Accountants Hartlepool: Filling out your self-assessment form every year can really give you nightmares. This is a worry for you and innumerable others in Hartlepool. You may prefer to track down a local Hartlepool accountant to do it for you. If self-assessment is too complex for you, this may be the way forward. Typically Hartlepool High Street accountants will do this for approximately £220-£300. Online accounting services are available for considerably less than this.

You may be confused when you find that accountants don't just do tax returns, they have many different roles. Therefore, picking the right one for your business is crucial. Certain accountants work as part of an accountancy business, whilst some work as sole traders. The benefit of accounting companies is that they have many fields of expertise in one place. Some of the principal accountancy posts include the likes of: auditors, bookkeepers, investment accountants, cost accountants, actuaries, financial accountants, management accountants, forensic accountants, tax accountants, chartered accountants and accounting technicians.

You should take care to find a properly qualified accountant in Hartlepool to complete your self-assessment forms correctly and professionally. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. Remember that a percentage of your accounting costs can be claimed back on the tax return.

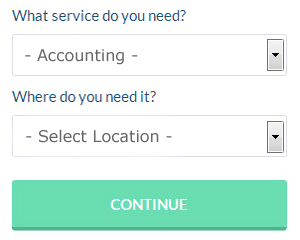

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. Tick a few boxes on their form and submit it in minutes. Then you just have to wait for some prospective accountants to contact you.

If you prefer the cheaper option of using an online tax returns service there are several available. Over the last few years many more of these services have been appearing. Picking a reputable company is important if you choose to go with this option. There are resources online that will help you choose, such as review websites. We will not be recommending any individual online accounting service in this article.

If you really want the best you could go with a chartered accountant. However, as a sole trader or smaller business in Hartlepool using one of these specialists may be a bit of overkill. Hiring the services of a chartered accountant means you will have the best that money can buy.

At the end of the day you could always do it yourself and it will cost you nothing but time. To make life even easier there is some intuitive software that you can use. Including GoSimple, TaxCalc, Taxfiler, Xero, Keytime, Sage, ACCTAX, Absolute Topup, Taxforward, Basetax, Ablegatio, Andica, Forbes, Gbooks, BTCSoftware, Taxshield, Ajaccts, Nomisma, CalCal, Capium and 123 e-Filing. Don't leave your self-assessment until the last minute, allow yourself plenty of time. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

Small Business Accountants Hartlepool

Doing the accounts can be a pretty stressful experience for any small business owner in Hartlepool. Retaining a small business accountant in Hartlepool will enable you to run your business knowing that your annual accounts, tax returns and VAT, and various other business tax requirements, are being met.

A good small business accountant will see it as their responsibility to help your business to grow, encouraging you with sound advice, and providing you with security and peace of mind concerning your financial situation at all times. The vagaries and often complicated sphere of business taxation will be clearly explained to you in order to lower your business expenses, while maximising tax efficiency.

It is critical that you explain your future plans, your current financial situation and your business structure truthfully to your small business accountant.

Payroll Services Hartlepool

An important aspect of any business enterprise in Hartlepool, big or small, is having an effective payroll system for its staff. Managing staff payrolls requires that all legal requirements in relation to their exactness, transparency and timing are observed in all cases.

Using a reputable accounting firm in Hartlepool, to deal with your payroll is a easiest way to minimise the workload of your own financial department. Your payroll accounting company will manage accurate BACS payments to your personnel, as well as working along with any pension schemes your business may have, and follow the latest HMRC legislation for deductions and NI contributions.

A genuine payroll management accountant in Hartlepool will also, in accordance with current legislations, organise P60 tax forms at the end of the financial year for every member of staff. Upon the termination of a staff member's contract with your company, the payroll company will supply an updated P45 form outlining what tax has been paid during the previous financial period. (Tags: Company Payrolls Hartlepool, Payroll Services Hartlepool, Payroll Accountant Hartlepool).

Hartlepool accountants will help with VAT returns, litigation support, pension forecasts, financial planning in Hartlepool, accounting services for the construction industry, tax investigations in Hartlepool, sole traders, VAT registrations, workplace pensions, bureau payroll services in Hartlepool, self-assessment tax returns, bookkeeping, business advisory, company secretarial services, payslips in Hartlepool, assurance services in Hartlepool, accounting services for buy to let rentals, accounting services for media companies Hartlepool, National Insurance numbers, business disposal and acquisition in Hartlepool, small business accounting, double entry accounting, PAYE, cashflow projections Hartlepool, inheritance tax, company formations, charities in Hartlepool, general accounting services in Hartlepool, accounting support services Hartlepool, year end accounts, audit and auditing, partnership registrations in Hartlepool and other accounting related services in Hartlepool, County Durham. These are just some of the tasks that are carried out by local accountants. Hartlepool providers will be delighted to keep you abreast of their entire range of services.

Hartlepool Accounting Services

- Hartlepool Bookkeepers

- Hartlepool VAT Returns

- Hartlepool Tax Advice

- Hartlepool Personal Taxation

- Hartlepool Tax Refunds

- Hartlepool PAYE Healthchecks

- Hartlepool Tax Services

- Hartlepool Forensic Accounting

- Hartlepool Account Management

- Hartlepool Business Accounting

- Hartlepool Bookkeeping Healthchecks

- Hartlepool Self-Assessment

- Hartlepool Auditing

- Hartlepool Debt Recovery

Also find accountants in: Hury, Morley, Killerby, Ingleton, Rookhope, Cornforth, Stillington, Waldridge, Seaton Carew, Dean Bank, Langdon Beck, Leadgate, Butsfield, Summer House, Cornsay, Hunstanworth, Mordon, Beamish, East Hedleyhope, Gilmonby, Crimdon Park, Littletown, High Coniscliffe, Port Clarence, Cornsay Colliery, West Auckland, Newbiggin, Wynyard, Castleside, Ushaw Moor, Middleton One Row, Wycliffe, South Wingate, Bishop Auckland, High Etherley and more.

Accountant Hartlepool

Accountant Hartlepool Accountants Near Me

Accountants Near Me Accountants Hartlepool

Accountants HartlepoolMore County Durham Accountants: Stanley, Hartlepool, Chester-le-Street, Darlington, Seaham, Peterlee, Stockton-on-Tees, Durham, Bishop Auckland, Billingham, Newton Aycliffe and Consett.

TOP - Accountants Hartlepool - Financial Advisers

Chartered Accountant Hartlepool - Small Business Accountants Hartlepool - Auditors Hartlepool - Bookkeeping Hartlepool - Financial Advice Hartlepool - Tax Advice Hartlepool - Investment Accounting Hartlepool - Self-Assessments Hartlepool - Financial Accountants Hartlepool