Accountants Horsham: Does filling in your annual self-assessment form make your head spin? A lot of folks in Horsham have the same problem as you. You may instead opt to hire a trusted Horsham accountant to take the load off your shoulders. Is self-assessment just a tad too complicated for you? You should expect to pay approximately two to three hundred pounds for the average small business accountant. You will be able to get this done considerably cheaper by making use of one of the various online services.

Locating an accountant in Horsham is not always that simple with various different types of accountants available. So, its vital to identify an accountant who can fulfil your requirements exactly. It isn't unusual for Horsham accountants to operate independently, others favour being part of a larger accounting business. A firm will employ a team of accountants, each with expertise in different disciplines of accountancy. Among the principal accounting positions are: management accountants, accounting technicians, actuaries, chartered accountants, forensic accountants, investment accountants, bookkeepers, tax accountants, auditors, cost accountants and financial accountants.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. An AAT qualified accountant should be adequate for sole traders and small businesses. The extra peace of mind should compensate for any higher costs. You will be able to claim the cost of your accountant as a tax deduction. It is perfectly acceptable to use a qualified bookkeeper in Horsham if you are a sole trader or a smaller business.

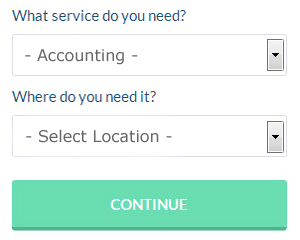

If you don't have the time to do a proper online search for local accountants, try using the Bark website. A couple of minutes is all that is needed to complete their simple and straighforward search form. You should start getting responses from local Horsham accountants within the next 24 hours.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. You might find that this is simpler and more convenient for you. Choose a company with a history of good service. It should be a simple task to find some online reviews to help you make your choice.

Although filling in your own tax return may seem too complicated, it is not actually that hard. You can take much of the hard graft out of this procedure by using a software program such as TaxCalc, Xero, Forbes, Taxshield, Sage, 123 e-Filing, Basetax, Ajaccts, ACCTAX, Andica, Gbooks, CalCal, Taxfiler, Absolute Topup, GoSimple, Ablegatio, Taxforward, Nomisma, BTCSoftware, Capium or Keytime. You'll receive a fine if your self-assessment is late. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

Forensic Accounting Horsham

During your search for a reliable accountant in Horsham there's a pretty good chance that you'll stumble on the term "forensic accounting" and be wondering what it is, and how it is different from regular accounting. The hint for this is the actual word 'forensic', which basically means "denoting or relating to the application of scientific techniques and methods to the investigation of criminal activity." Also often known as 'financial forensics' or 'forensic accountancy', it uses investigative skills, auditing and accounting to identify irregularities in financial accounts which have lead to fraud or theft. Some larger accounting firms in the Horsham area could even have independent forensic accounting divisions with forensic accountants concentrating on certain kinds of fraud, and may be addressing insurance claims, professional negligence, bankruptcy, personal injury claims, insolvency, tax fraud and money laundering. (Tags: Forensic Accounting Horsham, Forensic Accountant Horsham, Forensic Accountants Horsham)

Auditors Horsham

An auditor is an individual authorised to review and authenticate the reliability of financial accounts to make certain that companies conform to tax laws. They also sometimes act as advisors to recommend possible the prevention of risk and the implementation of cost reductions. To become an auditor, a person should be approved by the regulating authority of auditing and accounting or have earned certain specific qualifications. (Tags: Auditing Horsham, Auditor Horsham, Auditors Horsham)

Practicing Better Money Management to Help Your Business Succeed

If you've just launched your business, you'll find out soon enough that properly using money management strategies is not that easy to learn. You may be thinking that money management is something that you should already be able to do. Personal money management, however, is completely different from business money management, although being experienced in the former can be handy when you go into business. Your confidence can take a hard hit if you ruin your finances on accident. Continue reading if you want to know how you can better manage your business finances.

Have an account that's just for your business expenses and another for your personal expenses. It may be simple to keep track of everything in the beginning, but over time, you'll find it's so much easier to track your expenses if you have separate accounts. And here's the thing -- if you run your business expenses through your personal account, it'll be a lot harder to prove your income. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. Make it easy on yourself (or your accountant) by having an account for your business and another for your personal expenses.

You may be your own boss, but it's still a good idea to give yourself a regular paycheck. This can make it easier to keep track of your accounting both in your personal life and your professional life. So how do you do this exactly? First, any payments you get from the sale of your products or services should go to your business account. Next, decide how often you want to receive a salary. Let's say you want to pay yourself once every month, such as on the 15th. When the 15th comes around, write yourself a check. It's up to you how much salary you want to give yourself. It can be a percentage of your business income or it can be an hourly rate.

Make sure you account for every penny your business brings in. Every single time you receive a payment, write down that you have been paid and how much. Doing this will help you know how much money you've got and know exactly who has already paid you. This money management strategy also makes it a lot easier on you to determine the amount of money you owe in taxes and even how much money you should pay yourself.

When it comes to managing your money properly, there are so many things that go into it. It's a lot more than simply keeping a list of your expenditures. When you're in business, you have several things you need to keep track of. The tips we have shared will help you track your money more easily. As you become more skilled in managing your business finances, you'll be able to implement other things that will help make the process easier for you.

Payroll Services Horsham

Dealing with staff payrolls can be a complicated aspect of running a business enterprise in Horsham, irrespective of its size. The laws on payrolls and the legal obligations for openness and accuracy means that dealing with a company's payroll can be an intimidating task.

Not all small businesses have the help that a dedicated financial expert can provide, and the easiest way to handle employee pay is to hire an independent Horsham accounting firm. Working with HMRC and pension scheme administrators, a payroll accountant will also deal with BACS payments to personnel, make certain they are paid on time every month, and that all mandatory deductions are done correctly.

Adhering to the current regulations, a qualified payroll accountant in Horsham will also provide each of your employees with a P60 tax form at the conclusion of each financial year. A P45 should also be presented to any employee who stops working for your company, as outlined by current regulations.

Horsham accountants will help with business planning and support in Horsham, charities, accounting services for the construction sector, VAT returns, HMRC submissions, tax preparation, accounting support services in Horsham, cashflow projections, taxation accounting services, National Insurance numbers Horsham, financial planning, financial statements, management accounts in Horsham, double entry accounting, accounting and financial advice, capital gains tax in Horsham, bureau payroll services, monthly payroll in Horsham, business advisory, inheritance tax, auditing and accounting, business disposal and acquisition, self-assessment tax returns, payslips in Horsham, employment law, mergers and acquisitions, accounting services for media companies in Horsham, general accounting services, PAYE, investment reviews, sole traders, partnership registrations in Horsham and other forms of accounting in Horsham, West Sussex. Listed are just a selection of the duties that are handled by local accountants. Horsham professionals will inform you of their whole range of services.

With the world wide web as a resource it is quite easy to find plenty of valuable ideas and information regarding auditing & accounting, personal tax assistance, self-assessment help and accounting for small businesses. To illustrate, with a brief search we located this super article about choosing the right accountant.

Horsham Accounting Services

- Horsham Tax Services

- Horsham Bookkeepers

- Horsham Forensic Accounting

- Horsham Account Management

- Horsham VAT Returns

- Horsham Self-Assessment

- Horsham Audits

- Horsham Debt Recovery

- Horsham Business Accounting

- Horsham Tax Planning

- Horsham Personal Taxation

- Horsham Financial Advice

- Horsham Payroll Services

- Horsham PAYE Healthchecks

Also find accountants in: Amberley, Hardham, Poling Corner, Halnaker, Ashurstwood, North Heath, Woodmancote, Poling, Cross Bush, Warningcamp, Upwaltham, Worth, Kirdford, East Dean, Ashington, Fittleworth, Aldwick, Norton, Wineham, Burpham, East Harting, Donnington, Wisborough Green, Plaistow, West Wittering, Lowfield Heath, Balls Cross, Langley, Runcton, Sutton, East Wittering, Nursted, Tangmere, North Bersted, West Marden and more.

Accountant Horsham

Accountant Horsham Accountants Near Horsham

Accountants Near Horsham Accountants Horsham

Accountants HorshamMore West Sussex Accountants: Crawley, Bognor Regis, Shoreham-by-Sea, Lancing, Chichester, Worthing, Haywards Heath, Southwater, Southwick, Rustington, Horsham, East Grinstead, Burgess Hill, Hurstpierpoint and Littlehampton.

TOP - Accountants Horsham - Financial Advisers

Investment Accountant Horsham - Financial Accountants Horsham - Cheap Accountant Horsham - Tax Accountants Horsham - Self-Assessments Horsham - Small Business Accountant Horsham - Chartered Accountant Horsham - Tax Return Preparation Horsham - Bookkeeping Horsham