Accountants Havant: There are numerous benefits to be gained from hiring the expert services of an accountant if you're running a business or are self-employed in the Havant area. By handling crucial tasks such as payroll, tax returns and bookkeeping your accountant can at the minimum free up some time for you to concentrate on your core business. The importance of getting this sort of financial assistance can't be overstated, especially for start-ups and fledgling businesses who are not established yet.

Finding an accountant in Havant isn't always that easy with various kinds of accountants out there. Choosing the best one for your business is crucial. Yet another decision you will need to make is whether to go for an accountancy company or an independent accountant. Within an accounting business will be specialists in distinct sectors of accountancy. The types of accountant you are likely to find within a firm could include: chartered accountants, financial accountants, management accountants, investment accountants, tax preparation accountants, forensic accountants, accounting technicians, auditors, bookkeepers, costing accountants and actuaries.

Finding a properly qualified Havant accountant should be your priority. An AAT qualified accountant should be adequate for sole traders and small businesses. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Make sure that you include the accountants fees in your expenses, because these are tax deductable.

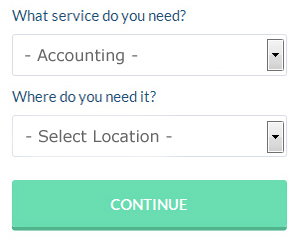

If you want to reach out to a number of local Havant accountants, you could always use a service called Bark. Little is required other than ticking a few boxes on the search form. Your requirements will be distributed to accountants in the Havant area and they will be in touch with you directly. You will not be charged for this service.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. This kind of service may not suit everyone but could be the answer for your needs. Choose a company with a history of good service. A good method for doing this is to check out any available customer reviews and testimonials. If you are looking for individual recommendations, this website is not the place to find them.

At the other extreme of the accounting spectrum are chartered accountants, these highly trained professional are at the top of their game. Their usual clients are big businesses and large limited companies. With a chartered accountant you will certainly have the best on your side.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Nomisma, CalCal, Capium, Taxfiler, Xero, Ablegatio, ACCTAX, TaxCalc, Ajaccts, Absolute Topup, Gbooks, Basetax, Forbes, Taxshield, BTCSoftware, Sage, Taxforward, GoSimple, 123 e-Filing, Keytime and Andica. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Forensic Accountant Havant

You may well come across the term "forensic accounting" when you're looking for an accountant in Havant, and will no doubt be interested to know about the difference between regular accounting and forensic accounting. The word 'forensic' is the thing that gives you an idea, meaning basically "denoting or relating to the application of scientific techniques and methods to the investigation of crime." Also often known as 'financial forensics' or 'forensic accountancy', it uses investigative skills, accounting and auditing to discover irregularities in financial accounts which have resulted in fraud or theft. There are even several bigger accountants firms in Hampshire who have specialised departments for forensic accounting, investigating personal injury claims, professional negligence, tax fraud, insolvency, bankruptcy, money laundering and insurance claims.

Small Business Accountants Havant

Doing the accounts and bookkeeping can be a fairly stressful experience for anybody running a small business in Havant. If your accounts are getting you down and tax returns and VAT issues are causing sleepless nights, it is advisable to hire a decent small business accountant in Havant.

Giving guidance, ensuring that your business adheres to the optimum financial practices and suggesting techniques to help your business to reach its full potential, are just some of the responsibilities of a reputable small business accountant in Havant. The capricious and complex sphere of business taxation will be clearly laid out for you so as to reduce your business expenses, while maximising tax efficiency.

It is crucial that you explain your company's situation, your business structure and your future plans accurately to your small business accountant. (Tags: Small Business Accountant Havant, Small Business Accounting Havant, Small Business Accountants Havant).

How Money Management Helps with Self Improvement and Business

Proper money management is something that many small business owners have to struggle with, especially when they are still trying to get their feet wet as a business owner. When you're managing your finances poorly, your confidence in yourself might go down, especially when your business isn't being as profitable as you'd hope. This could actually make you feel like giving up and returning to your old job. This, believe it or not, can keep you from reaching the level of success that you want to reach. You can be a good money manager with the help of the following tips.

Number your invoices. This may not be that big of a deal to you right now, but you'll thank yourself later on if you implement this tip early on in your business. When you've got your invoices numbered, you can easily track your transactions. You're able to track people who still owe you and for how much and even quickly find out who have already paid. You'll have those times when a client will be insistent in saying he has already paid you and if you have your invoices numbered, you can easily look it up and resolve the matter. It's so much easier to find errors in your invoicing too if you have an invoicing system in place.

Even if you are a sole proprietor, you can still give yourself a salary and a regular paycheck. This can make it easier to keep track of your accounting both in your personal life and your professional life. Your business account should be where all the payments you get for the sale of your products or services should go. Then on a weekly, bi-weekly, or monthly basis, you can pay yourself out of your business account. You decide the salary for yourself. You can pay yourself by billable hours or a portion of your business income for that month.

Of course, if you're keeping track of every penny you're spending, you should keep track of every penny you're getting as well. Every single time you receive a payment, write down that you have been paid and how much. You know who has already paid and who hasn't. In addition, you know exactly how much money you've got at any given time. It also makes it easy to figure out what you owe in taxes and how much you should pay yourself for that week or month.

Whether you're a business owner or not, it's important that you learn proper money management. Knowing what you have coming in, what you have going out, and what exactly is going on with your money can be a huge boost to your confidence and success. Use the tips in this article to help you get started. Developing proper money management skills not only will help boost your business but boost your self-confidence as well.

Havant accountants will help with HMRC liaison in Havant, year end accounts, financial planning, PAYE, self-employed registration, financial and accounting advice, employment law, tax investigations in Havant, accounting support services, mergers and acquisitions in Havant, capital gains tax, company formations, business outsourcing, workplace pensions, general accounting services, investment reviews, business advisory services, company secretarial services, estate planning Havant, monthly payroll, litigation support, pension forecasts Havant, corporation tax, partnership accounts in Havant, contractor accounts in Havant, debt recovery Havant, corporate finance Havant, consultancy and systems advice, limited company accounting, assurance services Havant, consulting services, National Insurance numbers in Havant and other accounting related services in Havant, Hampshire. These are just an example of the duties that are performed by nearby accountants. Havant providers will be delighted to keep you abreast of their whole range of services.

With the internet as a useful resource it is of course surprisingly easy to find plenty of valuable ideas and inspiration concerning self-assessment help, accounting for small businesses, auditing & accounting and personal tax assistance. For example, with a quick search we discovered this informative article about choosing the right accountant for your business.

Havant Accounting Services

- Havant Account Management

- Havant Specialist Tax

- Havant VAT Returns

- Havant Financial Audits

- Havant Bookkeeping Healthchecks

- Havant Payroll Management

- Havant Debt Recovery

- Havant Self-Assessment

- Havant Tax Planning

- Havant Tax Services

- Havant Personal Taxation

- Havant Business Accounting

- Havant Auditing

- Havant Tax Advice

Also find accountants in: Woodgreen, Longparish, High Cross, Everton, Bramshaw, Burridge, Old Netley, West End, Wootton, Abbottswood, Hartfordbridge, Golden Pot, Blendworth, Lepe, Whitchurch, Bank, Milford On Sea, South Hayling, Broadmere, Phoenix Green, Faccombe, West Town, Greywell, Andover Down, Upper Wield, Mortimer West End, Rowlands Castle, Enham Alamein, Fleet, Litchfield, Bordon, Well, Tichborne, Burley Street, Burgh Clere and more.

Accountant Havant

Accountant Havant Accountants Near Havant

Accountants Near Havant Accountants Havant

Accountants HavantMore Hampshire Accountants: Andover, New Milton, Aldershot, Southsea, Hedge End, Horndean, Waterlooville, Basingstoke, Yateley, Portsmouth, Alton, Winchester, Farnborough, Stubbington, Gosport, Fareham, Eastleigh, Hythe, Fleet, Totton, Emsworth, Havant and Southampton.

TOP - Accountants Havant - Financial Advisers

Investment Accountant Havant - Tax Advice Havant - Chartered Accountants Havant - Affordable Accountant Havant - Bookkeeping Havant - Small Business Accountant Havant - Online Accounting Havant - Financial Accountants Havant - Financial Advice Havant