Accountants Formby: There are numerous benefits from hiring the services of an accountant if you are self-employed or running a business in the Formby area. At the very least your accountant can handle important tasks like completing your tax returns and keeping your books up to date, giving you more hours to focus on your business. Being able to access professional financial advice is even more important for new businesses.

In your hunt for an accountant in the Formby area, you might be confused by the various kinds that you can choose from. Therefore, picking the right one for your business is vital. Many accountants work independently, whilst others will be part of a larger practice. Accounting firms will typically have different divisions each dealing with a certain field of accounting. It wouldn't be a great surprise to find management accountants, accounting technicians, investment accountants, auditors, forensic accountants, tax accountants, chartered accountants, cost accountants, financial accountants, bookkeepers and actuaries all offering their services within any decent sized accounting firm.

You would be best advised to find a fully qualified Formby accountant to do your tax returns. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction.

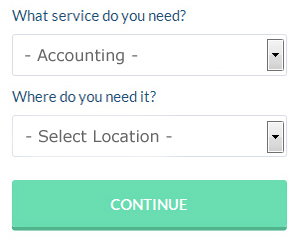

If you don't have the time to do a proper online search for local accountants, try using the Bark website. A couple of minutes is all that is needed to complete their simple and straighforward search form. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment. And the great thing about Bark is that it is completely free to use.

If you prefer the cheaper option of using an online tax returns service there are several available. Services like this are convenient and cost effective. Don't simply go with the first company you find on Google, take time to do some research. Check out some customer testimonials for companies you are considering.

Maybe when you have looked all the options you will still decide to do your own tax returns. Software is also available to make doing your self-assessment even easier. Some of the best ones include Forbes, CalCal, Andica, Nomisma, BTCSoftware, Taxforward, Sage, Xero, Absolute Topup, Taxshield, 123 e-Filing, Basetax, TaxCalc, Gbooks, GoSimple, Taxfiler, ACCTAX, Keytime, Capium, Ajaccts and Ablegatio. Make sure your tax returns are sent off promptly to avoid getting a penalty fine. A £100 fine is levied for late self-assessments up to 3 months, more if later.

Learn How to Manage Your Business Budget Properly

Are you thinking of going into business yourself? You'll find that many like being their own boss because they're in charge of how much they make and how much they get to spend. Then again, managing business finances isn't exactly a simple matter. In fact, even those who've successfully lived by sticking to a budget in their personal lives can have a tough time managing the finances of their business. Luckily there are plenty of things that you can do to make it easier on yourself. Continue reading if you'd like to know how you can be a better money manager for your own business.

Make sure you are numbering your invoices. You may not think that this simple tactic of keeping your invoices numbered is a big deal but wait till your business has grown. When you've got your invoices numbered, you can easily track your transactions. This way you can find out quickly who still hasn't paid you and who has already. It will help you verify claims by clients who insist they've already paid up if you have a numbering system in place for your invoice. In business, errors will happen and numbered invoices is one simple strategy to identify those problems when they take place.

You may want to offer payment plans to clients. Doing this will encourage more people to do business with you and ensure that you've got money coming in on a regular basis. Steady, regular payments, even if they're small, is a lot better than big payments that come in sporadically and you don't know when exactly they're going to come. If you have steady income coming in, you're in a better position to plan your budget, get your bills paid on time, and properly manage your money in general. If you're in control of your business finances, you'll feel more self-confident.

Be a responsible business owner by paying your taxes when they're due. Generally, taxes must be paid quarterly by small business owners. Taxes can be quite confusing so you might want to make an appointment with your local small business center or even at the IRS so you can get accurate information. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

There are so many different things that go into helping you properly manage your money. Proper money management isn't really a simple or basic skill you can master over the weekend. It's something you have to constantly learn over time, particularly if you have a small business. The tips we've shared should help you get started in managing your finances properly. Really, when it comes to self improvement for business, it doesn't get much more basic than learning how to stay on top of your finances.

Actuary Formby

Analysts and actuaries are business professionals in risk management. These risks can affect a company's balance sheet and require specialist asset management, liability management and valuation skills. To work as an actuary it's essential to have an economic, statistical and mathematical consciousness of day to day scenarios in the financial world.

Formby accountants will help with partnership accounts, business outsourcing, double entry accounting in Formby, accounting services for media companies, business start-ups, workplace pensions in Formby, business advisory services in Formby, audit and compliance reporting, sole traders, inheritance tax, contractor accounts, PAYE in Formby, consulting services, payslips in Formby, corporation tax, consultancy and systems advice, mergers and acquisitions, business support and planning in Formby, management accounts, monthly payroll Formby, company secretarial services Formby, financial statements, cashflow projections, personal tax, accounting support services, HMRC liaison, general accounting services, VAT payer registration in Formby, assurance services, self-employed registration, business disposal and acquisition in Formby, HMRC submissions and other kinds of accounting in Formby, Merseyside. Listed are just a handful of the tasks that are carried out by local accountants. Formby specialists will inform you of their entire range of services.

When hunting for advice and inspiration for auditing & accounting, self-assessment help, small business accounting and personal tax assistance, you won't need to look any further than the world wide web to get all the information that you need. With such a wide variety of well researched blog posts and webpages at your fingertips, you will quickly be overwhelmed with ideas and concepts for your planned project. Just recently we stumbled across this illuminating article on how to find an excellent accountant.

Formby Accounting Services

- Formby Business Accounting

- Formby Specialist Tax

- Formby Bookkeeping Healthchecks

- Formby Personal Taxation

- Formby Forensic Accounting

- Formby Audits

- Formby Payroll Services

- Formby VAT Returns

- Formby Tax Planning

- Formby Debt Recovery

- Formby Account Management

- Formby Tax Returns

- Formby Financial Advice

- Formby Self-Assessment

Also find accountants in: Rainford, Allerton, Knotty Ash, Greasby, Thornton, Clock Face, Hightown, Freshfield, Liverpool, Bebington, Saughall Massie, Huyton, New Brighton, Cronton, Birkenhead, Moreton, Halewood, West Derby, Speke, Bold Heath, Upton, Thornton Hough, Sefton, Raby, Thurstaston, Lydiate, Bromborough, Billinge, Rock Ferry, Melling Mount, Wallasey, Earlestown, Aintree, Southport, Prenton and more.

Accountant Formby

Accountant Formby Accountants Near Me

Accountants Near Me Accountants Formby

Accountants FormbyMore Merseyside Accountants: Liverpool, Formby, St Helens, Wallasey, Bootle, Haydock, Birkenhead, Litherland, Southport, Kirkby, Halewood, Heswall, Prescot, Newton-le-Willows, Maghull, Crosby and Bebington.

TOP - Accountants Formby - Financial Advisers

Bookkeeping Formby - Financial Advice Formby - Chartered Accountants Formby - Tax Advice Formby - Financial Accountants Formby - Tax Preparation Formby - Self-Assessments Formby - Auditing Formby - Investment Accounting Formby