Accountants Glasgow: There are many benefits from hiring the professional services of an accountant if you are self-employed or running a business in the Glasgow area. You should at the very least have much more time to focus on your key business operations whilst the accountant deals with the routine financial paperwork and bookkeeping. Having access to this sort of help and advice can be crucial for smaller businesses and even more so for start-ups.

Obtaining an accountant in Glasgow isn't always that simple with various different types of accountants available. Check that any prospective Glasgow accountant is suitable for the services that you need. Accountants sometimes work independently but often as part of a much bigger practice. The various accounting disciplines can be better covered by an accountancy company with several experts under one roof. The types of accountant you are likely to find within a practice may include: costing accountants, bookkeepers, chartered accountants, accounting technicians, tax accountants, investment accountants, auditors, forensic accountants, management accountants, actuaries and financial accountants.

Find yourself a properly qualified one and don't take any chances. Membership of the AAT shows that they hold the minimum recommended qualification. Qualified Glasgow accountants might charge a bit more but they may also get you the maximum tax savings. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form. Glasgow sole traders often opt to use bookkeeper rather than accountants for their tax returns.

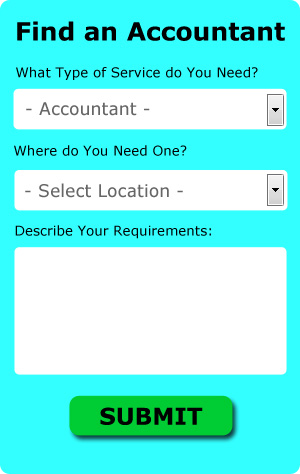

If you want to reach out to a number of local Glasgow accountants, you could always use a service called Bark. A couple of minutes is all that is needed to complete their simple and straighforward search form. Within a few hours you should hear from some local accountants who are willing to help you. Why not give Bark a try since there is no charge for this useful service.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. For many self-employed people this is a convenient and time-effective solution. Even if you do decide to go down this route, take some time in singling out a trustworthy company. A good method for doing this is to check out any available customer reviews and testimonials.

Although filling in your own tax return may seem too complicated, it is not actually that hard. Available software that will also help includes Gbooks, Sage, Xero, ACCTAX, GoSimple, Taxfiler, Nomisma, Forbes, Absolute Topup, Taxshield, Ablegatio, Keytime, Basetax, 123 e-Filing, Capium, Andica, Ajaccts, BTCSoftware, Taxforward, CalCal and TaxCalc. Whatever happens you need to get your self-assessment form in on time. The fine for late submissions (up to 3 months) is £100.

Auditors Glasgow

An auditor is an individual brought in to assess and validate the accuracy of financial accounts to make sure that businesses or organisations comply with tax legislation. Auditors examine the monetary activities of the company that appoints them to ensure the steady operation of the business. For anybody to become an auditor they should have certain specified qualifications and be certified by the regulatory authority for accounting and auditing. (Tags: Auditing Glasgow, Auditor Glasgow, Auditors Glasgow)

Payroll Services Glasgow

Staff payrolls can be a challenging part of running a business in Glasgow, regardless of its size. The laws relating to payroll requirements for accuracy and transparency mean that processing a company's payroll can be a daunting task for those untrained in this discipline.

A small business may well not have the advantage of an in-house financial expert and the simplest way to deal with the issue of employee payrolls is to hire an outside accountant in Glasgow. The payroll service will work along with HMRC and pension scheme administrators, and take care of BACS transfers to ensure accurate and timely wage payment to all staff.

A qualified payroll management accountant in Glasgow will also, in keeping with the current legislation, organise P60 tax forms at the end of the financial year for each of your staff members. They'll also provide P45 tax forms at the termination of a staff member's working contract.

Glasgow accountants will help with business outsourcing, management accounts, personal tax, partnership accounts in Glasgow, accounting services for the construction sector in Glasgow, bureau payroll services, small business accounting, taxation accounting services Glasgow, sole traders, VAT registration in Glasgow, corporate finance Glasgow, audit and auditing in Glasgow, self-employed registration Glasgow, bookkeeping in Glasgow, company secretarial services, litigation support, general accounting services in Glasgow, employment law, estate planning, consulting services, company formations, VAT returns, audit and compliance reports, debt recovery, HMRC submissions, inheritance tax Glasgow, capital gains tax, investment reviews, National Insurance numbers, mergers and acquisitions, corporation tax Glasgow, monthly payroll and other professional accounting services in Glasgow, Scotland. These are just a handful of the tasks that are conducted by nearby accountants. Glasgow providers will tell you about their entire range of accountancy services.

By using the web as a resource it is quite simple to find lots of invaluable ideas and information concerning self-assessment help, personal tax assistance, accounting & auditing and accounting for small businesses. For example, with a brief search we found this thought provoking article on the subject of choosing the right accountant.

Glasgow Accounting Services

- Glasgow Tax Advice

- Glasgow Business Accounting

- Glasgow Bookkeeping Healthchecks

- Glasgow Tax Returns

- Glasgow PAYE Healthchecks

- Glasgow Specialist Tax

- Glasgow Chartered Accountants

- Glasgow Self-Assessment

- Glasgow Business Planning

- Glasgow Forensic Accounting

- Glasgow Account Management

- Glasgow Audits

- Glasgow Bookkeepers

- Glasgow Tax Planning

Also find accountants in: Erskine, Grangemouth, Kintore, East Kilbride, Musselburgh, Bearsden, Selkirk, Clydebank, Hamilton, Motherwell, Glasgow, Rutherglen, Perth, Dundee, Dumbarton, Penicuik, Viewpark, Irvine, Larbert, Airdrie, Bonnybridge, Elgin, Bonnyrigg, Stirling, Coatbridge, Renfrew, Cambuslang, Cumbernauld, Peebles, Arbroath, Bathgate, Banchory, Barrhead, Ayr, Inverurie and more.

Accountant Glasgow

Accountant Glasgow Accountants Near Glasgow

Accountants Near Glasgow Accountants Glasgow

Accountants GlasgowMore Scotland Accountants: Hamilton, Coatbridge, Livingston, Cumbernauld, Falkirk, Inverness, East Kilbride, Stirling, Perth, Irvine, Glasgow, Ayr, Aberdeen, Dunfermline, Kirkcaldy, Kilmarnock, Paisley, Greenock, Motherwell, Dumfries, Airdrie, Dundee, Edinburgh and Glenrothes.

TOP - Accountants Glasgow - Financial Advisers

Financial Accountants Glasgow - Tax Preparation Glasgow - Tax Advice Glasgow - Self-Assessments Glasgow - Chartered Accountants Glasgow - Affordable Accountant Glasgow - Bookkeeping Glasgow - Financial Advice Glasgow - Small Business Accountant Glasgow