Accountants Hessle: If you've got your own business or are a self-employed person in Hessle, East Yorkshire, you will soon discover that there are several advantages to be gained from using a qualified accountant. At the minimum your accountant can handle important tasks like doing your tax returns and keeping your books up to date, giving you more hours to focus on your business. Being able to access expert financial advice is even more crucial for new businesses.

So, what sort of accounting service should you look for and how much should you expect to pay? In this day and age the first place to head is the internet when searching for any local service, including bookkeepers and accountants. But, how can you tell who to trust? You must never forget that anybody in Hessle can claim to be an accountant. Qualifications aren't even a prerequisite. Which seems a bit weird on the face of things.

It is advisable for you to find an accountant in Hessle who is properly qualified. Ask if they at least have an AAT qualification or higher. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. Accounting fees are of course a business expense and can be included as such on your tax return. Sole traders and smaller businesses might get away with using a bookkeeper.

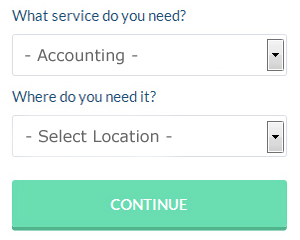

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Hessle accountant. It is just a case of ticking some boxes on a form. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment.

If you prefer the cheaper option of using an online tax returns service there are several available. An increasing number of self-employed people are plumping for this option. Some of these companies are more reputable than others. Have a good look at customer testimonials and reviews both on the company website and on independent review websites. Sorry but we cannot recommend any individual service on this website.

Going from the cheapest service to the most expensive, you could always use a chartered accountant if you are prepared to pay the price. However, as a sole trader or smaller business in Hessle using one of these specialists may be a bit of overkill. So, these are your possible options.

Of course, completing and sending in your own self-assessment form is the cheapest solution. The process can be simplified even further by the use of software such as Ajaccts, Sage, Absolute Topup, TaxCalc, Andica, 123 e-Filing, ACCTAX, Taxshield, Taxforward, CalCal, Forbes, Ablegatio, Gbooks, BTCSoftware, Nomisma, Capium, Basetax, Xero, Taxfiler, GoSimple or Keytime. Make sure your tax returns are sent off promptly to avoid getting a penalty fine.

Payroll Services Hessle

Staff payrolls can be a challenging area of running a business in Hessle, regardless of its size. Controlling staff payrolls requires that all legal requirements in relation to their exactness, timings and transparency are followed to the finest detail.

A small business may not have the luxury of a dedicated financial expert and an easy way to deal with the issue of employee payrolls is to employ an outside payroll company in Hessle. The payroll management service will work along with HMRC and pension scheme administrators, and deal with BACS payments to ensure timely and accurate payment to all personnel.

It will also be a requirement for a payroll management company in Hessle to provide a P60 declaration for all personnel after the end of the financial year (by May 31st). They'll also provide P45 tax forms at the termination of a staff member's contract with your company. (Tags: Payroll Services Hessle, Payroll Accountants Hessle, Payroll Companies Hessle).

Hessle accountants will help with estate planning, investment reviews, National Insurance numbers, assurance services, business acquisition and disposal, general accounting services, cashflow projections, VAT registrations, VAT returns, taxation accounting services Hessle, accounting services for property rentals, debt recovery, double entry accounting, corporate finance, business advisory services Hessle, business support and planning, financial planning, tax returns in Hessle, retirement advice, consultancy and systems advice, PAYE, litigation support, partnership registration, HMRC submissions, HMRC submissions, bureau payroll services, contractor accounts in Hessle, accounting services for the construction industry, partnership accounts, personal tax Hessle, corporation tax, company formations in Hessle and other kinds of accounting in Hessle, East Yorkshire. Listed are just a handful of the activities that are accomplished by nearby accountants. Hessle specialists will keep you informed about their full range of services.

Hessle Accounting Services

- Hessle Tax Investigations

- Hessle Specialist Tax

- Hessle Forensic Accounting

- Hessle Taxation Advice

- Hessle Tax Services

- Hessle VAT Returns

- Hessle Bookkeepers

- Hessle Chartered Accountants

- Hessle Tax Returns

- Hessle Auditing

- Hessle Financial Advice

- Hessle PAYE Healthchecks

- Hessle Personal Taxation

- Hessle Self-Assessment

Also find accountants in: Laxton, Beswick, Out Newton, Eastrington, Fridaythorpe, Shiptonthorpe, Meltonby, North Cliffe, Blacktoft, Kilham, South Skirlaugh, Haisthorpe, Little Driffield, Gembling, Bielby, Bolton, Sutton Upon Derwent, Buckton, Newton Upon Derwent, Kilnsea, Garton On The Wolds, Howden, Rise, Carnaby, Bugthorpe, Cherry Burton, West Ella, Hempholme, Old Ellerby, Fordon, Arram, Reedness, Storwood, Millington, Gardham and more.

Accountant Hessle

Accountant Hessle Accountants Near Me

Accountants Near Me Accountants Hessle

Accountants HessleMore East Yorkshire Accountants: Hessle, Cottingham, Beverley, Bridlington, Goole, Driffield and Hull.

TOP - Accountants Hessle - Financial Advisers

Auditing Hessle - Self-Assessments Hessle - Bookkeeping Hessle - Small Business Accountant Hessle - Chartered Accountants Hessle - Cheap Accountant Hessle - Tax Return Preparation Hessle - Investment Accountant Hessle - Financial Advice Hessle