Accountants Halstead: If you have your own business or are a sole trader in Halstead, Essex, you will soon discover that there are several benefits to be gained from using a qualified accountant. Bookkeeping takes up precious time that you cannot afford to waste, therefore having an accountant take care of this allows you to put your emphasis on your key business. Start-ups will find that having access to this kind of expertise is incredibly beneficial.

Halstead accountants are available in many forms and types. Therefore, choosing the right one for your business is crucial. It is possible that you may opt to use an accountant who is working within a local Halstead accountancy firm, as opposed to one who works by himself/herself. A company may employ a number of accountants, each specialising in different disciplines of accountancy. It is likely that management accountants, forensic accountants, investment accountants, bookkeepers, chartered accountants, cost accountants, accounting technicians, financial accountants, actuaries, auditors and tax preparation accountants will be available within an accounting firm of any note.

You would be best advised to find a fully qualified Halstead accountant to do your tax returns. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. The extra peace of mind should compensate for any higher costs. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. For smaller businesses in Halstead, a qualified bookkeeper may well be adequate.

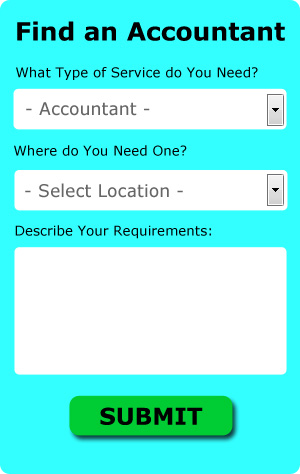

If you don't have the time to do a proper online search for local accountants, try using the Bark website. They provide an easy to fill in form that gives an overview of your requirements. Accountants in your local area will be sent your details, and if they are interested in doing the work will contact you shortly. Why not give Bark a try since there is no charge for this useful service.

Utilizing an online tax returns service will be your other option. This may save time and be more cost-effective for self-employed people in Halstead. Even if you do decide to go down this route, take some time in singling out a trustworthy company. It should be a simple task to find some online reviews to help you make your choice. We cannot endorse or recommend any of the available services here.

While possibly a little over the top for a small business, using a chartered accountant is another option. Larger limited companies must use a chartered accountant, smaller businesses do not need to. So, these are your possible options.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. It is also a good idea to make use of some self-assessment software such as Nomisma, Keytime, Capium, ACCTAX, Absolute Topup, Ajaccts, Gbooks, Xero, Basetax, Taxshield, BTCSoftware, Sage, GoSimple, Andica, CalCal, Ablegatio, Forbes, TaxCalc, 123 e-Filing, Taxforward or Taxfiler to simplify the process. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Tips to Help You Manage Your Business Finances Better

The fact that you get to be completely in charge of your income is one of the good reasons to put up your own business. Then again, managing business finances isn't exactly a simple matter. In fact, even those who've successfully lived by sticking to a budget in their personal lives can have a tough time managing the finances of their business. Fortunately, you can do some things that will make it so much easier on you to manage your business finances. Today, we'll discuss a few tips on how you can be better at managing the money for your business.

It could be that you use your credit card to pay many of your regular expenditures like web hosting, recurring membership fees, advertising accounts, and so on. This can certainly help your memory because you only have one payment to make each month instead of several. But then again, there's a risk to using credit cards because you'll end up paying interest if you don't pay the balance off in full every month. Sure, you can keep putting your monthly expenditures on your credit card, but if you do, you should pay the balance in full each month. When you do this, you streamline your process and not have to pay interest. Your credit rating will get a boost in the process.

Set a salary and pay yourself on a regular basis even though you're running your own business and you may be the only "employee" you have This can make it easier to keep track of your accounting both in your personal life and your professional life. All payments you get from selling goods or offering services should go straight to your business account. Every two weeks or every month, write yourself a paycheck and then deposit that to your personal account. It's up to you how much salary you want to give yourself. Your salary can be an hourly rate or a portion of your business income.

If you deal with cash in any capacity, make sure that you deposit that cash every day, as keeping cash on hand is just too tempting. You might need a few extra bucks to pay for lunch and you might think, "oh I'll put this back in a couple of days." When you do this, however, it's very possible that you'll forget all about the money you took out and then when you're doing your books, you're going to wonder why you're short. You can avoid this problem by putting your cash in your bank account at the end of the day.

Proper money management is a skill that every adult needs to develop. Knowing what you have coming in, what you have going out, and what exactly is going on with your money can be a huge boost to your confidence and success. So make sure you use the tips on proper money management that we mentioned in this article. If you want your business to be a success, it's important that you develop money management skills.

Payroll Services Halstead

For any company in Halstead, from large scale organisations down to independent contractors, staff payrolls can be stressful. Dealing with payrolls requires that all legal obligations regarding their accuracy, timings and transparency are observed to the finest detail.

Using an experienced company in Halstead, to deal with your payroll is the simple way to minimise the workload of yourself or your financial team. Your chosen payroll service company will provide accurate BACS payments to your staff, as well as working with any pension providers that your company might have, and follow current HMRC legislation for NI contributions and tax deductions.

A qualified payroll accountant in Halstead will also, in keeping with current legislations, organise P60 tax forms at the conclusion of the financial year for every member of staff. A P45 tax form will also be provided for any employee who stops working for the business, in keeping with current legislations.

Halstead accountants will help with bookkeeping, business advisory services, workplace pensions, investment reviews, small business accounting, capital gains tax, assurance services, PAYE, estate planning, VAT registration Halstead, general accounting services, debt recovery, accounting services for the construction industry, business start-ups, pension forecasts, bureau payroll services, financial and accounting advice, business outsourcing, consulting services, accounting services for landlords, business disposal and acquisition, auditing and accounting Halstead, financial planning, taxation accounting services, payslips Halstead, corporate tax, accounting support services in Halstead, double entry accounting, HMRC submissions Halstead, employment law in Halstead, annual tax returns, personal tax and other kinds of accounting in Halstead, Essex. These are just some of the duties that are handled by nearby accountants. Halstead companies will inform you of their entire range of accounting services.

Halstead Accounting Services

- Halstead Account Management

- Halstead Financial Advice

- Halstead Tax Services

- Halstead Tax Investigations

- Halstead Tax Returns

- Halstead Specialist Tax

- Halstead PAYE Healthchecks

- Halstead Debt Recovery

- Halstead Taxation Advice

- Halstead Tax Planning

- Halstead Business Accounting

- Halstead Chartered Accountants

- Halstead Tax Refunds

- Halstead Bookkeeping Healthchecks

Also find accountants in: Witham, Pitsea, Tollesbury, Westcliff On Sea, Duck End, Epping Green, Tolleshunt Knights, North End, Southminster, Hatfield Heath, Whiteash Green, St Osyth, High Laver, Gosfield, Great Bentley, Beauchamp Roding, Holland On Sea, Steeple Bumpstead, Wickham St Paul, Stow Maries, Foxearth, Faulkbourne, Alphamstone, Steeple, Great Saling, Wickford, Pool Street, Knowl Green, Langdon Hills, Great Holland, Hempstead, Horsley Cross, Hockley, Ramsden Bellhouse, Stoneyhills and more.

Accountant Halstead

Accountant Halstead Accountants Near Halstead

Accountants Near Halstead Accountants Halstead

Accountants HalsteadMore Essex Accountants: Chelmsford, Frinton-on-Sea, Leigh-on-Sea, Great Wakering, Colchester, Great Baddow, Holland-on-Sea, Burnham-on-Crouch, Harlow, Laindon, Wivenhoe, Hockley, Clacton-on-Sea, Pitsea, Heybridge, Wickford, Stanford-le-Hope, Shoeburyness, Great Dunmow, Hawkwell, Ingatestone, Brightlingsea, Maldon, Billericay, Manningtree, Stansted Mountfitchet, North Weald Bassett, Romford, Southend-on-Sea, Chipping Ongar, Southchurch, Rayleigh, Corringham, Stanway, Barking, Upminster, Dagenham, Parkeston, Galleywood, Westcliff-on-Sea, Chingford, West Thurrock, Hornchurch, Brentwood, Canvey Island, Basildon, Harwich, Buckhurst Hill, Rochford, South Ockendon, Witham, Tiptree, Walton-on-the-Naze, Danbury, Coggeshall, Tilbury, Ilford, Loughton, Hullbridge, Saffron Walden, South Benfleet, Purfleet, Hadleigh, Langdon Hills, Waltham Abbey, Writtle, Chafford Hundred, Grays, Chigwell, South Woodham Ferrers, Epping, Southminster, Braintree, Rainham, West Mersea and Halstead.

TOP - Accountants Halstead - Financial Advisers

Small Business Accountant Halstead - Investment Accountant Halstead - Affordable Accountant Halstead - Tax Preparation Halstead - Chartered Accountants Halstead - Financial Accountants Halstead - Financial Advice Halstead - Tax Accountants Halstead - Online Accounting Halstead