Accountants: For UK individuals who are self-employed or running a business, there are a number of benefits to be had from retaining the services of a qualified accountant. At the minimum your accountant can handle important tasks like doing your tax returns and keeping your books up to date, giving you more hours to concentrate on running your business. This sort of help can be particularly vital to small start-up businesses, and those who've not run a business before.

In your search for an accountant in the UK area, you could be confused by the various kinds that you can choose from. Locating one that meets your precise needs should be a priority. Certain accountants work as part of an accountancy practice, whilst some work solo. Within an accounting practice there will be specialists in distinct sectors of accountancy. Usually accounting practices will employ: tax accountants, bookkeepers, financial accountants, management accountants, investment accountants, actuaries, auditors, chartered accountants, cost accountants, forensic accountants and accounting technicians.

Find yourself a properly qualified one and don't take any chances. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. It is worth paying a little more for that extra peace of mind. It should go without saying that accountants fees are tax deductable. Sole traders and smaller businesses might get away with using a bookkeeper.

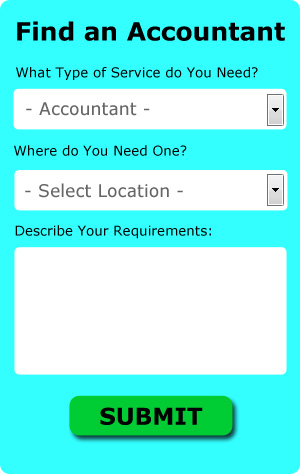

Though you may not have heard of them before there is an online service called Bark who can help you in your search. Little is required other than ticking a few boxes on the search form. As soon as this form is submitted, your requirements will be forwarded to local accountants.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. This may save time and be more cost-effective for self-employed people in the UK. Make a short list of such companies and do your homework to find the most reputable. The easiest way to do this is by studying online reviews. This is something you need to do yourself as we do not wish to favour any particular service here.

Although filling in your own tax return may seem too complicated, it is not actually that hard. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Keytime, Ajaccts, CalCal, Capium, 123 e-Filing, Forbes, Taxforward, Gbooks, BTCSoftware, Sage, Absolute Topup, Taxfiler, Nomisma, ACCTAX, Ablegatio, Basetax, Taxshield, Xero, Andica, TaxCalc and GoSimple. Getting your self-assessment form submitted on time is the most important thing.

Payroll Services UK

A vital component of any company in the UK, small or large, is having an efficient payroll system for its staff. The legislation regarding payrolls and the legal obligations for openness and accuracy means that handling a company's payroll can be a daunting task.

Using an experienced accountant in the UK, to handle your payroll is the easiest way to minimise the workload of your own financial team. Working with HMRC and pension schemes, a managed payroll service accountant will also manage BACS payments to personnel, making certain that they are paid promptly every month, and that all required deductions are done accurately.

Working to current regulations, a professional payroll management accountant in the UK will also present each of your workers with a P60 tax form after the end of each financial year. A P45 form must also be provided for any staff member who finishes working for the business, in accordance with current legislation.

Small Business Accountants UK

Managing a small business in the UK is stressful enough, without having to fret about doing your accounts and other bookkeeping chores. A focused small business accountant in the UK will offer you a stress free solution to keep your annual accounts, VAT and tax returns in the best possible order.

A qualified small business accountant in the UK will regard it as their responsibility to help develop your business, and provide you with sound financial advice for security and peace of mind in your unique situation. An accountancy firm in the UK should provide an allocated small business accountant and mentor who will clear away the haze that shrouds business taxation, so as to enhance your tax efficiency.

It is vital that you explain your future plans, your business structure and your current financial situation accurately to your small business accountant. (Tags: Small Business Accounting UK, Small Business Accountants UK, Small Business Accountant UK).

How to Manage Your Finances Better If Your a Small Business Owner

Properly using money management strategies is one of those things that is most difficult to learn when you're just starting a business. You may be thinking that money management is something that you should already be able to do. The reality, however, is that budgeting and financial planning for your business is a lot different from budgeting and financial planning for your personal life. It does help a lot if you have some experience in the latter. It can be quite a confidence killer to accidentally ruin your financial situation. Continue reading if you want to know how you can better manage your business finances.

Don't wait for the due date to pay your taxes because you may not have the funds to pay by then, especially if you're not a good money manager. To avoid this problem, it's a good idea to set aside a portion of every payment you get into a savings count. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. It's extremely satisfying when you know you have the ability to pay the taxes you owe fully and promptly.

Try to learn bookkeeping. Having a system in place for your business and personal finance is crucial. You can either use an Excel spreadsheet or invest in bookkeeping software such as QuickBooks and Quicken. You could also try to use a personal budgeting tool like Mint.com. The internet is full of free resources on how you can manage your small business bookkeeping. It's crucial that you keep your books in order because they provide you a clear picture of what your finances (both personal and business) look like. It's also a good idea to take a couple of classes on basic accounting and bookkeeping, particularly if you're not in a position yet to hire a bookkeeper full-time.

Don't throw away your receipt. If the IRS ever demands proof of your business expenses, receipts will come in handy. Any business related expenses you have, you can keep track of them if you keep your receipts. Be organized with your receipts and have them together in just one place. This will make it easy for you to track down certain amounts for expenditures you may not recognize in your bank account because you didn't write them down. The easiest way to keep track of them is with a small accordion file that you keep in your desk drawer.

Proper management of your business finances involves a lot of different things. It's not only about keeping a record of when you spent what. When you're in business, you have several things you need to keep track of. In this article, you've just read a few tips to help tracking your money a lot easier. As you become more skilled in managing your business finances, you'll be able to implement other things that will help make the process easier for you.

Auditors UK

An auditor is an individual authorised to assess and verify the reliability of accounts to make certain that companies adhere to tax legislation. They sometimes also take on a consultative role to recommend possible risk prevention measures and the introduction of cost savings. Auditors should be licensed by the regulatory authority for auditing and accounting and have the necessary qualifications. (Tags: Auditors UK, Auditing UK, Auditor UK)

UK Accounting Services

- UK Tax Returns

- UK Chartered Accountants

- UK Tax Refunds

- UK Specialist Tax

- UK Debt Recovery

- UK Bookkeeping Healthchecks

- UK Tax Planning

- UK Auditing Services

- UK VAT Returns

- UK Tax Advice

- UK Forensic Accounting

- UK Business Planning

- UK Financial Advice

- UK Payroll Services

UK accountants will help with personal tax in the UK, National Insurance numbers, HMRC submissions UK, financial statements, partnership accounts, capital gains tax, consultancy and systems advice, sole traders, accounting services for media companies in the UK, corporation tax, payroll accounting UK, management accounts, accounting services for the construction industry, general accounting services, financial and accounting advice UK, business advisory services UK, debt recovery, litigation support in the UK, charities, company secretarial services UK, business support and planning, inheritance tax UK, payslips, assurance services, employment law in the UK, pension planning, investment reviews, auditing and accounting, accounting services for buy to let landlords in the UK, tax investigations in the UK, VAT returns in the UK, small business accounting and other professional accounting services in the UK. These are just a few of the duties that are performed by local accountants. UK companies will be happy to inform you of their whole range of accounting services.

Accountant UK

Accountant UK Accountants Near Me

Accountants Near Me Accountants UK

Accountants UKMore UK Accountants: Witham, Stalybridge, Leigh, Sutton Coldfield, Knaresborough, Barnsley, Greenwich, Hitchin, Radcliffe, Bexhill On Sea, Marlborough, Eccles, Hessle, Oswestry, Hurstpierpoint, Sandy, Folkestone, Chorley, Cleethorpes, Christchurch, Lytham St Annes, Bearsted, Harpenden, Warwick, Sandwich, Rayleigh, Ulverston, Ormskirk, Great Baddow, Brackley, Tonbridge, Tewkesbury, Earl Shilton, Rugeley, Ledbury, Waterlooville, Hullbridge, Wisbech, Conisbrough, Boxley, Hockley, Long Eaton, Droylsden, Flint, Coggeshall, Chapeltown, Leamington Spa, Herne Bay, Malvern, Bodmin, Newcastle Under Lyme, Ash, Craigavon, Dorchester, Abbots Langley, Wallasey, Tiptree, Fleetwood, Lymm, Ilford, Ashington, Biggin Hill, Stockton On Tees, Aberdare, Sherborne, Hucknall, Esher, Taverham, Newark On Trent, Saltash, Burton Upon Trent, Walton On Thames, Wareham, Rochford, Harlow, Wetherby, Hersham, Cranleigh, Burntwood, Royston, Kidlington, Finchampstead, Liversedge, Hebburn, Marlow, Kidderminster, Galleywood, Wootton Bassett, Bedworth, Reigate, Consett, Exmouth, Falkirk, Richmond Upon Thames, Bingley, Tynemouth, Barking, Dagenham, Inverness, Heywood, Haverhill, Dumfries, Gorseinon, West Bridgford, Dukinfield, Havant, Clevedon, Shaftesbury, Brightlingsea, Cheshunt, Darwen, Calne, Wallsend, Rothwell, Chingford, Ingatestone, Arnold, Dunfermline, Beccles, Witney, Redruth, Heathfield, Hertford, Berkhamsted, Chatteris, Rochester, Hyde, Castlereagh, Wellington, Merthyr Tydfil, Ashford, Prescot, Peacehaven, Prestatyn, Godalming, Meopham, Corby, Haydock, Cleckheaton, Royton, Cottingham, Maldon, Frome, Northwich, Bicester, Newbury, Forest Row, Crowborough, Spalding, Otley, Ely, Bromsgrove, Great Yarmouth, Westham, Redhill, Saffron Walden, Brierley Hill, Minster, Newton Aycliffe, Ilkley, Bootle, Chalfont St Peter, Dewsbury, Haslingden, Aylesford, Grantham, Ballymena, Wokingham, Wickford, Aldridge, Ossett, Dover, Biddulph, Seaford, Stowmarket, Aldershot, Staplehurst, Hindley, Kidsgrove, Llanelli, Tilbury, Paddock Wood, Romiley, Stirling, Cannock, West Mersea, Burnham On Sea, Eastwood, Deal, Sturry, Livingston, Southborough, Brighouse, Wivenhoe, East Malling, Fenton, Hadleigh, Bradford On Avon, Epsom, Willingdon, Sutton In Ashfield, Durham, Nailsea, Carlton, Abingdon, Aberystwyth, Northallerton, Paignton, Writtle, St Austell, Snodland, Caterham, Knutsford, Chester Le Street, Waltham Abbey, Harwich, Maryport, Wadhurst, Epping, Urmston, Polegate, Southport, Corringham, Buxton, Thornaby, Knottingley, Westgate On Sea, Houghton Le Spring, Atherstone, Stanway, St Albans, Ferndown, Canterbury, Whitley Bay, Washington, Chadderton, Baildon, Bridgwater, Staveley, Bentley, Loughton, Lewes, Horley, Brixham, Cirencester, Winkfield.

TOP - Accountants UK - Financial Advisers

Small Business Accountants UK - Chartered Accountants UK - Bookkeeping UK - Financial Accountants UK - Tax Return Preparation UK - Self-Assessments UK - Financial Advice UK - Tax Advice UK - Online Accounting UK