts. And here's the thing -- if you run your business expenses through your personal account, it'll be a lot harder to prove your income. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. Having separate accounts for your personal and business finances will save you a lot of headaches in the long run.

Think about setting up payment plans for your clients. Not only will this drum up more business for you, this will ensure that money is coming in regularly. Having payments come in regularly even if they aren't in huge amounts is certainly so much better than getting big payments irregularly. When you have reliable income, you're better able to budget, pay your bills, and manage your money overall. This is a great boost to your confidence.

Save every receipt. You'll save yourself a lot of grief if you've got your receipts with you if ever the IRS wants to see where you've been spending your money on. They're also records of business related expenses. Keep them all in one central location. Tracking your expenses becomes easy if you have all your receipts in one place. You can easily keep track of and access your receipts by putting them in an accordion file and placing that file in your desk drawer.

Whether you're a business owner or not, it's important that you learn proper money management. As a business owner, you're a lot more likely to succeed if you know how much money your business is generating, how much money you're spending, and basically what's happening with your money. So make sure you use the tips on proper money management that we mentioned in this article. In truth, if you want to improve yourself as you relate to your business, learning proper money management is crucial.

Small Business Accountants Didcot

Doing the accounts and bookkeeping can be a pretty stressful experience for any small business owner in Didcot. Hiring the services of a small business accountant in Didcot will allow you to operate your business knowing your tax returns, annual accounts and VAT, and various other business tax requirements, are being met.

A seasoned small business accountant in Didcot will consider that it's their responsibility to help develop your business, and offer you sound financial guidance for security and peace of mind in your specific circumstances. An accountancy firm in Didcot will provide an allocated small business accountant and adviser who will remove the haze that veils business taxation, in order to enhance your tax efficiency.

It is crucial that you clarify your future plans, your business structure and your company's situation accurately to your small business accountant.

Didcot accountants will help with business planning and support, HMRC submissions in Didcot, inheritance tax, tax preparation Didcot, PAYE in Didcot, sole traders, taxation accounting services, investment reviews, auditing and accounting in Didcot, consultancy and systems advice in Didcot, assurance services, debt recovery, partnership accounts, accounting services for the construction sector Didcot, business acquisition and disposal Didcot, audit and compliance reporting, management accounts, company secretarial services Didcot, cashflow projections, accounting services for buy to let property rentals, contractor accounts in Didcot, self-assessment tax returns, payroll accounting, corporate finance, company formations, financial planning in Didcot, business outsourcing Didcot, limited company accounting Didcot, financial statements, accounting support services Didcot, general accounting services, accounting services for start-ups and other types of accounting in Didcot, Oxfordshire. Listed are just a selection of the activities that are conducted by nearby accountants. Didcot professionals will tell you about their whole range of services.

When looking for advice and inspiration for personal tax assistance, accounting & auditing, small business accounting and self-assessment help, you do not really need to look much further than the internet to get all of the guidance that you need. With such a wide range of meticulously researched blog posts and webpages to pick from, you will very shortly be knee-deep in great ideas for your forthcoming project. We recently stumbled on this fascinating article about five tips for locating a first-rate accountant.

Didcot Accounting Services

- Didcot Tax Services

- Didcot Business Planning

- Didcot Self-Assessment

- Didcot Taxation Advice

- Didcot VAT Returns

- Didcot Bookkeepers

- Didcot PAYE Healthchecks

- Didcot Account Management

- Didcot Tax Returns

- Didcot Debt Recovery

- Didcot Financial Advice

- Didcot Payroll Services

- Didcot Specialist Tax

- Didcot Personal Taxation

Also find accountants in: Northbrook, Crowmarsh Gifford, Rotherfield Greys, Swinbrook, Great Milton, East Ginge, Forest Hill, Sandford On Thames, Fencott, Long Hanborough, Mollington, Gallowstree Common, Great Coxwell, Eaton Hastings, Netherton, Aston Tirrold, Ewelme, Shellingford, Cleeve, Westwell, Kennington, Hampton Poyle, Tiddington, Adwell, Hailey, Wantage, Goosey, Woodcote, Little Coxwell, Woodstock, Moulsford, North Moreton, Lower Shiplake, Glympton, Abingdon and more.

Accountant Didcot

Accountant Didcot Accountants Near Didcot

Accountants Near Didcot Accountants Didcot

Accountants DidcotMore Oxfordshire Accountants: Kidlington, Witney, Oxford, Carterton, Bicester, Banbury, Didcot and Abingdon.

TOP - Accountants Didcot - Financial Advisers

Tax Preparation Didcot - Financial Accountants Didcot - Auditing Didcot - Chartered Accountants Didcot - Affordable Accountant Didcot - Online Accounting Didcot - Small Business Accountants Didcot - Tax Advice Didcot - Investment Accountant Didcot