Accountants Doncaster: If you are a sole trader or run a small business in Doncaster, you will find that there are several benefits to be enjoyed from having an accountant at hand. You should at the very least have a lot more time to concentrate on your key business operations whilst the accountant manages the routine bookkeeping and paperwork. The importance of getting this type of financial assistance cannot be overstated, particularly for start-ups and fledgling businesses that are not yet established. You may find that you need this help more as your Doncaster business expands.

There are many different branches of accounting. So, figure out your precise requirements and choose an accountant that satisfies those needs. You will come to realise that there are accountants who work independently and accountants who work for accountancy firms. Accounting practices will normally have different departments each handling a certain field of accounting. The main positions that will be covered by an accountancy practice include: financial accountants, chartered accountants, forensic accountants, tax preparation accountants, costing accountants, accounting technicians, bookkeepers, actuaries, management accountants, auditors and investment accountants.

Finding an accountant in Doncaster who is qualified is generally advisable. For basic tax returns an AAT qualified accountant should be sufficient. Qualified accountants in Doncaster might cost more but they will do a proper job. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat.

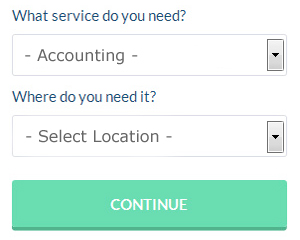

One online service which helps people like you find an accountant is Bark. It is just a case of ticking some boxes on a form. Just sit back and wait for the responses to roll in. You can use Bark to find accountants and other similar services.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. This kind of service may not suit everyone but could be the answer for your needs. You still need to do your homework to pick out a company you can trust. Study reviews and customer feedback. We will not be recommending any individual online accounting service in this article.

Of course, completing and sending in your own self-assessment form is the cheapest solution. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of Ablegatio, Sage, BTCSoftware, Gbooks, Nomisma, CalCal, Taxshield, Absolute Topup, GoSimple, Forbes, Xero, Andica, ACCTAX, Ajaccts, Taxforward, Taxfiler, Basetax, Keytime, Capium, 123 e-Filing and TaxCalc. You will get a penalty if your tax return isn't in on time. Penalties are £100 for being 3 months late and an extra £10 per day after that, so don't be late.

Learning the Top Money Management Strategies for Business Success

Are you thinking of going into business yourself? You'll find that many like being their own boss because they're in charge of how much they make and how much they get to spend. Then again, managing business finances isn't exactly a simple matter. In fact, even those who've successfully lived by sticking to a budget in their personal lives can have a tough time managing the finances of their business. Don't worry, though, because there are a few things you can do to make sure you properly manage the financial side of your business. Continue reading if you'd like to know how you can be a better money manager for your own business.

It could be that you use your credit card to pay many of your regular expenditures like web hosting, recurring membership fees, advertising accounts, and so on. Instead of having to pay many separate bills, you only have to pay your credit card bill each month. However, it can be tricky to use credit cards for your business expenses because interest charges can accrue and you may end up paying more if you carry a balance each month. So if you want to keep it all on your bank account, you need to make sure that you pay off your credit card in full each month. Not only will this help you deal with just one payment and not have to pay interest charges, this will help boost your credit score as well.

Set a salary and pay yourself on a regular basis even though you're running your own business and you may be the only "employee" you have This can make it easier to keep track of your accounting both in your personal life and your professional life. All payments you get from selling goods or offering services should go straight to your business account. Every two weeks or every month, write yourself a paycheck and then deposit that to your personal account. You decide the salary for yourself. Your salary can be a portion of how much your business brought in for the month or it can be based on how many hours you worked.

Of course, if you're keeping track of every penny you're spending, you should keep track of every penny you're getting as well. Make sure that you write down the amount from every payment you receive that's business related. You know who has already paid and who hasn't. In addition, you know exactly how much money you've got at any given time. It also makes it easy to figure out what you owe in taxes and how much you should pay yourself for that week or month.

There are so many little things that go into properly managing your money. It's not only about keeping a record of when you spent what. When you're in business, you have several things you need to keep track of. With the tips above, you'll have an easier time tracking your money. Your business and your self-confidence stand to benefit when you keep on learning how to manage your business finances better.

Auditors Doncaster

Auditors are experts who review the fiscal accounts of businesses and organisations to verify the validity and legality of their current financial records. They also often undertake a consultative role to suggest possible the prevention of risk and the application of cost efficiency. For anyone to start working as an auditor they have to have specified qualifications and be approved by the regulatory body for accounting and auditing. (Tags: Auditor Doncaster, Auditors Doncaster, Auditing Doncaster)

Payroll Services Doncaster

A vital component of any business in Doncaster, large or small, is having an accurate payroll system for its workers. Dealing with company payrolls requires that all legal obligations regarding their openness, accuracy and timings are observed to the finest detail.

Not all small businesses have the help that a dedicated financial specialist can provide, and the easiest way to manage employee payrolls is to retain the services of an independent Doncaster accounting company. The payroll service will work with HMRC and pension providers, and oversee BACS transfers to guarantee accurate and timely wage payment to all employees.

A qualified payroll management accountant in Doncaster will also, in line with current legislations, provide P60's at the end of the financial year for every one of your employees. They'll also be responsible for providing P45 tax forms at the termination of a staff member's working contract.

Doncaster accountants will help with National Insurance numbers, financial statements, capital gains tax, retirement planning, limited company accounting, cashflow projections, inheritance tax in Doncaster, consultancy and systems advice in Doncaster, year end accounts in Doncaster, double entry accounting, accounting support services, partnership accounts in Doncaster, accounting services for buy to let property rentals, workplace pensions in Doncaster, partnership registrations Doncaster, tax preparation, self-employed registration Doncaster, general accounting services Doncaster, company formations, small business accounting in Doncaster, VAT returns Doncaster, payslips, monthly payroll Doncaster, business advisory Doncaster, bookkeeping, corporate finance in Doncaster, personal tax, bureau payroll services, contractor accounts in Doncaster, HMRC submissions in Doncaster, business outsourcing, accounting services for media companies and other kinds of accounting in Doncaster, South Yorkshire. These are just some of the tasks that are handled by local accountants. Doncaster specialists will keep you informed about their full range of accounting services.

You do, in fact have the perfect resource right at your fingertips in the form of the internet. There is such a lot of information and inspiration available online for stuff like accounting & auditing, personal tax assistance, self-assessment help and accounting for small businesses, that you'll soon be bursting with suggestions for your accounting requirements. One example may be this illuminating article on choosing the right accountant.

Doncaster Accounting Services

- Doncaster Chartered Accountants

- Doncaster Auditing

- Doncaster Specialist Tax

- Doncaster Account Management

- Doncaster Forensic Accounting

- Doncaster Bookkeeping

- Doncaster PAYE Healthchecks

- Doncaster Debt Recovery

- Doncaster Business Accounting

- Doncaster Taxation Advice

- Doncaster Payroll Management

- Doncaster Tax Services

- Doncaster Business Planning

- Doncaster Financial Advice

Also find accountants in: Austerfield, Oxspring, Elsecar, Woodsetts, Ingbirchworth, Finningly, Nether Haugh, Campsall, Aston, Gleadless, Worrall, Hooton Levitt, Adwick Upon Dearne, Braithwell, Woodhouse, Birdwell, Stocksbridge, Darnall, Skellow, Langsett, Warmsworth, Harthill, Deepcar, Carcroft, Loversall, Greenhill, Parkgate, High Green, Greasbrough, Dunford Bridge, Cawthorne, Bentley, Denaby Main, Kirk Sandall, Barnby Dun and more.

Accountant Doncaster

Accountant Doncaster Accountants Near Me

Accountants Near Me Accountants Doncaster

Accountants DoncasterMore South Yorkshire Accountants: Chapeltown, Hoyland, Wombwell, Conisbrough, Rawmarsh, Sheffield, Rotherham, Bentley, Barnsley, Dinnington, Maltby, Wath-upon-Dearne and Doncaster.

TOP - Accountants Doncaster - Financial Advisers

Financial Accountants Doncaster - Chartered Accountants Doncaster - Self-Assessments Doncaster - Small Business Accountant Doncaster - Auditing Doncaster - Tax Preparation Doncaster - Online Accounting Doncaster - Investment Accounting Doncaster - Tax Advice Doncaster