Accountants Ilford: Does filling in your self-assessment tax form cause you problems every year? You aren't alone in Ilford if this problem affects you every year. Tracking down a local Ilford professional to do this for you may be the solution. Do you find self-assessment simply too taxing to tackle by yourself? Typically Ilford High Street accountants will do this for about £220-£300. You'll be able to get it done a lot cheaper by making use of one of the numerous online accounting services.

So, how should you set about finding an accountant in Ilford? An internet search engine will pretty rapidly provide a substantial list of possible candidates in Ilford. But, are they all trustworthy? You must always remember that it's possible for anybody in Ilford to claim that they are an accountant. There is no legal requirement that says they have to have particular qualifications or certifications. This can result in unskilled individuals entering the profession.

Finding an accountant in Ilford who is qualified is generally advisable. You don't need a chartered accountant but should get one who is at least AAT qualified. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. It should go without saying that accountants fees are tax deductable. Ilford sole traders often opt to use bookkeeper rather than accountants for their tax returns.

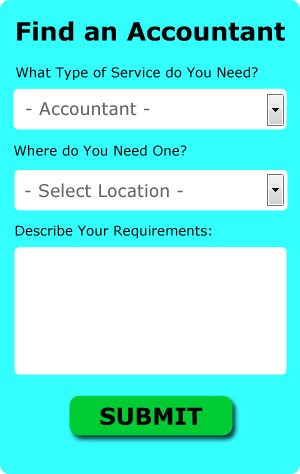

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Ilford accountant. Tick a few boxes on their form and submit it in minutes. Within a few hours you should hear from some local accountants who are willing to help you.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. While not recommended in every case, it could be the ideal solution for you. It would be advisable to investigate that any online company you use is reputable. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable. This is something you need to do yourself as we do not wish to favour any particular service here.

Of course, completing and sending in your own self-assessment form is the cheapest solution. Software programs like Taxfiler, Nomisma, GoSimple, Andica, Absolute Topup, Ajaccts, Sage, Capium, Taxforward, TaxCalc, ACCTAX, Forbes, Xero, Taxshield, Keytime, Ablegatio, CalCal, Basetax, 123 e-Filing, Gbooks and BTCSoftware have been developed to help small businesses do their own tax returns. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time. For being up to 3 months late you will be fined £100, and £10 per day thereafter.

Actuary Ilford

An actuary is a business specialist who analyses the measurement and managing of risk and uncertainty. An actuary employs financial and statistical practices to calculate the likelihood of a certain event occurring and its potential monetary implications. Actuaries supply judgements of financial security systems, with an emphasis on their complexity, their mechanisms and their mathematics.

Forensic Accounting Ilford

When you're trying to find an accountant in Ilford you will probably notice the phrase "forensic accounting" and be curious about what the differences are between a forensic accountant and a normal accountant. The word 'forensic' is the thing that gives you an idea, meaning basically "denoting or relating to the application of scientific methods and techniques for the investigation of a crime." Sometimes also called 'forensic accountancy' or 'financial forensics', it uses accounting, auditing and investigative skills to inspect financial accounts so as to identify fraud and criminal activity. There are even a few larger accountants firms in Essex who have got dedicated departments for forensic accounting, dealing with personal injury claims, professional negligence, tax fraud, bankruptcy, insurance claims, insolvency and money laundering. (Tags: Forensic Accounting Ilford, Forensic Accountants Ilford, Forensic Accountant Ilford)

Staying on Top of Your Finances When You're a Business Owner

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. For many new business owners, it's hardest to make their business profitable mainly because of the things that can happen during the process that can adversely impact the business and their self-confidence. For instance, if you don't manage your finances properly, this can hurt you and your business. You might not think that there is much to money management because in the beginning it might be pretty simple. We're sharing a few proper money management tips to help you out because the financial aspect of your business is only going to get more complicated as your business grows.

Don't wait for the due date to pay your taxes because you may not have the funds to pay by then, especially if you're not a good money manager. To avoid this problem, it's a good idea to set aside a portion of every payment you get into a savings count. Do this and you'll never have to worry where to get the money to pay your taxes every quarter because you've already got it saved. As a business owner, you'll be able to breathe easily each time knowing that you're able to pay your taxes fully and promptly.

Give your clients the choice to pay in installments. Besides making it more appealing for potential clients to do business with you, this strategy will have money coming in on a regular basis. Having payments come in regularly even if they aren't in huge amounts is certainly so much better than getting big payments irregularly. Reliable income makes it a lot easier for you to budget, makes it easier to keep your bills paid, and makes it much simpler to properly manage your money. This can certainly boost your self-confidence.

Make sure you're prompt in paying your taxes. Generally, taxes must be paid quarterly by small business owners. It's crucial that you have the most current and accurate information when it comes to small business taxes. For this, it's best that you get your information from the IRS or from the local small business center. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. Having the IRS at your doorstep isn't something you'd want, believe me!

Every adult should learn the proper way of managing their money. As a business owner, you're a lot more likely to succeed if you know how much money your business is generating, how much money you're spending, and basically what's happening with your money. Try implementing the above tips in your business. Truly, when it comes to self improvement in business, properly managing your money is incredibly important.

Auditors Ilford

An auditor is an individual or company brought in to assess and authenticate the accuracy of financial accounts to make sure that businesses or organisations comply with tax legislation. They can also act as consultants to advocate potential the prevention of risk and the implementation of cost reductions. For anybody to start working as an auditor they should have certain qualifications and be licensed by the regulating body for accounting and auditing. (Tags: Auditing Ilford, Auditor Ilford, Auditors Ilford)

Ilford accountants will help with business planning and support, bookkeeping, financial statements, estate planning, inheritance tax, tax investigations, auditing and accounting Ilford, accounting services for media companies, investment reviews, accounting services for the construction sector, year end accounts, company secretarial services, limited company accounting, cashflow projections, business advisory, HMRC submissions, VAT registrations, bureau payroll services, accounting and financial advice, accounting services for buy to let property rentals, corporate finance, charities, employment law, business start-ups, self-assessment tax returns, VAT returns Ilford, self-employed registration, workplace pensions in Ilford, company formations, double entry accounting in Ilford, payslips, consultancy and systems advice in Ilford and other professional accounting services in Ilford, Essex. These are just some of the tasks that are handled by local accountants. Ilford specialists will tell you about their entire range of accountancy services.

You actually have the very best resource at your fingertips in the form of the web. There is such a lot of inspiration and information readily available online for things like accounting & auditing, personal tax assistance, small business accounting and self-assessment help, that you will pretty quickly be deluged with suggestions for your accounting requirements. An example might be this illuminating article on the subject of 5 tips for finding a top-notch accountant.

Ilford Accounting Services

- Ilford Forensic Accounting

- Ilford Tax Refunds

- Ilford Chartered Accountants

- Ilford Payroll Management

- Ilford Specialist Tax

- Ilford Audits

- Ilford Financial Advice

- Ilford Tax Returns

- Ilford Tax Advice

- Ilford Self-Assessment

- Ilford Tax Services

- Ilford Personal Taxation

- Ilford Bookkeepers

- Ilford Bookkeeping Healthchecks

Also find accountants in: West Horndon, South Weald, Little End, Great Hallingbury, Runwell, Starlings Green, Fox Street, Langham Moor, Wickford, Eight Ash Green, High Laver, Colchester, Manuden, Upper Green, Bradwell On Sea, Broad Street Green, Mill Green, Stapleford Abbotts, Fiddlers Hamlet, Stanway, Parkeston, Sewardstone, Debden, Baker Street, Widford, High Ongar, Ostend, Orsett, Great Sampford, Weeley Heath, South Woodham Ferrers, Little Sampford, Great Waltham, North Benfleet, Galleyend and more.

Accountant Ilford

Accountant Ilford Accountants Near Me

Accountants Near Me Accountants Ilford

Accountants IlfordMore Essex Accountants: Tilbury, South Ockendon, Halstead, Upminster, Rayleigh, Stansted Mountfitchet, Maldon, West Mersea, South Benfleet, Chingford, Walton-on-the-Naze, Waltham Abbey, Leigh-on-Sea, Billericay, Hullbridge, Chafford Hundred, Braintree, Great Baddow, Brightlingsea, Clacton-on-Sea, Dagenham, Hawkwell, Basildon, Writtle, Purfleet, Southchurch, Loughton, Chigwell, Rochford, Southminster, Danbury, Shoeburyness, Brentwood, Epping, Galleywood, Laindon, Wivenhoe, Chipping Ongar, Buckhurst Hill, Frinton-on-Sea, Colchester, Great Dunmow, Hornchurch, Hockley, Great Wakering, South Woodham Ferrers, Holland-on-Sea, Grays, Stanway, Ingatestone, Chelmsford, Hadleigh, Tiptree, Barking, Romford, Ilford, Burnham-on-Crouch, Langdon Hills, North Weald Bassett, Heybridge, West Thurrock, Corringham, Southend-on-Sea, Coggeshall, Harlow, Manningtree, Stanford-le-Hope, Canvey Island, Westcliff-on-Sea, Harwich, Pitsea, Rainham, Saffron Walden, Witham, Parkeston and Wickford.

TOP - Accountants Ilford - Financial Advisers

Tax Accountants Ilford - Investment Accounting Ilford - Online Accounting Ilford - Financial Accountants Ilford - Affordable Accountant Ilford - Chartered Accountants Ilford - Auditors Ilford - Self-Assessments Ilford - Bookkeeping Ilford