Accountants Ferndown: For Ferndown individuals who are self-employed or running a business, there are several benefits to be gained from using the services of a qualified accountant. You should at the very least have much more time to focus on your key business operations while your accountant takes care of the routine bookkeeping and paperwork. This kind of help can be particularly crucial for small start-up businesses, and those who've not run a business before. If you've got plans to expand your Ferndown business you will find an increasing need for good financial advice.

So, how do you go about locating a qualified Ferndown accountant? Tracking down a shortlist of local Ferndown accountants ought to be fairly easy by doing a a quick search on the net. But, how do you know which of these can be trusted with your paperwork? You should never forget that anybody in Ferndown can call themselves an accountant. There's no legal requirements that say they must have formal qualifications or certifications. Which, like me, you may find astonishing.

You should take care to find a properly qualified accountant in Ferndown to complete your self-assessment forms correctly and professionally. Your minimum requirement should be an AAT qualified accountant. A certified Ferndown accountant might be more costly than an untrained one, but should be worth the extra expense. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent. A qualified bookkeeper will probably be just as suitable for sole traders and smaller businesses in Ferndown.

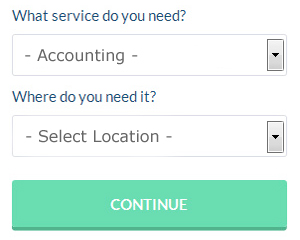

Though you may not have heard of them before there is an online service called Bark who can help you in your search. A couple of minutes is all that is needed to complete their simple and straighforward search form. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. More accountants are offering this modern alternative. There is no reason why this type of service will not prove to be as good as your average High Street accountant. Check out some customer testimonials for companies you are considering. Sorry, but we cannot give any recommendations in this respect.

While possibly a little over the top for a small business, using a chartered accountant is another option. These highly motivated professionals will have all the answers but may be over the top for small businesses. If you can afford one why not hire the best?

Maybe when you have looked all the options you will still decide to do your own tax returns. Software is also available to make doing your self-assessment even easier. Some of the best ones include Sage, Taxforward, TaxCalc, Ablegatio, Basetax, Xero, GoSimple, Keytime, Ajaccts, Taxshield, Nomisma, Taxfiler, Absolute Topup, BTCSoftware, CalCal, Gbooks, Forbes, Capium, 123 e-Filing, ACCTAX and Andica. The most important thing is to make sure your self-assessment is sent in promptly. You can expect to pay a minimum penalty of £100 for being late.

How Proper Money Management Helps Your Business and Yourself

If you've just launched your business, you'll find out soon enough that properly using money management strategies is not that easy to learn. Money management seems like one of those things that you should have the ability to do already. The truth is that business budgeting and financial planning is quite a lot different from personal budgeting and financial planning (though having experience in the latter can help with the former). It can be quite a confidence killer to accidentally ruin your financial situation. You can be better at money management and if you keep reading, you'll learn a few strategies to help you do so.

Find yourself an accountant who's competent. This is a business expense that's really worth it because an accountant can help keep your books straight on a full time basis. Your accountant will be keeping track of the money that your business is bringing in and the money that goes on your expenditures. She will also help you figure out just how much you should pay yourself as well as how much money you need to pay for taxes. The best part is that you won't have to deal with the paperwork because your accountant will take care of that for you. This frees you up and lets you concentrate on other aspects of your business. When you've got an accountant working for you, you won't end up wasting hours or even days working your finances every week or every month.

You can help yourself by finding out how to keep your books. Don't neglect the importance of having a system set up for both your personal and business finances. For this, you can use a basic spreadsheet or go with software like Quicken. You could also try to use a personal budgeting tool like Mint.com. You'll find plenty of free resources on the internet that can help small business owners like you manage your books better. Keeping your books organized and up to date will help you understand your finances better. It's also a good idea to take a couple of classes on basic accounting and bookkeeping, particularly if you're not in a position yet to hire a bookkeeper full-time.

Do not forget to pay your taxes on time. Small businesses typically pay file taxes quarterly. It's crucial that you have the most current and accurate information when it comes to small business taxes. For this, it's best that you get your information from the IRS or from the local small business center. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. The only way you won't get that dreaded visit from the IRS is if you're paying your taxes.

A lot of things go into proper money management. Managing your money is not a basic skill or easy thing to learn. It's really a complicated process that requires constant learning and practicing, especially by small business owners. Hopefully, the tips we've shared in this article will help you get started in managing your finances better. One of the secrets to having a successful business is learning proper money management.

Ferndown accountants will help with mergers and acquisitions, limited company accounting, double entry accounting, self-assessment tax returns, litigation support, HMRC submissions Ferndown, corporate finance Ferndown, business support and planning, inheritance tax, monthly payroll, company secretarial services in Ferndown, partnership accounts Ferndown, compliance and audit reporting in Ferndown, business disposal and acquisition, pension forecasts, business advisory services, general accounting services, investment reviews, company formations, accounting services for property rentals, cash flow Ferndown, personal tax, tax preparation, capital gains tax, tax investigations, financial planning, corporation tax, contractor accounts Ferndown, audit and auditing in Ferndown, accounting services for start-ups, year end accounts, bureau payroll services and other types of accounting in Ferndown, Dorset. Listed are just a few of the activities that are accomplished by nearby accountants. Ferndown companies will keep you informed about their whole range of services.

You do, of course have the very best resource close at hand in the shape of the web. There's such a lot of information and inspiration readily available online for things like self-assessment help, personal tax assistance, accounting & auditing and small business accounting, that you'll soon be deluged with suggestions for your accounting needs. One example could be this interesting article outlining 5 tips for selecting the best accountant.

Ferndown Accounting Services

- Ferndown Account Management

- Ferndown Tax Planning

- Ferndown Tax Services

- Ferndown PAYE Healthchecks

- Ferndown Tax Advice

- Ferndown Forensic Accounting

- Ferndown Chartered Accountants

- Ferndown Tax Returns

- Ferndown Payroll Services

- Ferndown Self-Assessment

- Ferndown VAT Returns

- Ferndown Debt Recovery

- Ferndown Specialist Tax

- Ferndown Bookkeeping Healthchecks

Also find accountants in: Winterborne Monkton, Benville Lane, Longburton, Huntingford, Knowlton, Bedchester, Tricketts Cross, Folke, Charlestown, Stoke Wake, Mosterton, Shipton Gorge, Kings Stag, Pilsdon, Chettle, Easton, Over Compton, Ashley Heath, Mannington, Sturminster Marshall, Fontmell Magna, East Morden, Hinton Martell, Wareham, Winkton, Stalbridge Weston, Haydon, Harmans Cross, Fifehead Neville, Marshalsea, Maiden Newton, Longham, Stoke Abbott, Purse Caundle, Compton Valence and more.

Accountant Ferndown

Accountant Ferndown Accountants Near Ferndown

Accountants Near Ferndown Accountants Ferndown

Accountants FerndownMore Dorset Accountants: Poole, Sherborne, Wareham, Corfe Mullen, Wimborne Minster, Ferndown, Bournemouth, Dorchester, Christchurch, Weymouth, Blandford Forum, Bridport, Swanage, Shaftesbury and Verwood.

TOP - Accountants Ferndown - Financial Advisers

Financial Advice Ferndown - Tax Preparation Ferndown - Online Accounting Ferndown - Small Business Accountant Ferndown - Chartered Accountant Ferndown - Financial Accountants Ferndown - Affordable Accountant Ferndown - Auditors Ferndown - Tax Advice Ferndown