Accountants Farnworth: Filling out your annual self-assessment form can be something of a headache. Other sole traders and small businesses in the Farnworth area face the same predicament. The obvious answer would be to pay a reliable Farnworth accountant to tackle this task instead. It could be the case that doing your own self-assessment is simply too challenging. A run of the mill bookkeeper or accountant in Farnworth will likely charge you in the region of £200-£300 for completing your self-assessment form. Online accounting services are available more cheaply than this.

With various different kinds of accountants advertising in Farnworth it can be baffling. Therefore, figure out your precise requirements and choose an accountant that satisfies those needs. A lot of accountants work independently, whilst others will be part of a larger accounting practice. Accounting companies will usually have different divisions each handling a particular discipline of accounting. Accounting practices will typically offer the expert services of actuaries, auditors, costing accountants, financial accountants, chartered accountants, tax accountants, accounting technicians, bookkeepers, forensic accountants, investment accountants and management accountants.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. The AAT qualification is the minimum you should look for. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. The cost of preparing your self-assessment form can be claimed back as a business expense. A lot of smaller businesses in Farnworth choose to use bookkeepers rather than accountants.

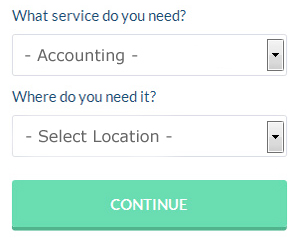

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. Tick a few boxes on their form and submit it in minutes. Sometimes in as little as a couple of hours you will hear from prospective Farnworth accountants who are keen to get to work for you.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. A number of self-employed people in Farnworth prefer to use this simple and convenient alternative. Even if you do decide to go down this route, take some time in singling out a trustworthy company. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable. Sorry but we cannot recommend any individual service on this website.

At the end of the day you could always do it yourself and it will cost you nothing but time. You could even use a software program like GoSimple, Forbes, Ajaccts, TaxCalc, Taxshield, ACCTAX, Taxfiler, 123 e-Filing, Gbooks, Andica, Taxforward, BTCSoftware, Basetax, Absolute Topup, CalCal, Sage, Nomisma, Xero, Capium, Ablegatio or Keytime to make life even easier. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare. You can expect to pay a minimum penalty of £100 for being late.

Actuaries Farnworth

An actuary measures, manages and gives advice on financial risks. Actuaries employ their mathematical skills to calculate the risk and probability of future happenings and to calculate their ramifications for a business. Actuaries provide evaluations of financial security systems, with a focus on their mechanisms, complexity and mathematics. (Tags: Actuaries Farnworth, Financial Actuary Farnworth, Actuary Farnworth)

Boost Your Confidence and Your Business By Learning Better Money Management

Starting your own business is exciting, and this is true whether you are starting this business online or offline. When you're a business owner, you're your own boss and in control of your income. It's a bit scary, isn't it? However, starting up a business of your own can also be very intimidating, especially during the initial stages when you're just getting your feet wet. In this case, you'll benefit a great deal from knowing a few simple techniques like managing your business finances properly. If you'd like to keep your finances in order, continue reading this article.

Find yourself an accountant who's competent. This is a business expense that will pay for itself a hundredfold because you know your books will be in order. An accountant can easily monitor your business cash flow, help you pay yourself, and even determine the right amount of taxes you should be paying and when. What's more, she'll deal with all of the paperwork that is associated with those things. As a result, you can put your energy towards making your business more profitable, such as creating new products, marketing, and increasing your customer base. The expense of having a business accountant is nothing compared to how much you'll save trying to figure out your finances and keeping everything in order.

Balance your books at least once a week. However, you should balance your books at the end of business day every day if what you have is a traditional store with cash registers or takes in multiple payments throughout the day every day. You need to keep track of all the payments you receive and payments you make out and make sure that the cash you have on hand or in your bank account matches with the numbers in your record. If there are any discrepancies in your records, there won't be a lot of them or they won't be too difficult to track when you do your end-of-month or quarterly balancing. If you regularly balance your books, you won't need to spend too long a time doing it. If you do it every once in a while, though, it can take hours.

Do not forget to pay your taxes on time. Generally, taxes must be paid quarterly by small business owners. Taxes can be quite confusing so you might want to make an appointment with your local small business center or even at the IRS so you can get accurate information. Additionally, you can have a professional set up a payment plan for you to ensure that you're paying your taxes promptly and that you're meeting all your business obligation as required by the law. Having the IRS at your doorstep isn't something you'd want, believe me!

Every adult should learn the proper way of managing their money. Knowing what you have coming in, what you have going out, and what exactly is going on with your money can be a huge boost to your confidence and success. So keep in mind the tips we've shared. Truly, when it comes to self improvement in business, properly managing your money is incredibly important.

Payroll Services Farnworth

An important element of any business enterprise in Farnworth, small or large, is having an effective payroll system for its personnel. The laws regarding payrolls and the legal obligations for openness and accuracy means that dealing with a company's payroll can be a daunting task.

Using a professional company in Farnworth, to take care of your payroll needs is a easiest way to reduce the workload of your financial team. A payroll accountant will work with HMRC, with pensions scheme administrators and oversee BACS payments to make sure that your staff are always paid on time, and that all required deductions are correct.

A qualified payroll management accountant in Farnworth will also, in accordance with current legislations, provide P60 tax forms after the end of the financial year for each of your employees. A P45 form should also be provided for any member of staff who finishes working for the company, in line with current legislations.

Farnworth accountants will help with payslips, corporate tax, VAT registrations in Farnworth, general accounting services, bureau payroll services, personal tax, inheritance tax, tax investigations Farnworth, business planning and support Farnworth, National Insurance numbers Farnworth, estate planning, charities, debt recovery, limited company accounting Farnworth, litigation support, workplace pensions, accounting services for media companies, accounting support services in Farnworth, accounting services for buy to let rentals Farnworth, business acquisition and disposal, sole traders Farnworth, year end accounts in Farnworth, financial statements, tax preparation, company secretarial services, retirement planning, financial planning, consultancy and systems advice, accounting services for start-ups, tax returns, consulting services Farnworth, employment law and other accounting services in Farnworth, Greater Manchester. These are just an example of the tasks that are carried out by nearby accountants. Farnworth specialists will let you know their whole range of accounting services.

You do, in fact have the best possible resource right at your fingertips in the shape of the web. There is such a lot of information and inspiration available online for stuff like self-assessment help, personal tax assistance, accounting & auditing and small business accounting, that you will soon be awash with ideas for your accounting needs. One example might be this engaging article on how to choose an accountant to complete your tax return.

Farnworth Accounting Services

- Farnworth Personal Taxation

- Farnworth Taxation Advice

- Farnworth Account Management

- Farnworth Tax Returns

- Farnworth Financial Advice

- Farnworth Bookkeeping Healthchecks

- Farnworth Tax Investigations

- Farnworth Specialist Tax

- Farnworth VAT Returns

- Farnworth PAYE Healthchecks

- Farnworth Audits

- Farnworth Bookkeeping

- Farnworth Payroll Services

- Farnworth Forensic Accounting

Also find accountants in: Levenshulme, Newton, Timperley, Summerseat, Kenyon, Romiley, Boothstown, Trafford Park, Kearsley, Dukinfield, Gatley, Eccles, Warburton, Reddish, Stretford, Bryn Gates, Pendlebury, Wigan, Moss Nook, Bardsley, Syke, Hyde, Hale, Walkden, Lately Common, Littleborough, Lane Head, Didsbury, Chorlton Cum Hardy, Ramsbottom, Standish, Delph, Fishpool, Bredbury, Astley Bridge and more.

Accountant Farnworth

Accountant Farnworth Accountants Near Farnworth

Accountants Near Farnworth Accountants Farnworth

Accountants FarnworthMore Greater Manchester Accountants: Ashton-in-Makerfield, Gatley, Eccles, Leigh, Whitefield, Stalybridge, Hyde, Rochdale, Salford, Romiley, Farnworth, Denton, Sale, Bury, Walkden, Horwich, Radcliffe, Urmston, Swinton, Westhoughton, Heywood, Cheadle Hulme, Atherton, Wigan, Middleton, Royton, Ashton-under-Lyne, Golborne, Dukinfield, Irlam, Droylsden, Hindley, Altrincham, Manchester, Bolton, Stretford, Chadderton, Stockport and Oldham.

TOP - Accountants Farnworth - Financial Advisers

Small Business Accountant Farnworth - Self-Assessments Farnworth - Financial Advice Farnworth - Online Accounting Farnworth - Auditing Farnworth - Investment Accountant Farnworth - Tax Preparation Farnworth - Tax Accountants Farnworth - Cheap Accountant Farnworth