Accountants Knutsford: Having a qualified accountant to keep an eye on your finances brings numerous benefits to anyone operating a business in Knutsford or for that matter anywhere else in the British Isles. Time consuming accounts paperwork and bookkeeping can be given to your accountant, while you're left to focus your attention on your main business activities. This could be especially important if you are a start-up business or even if you are just planning to start a business. If your Knutsford business is to prosper and grow you will find this expertise more and more important.

There are a number of different disciplines of accounting. Finding one that dovetails perfectly with your business is crucial. Certain accountants work as part of an accountancy business, whilst some work solo. Each particular field of accounting will probably have their own experts within an accounting company. With an accountancy company you'll have the pick of: bookkeepers, investment accountants, management accountants, forensic accountants, chartered accountants, costing accountants, tax accountants, actuaries, accounting technicians, financial accountants and auditors.

You would be best advised to find a fully qualified Knutsford accountant to do your tax returns. For basic tax returns an AAT qualified accountant should be sufficient. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Your accountant's fees are tax deductable. Local Knutsford bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

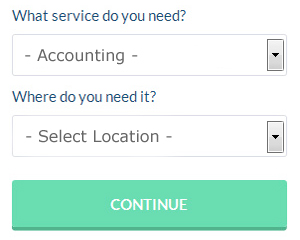

To save yourself a bit of time when searching for a reliable Knutsford accountant online, you might like to try a service called Bark. In no time at all you can fill out the job form and submit it with a single click. Sometimes in as little as a couple of hours you will hear from prospective Knutsford accountants who are keen to get to work for you. Bark do not charge people looking for services.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. Services like this are convenient and cost effective. Some of these companies are more reputable than others. There are resources online that will help you choose, such as review websites.

Chartered accountants are the most qualified and highly trained individuals within the profession. Their services are normally required by larger limited companies and big business. All that remains is to make your final choice.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! Available software that will also help includes GoSimple, Andica, Gbooks, Basetax, Taxshield, 123 e-Filing, Absolute Topup, ACCTAX, Keytime, Nomisma, BTCSoftware, Sage, CalCal, Taxfiler, Capium, Taxforward, Ablegatio, Ajaccts, TaxCalc, Forbes and Xero. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

How Money Management Helps with Self Improvement and Business

Are you thinking of going into business yourself? You'll find that many like being their own boss because they're in charge of how much they make and how much they get to spend. However, proper management of business finances isn't always easy, and many people tend to get overwhelmed with this aspect of the business. Don't worry, though, because there are a few things you can do to make sure you properly manage the financial side of your business. Today, we'll discuss a few tips on how you can be better at managing the money for your business.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. You're only going to make it hard on yourself if you insist on running everything through one account. And here's the thing -- if you run your business expenses through your personal account, it'll be a lot harder to prove your income. Moreover, come tax season, you'll be in for a tough time proving which expenses were business related and which ones were personal. Make it easy on yourself (or your accountant) by having an account for your business and another for your personal expenses.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. This way, you won't have a hard time keeping track of your business and personal finances. All payments you get from selling goods or offering services should go straight to your business account. Every two weeks or every month, write yourself a paycheck and then deposit that to your personal account. Just how much money you pay yourself is completely up to you. You can pay yourself by billable hours or a portion of your business income for that month.

Keep a complete accounting of how much business you generate down to the last penny. Keep a record of every payment you get from customers or clients. You know who has already paid and who hasn't. In addition, you know exactly how much money you've got at any given time. When you know what your income is, you'll also be able to figure out how much taxes you can expect to pay and even how much money you should pay yourself.

Even if you don't have your own business, you'll still benefit from learning how to manage your money properly. Knowing what you have coming in, what you have going out, and what exactly is going on with your money can be a huge boost to your confidence and success. So keep in mind the tips we've shared. When you take the time to learn how to properly manage money, you'll get the benefit of having a successful business and a higher confidence level.

Auditors Knutsford

An auditor is an individual or company hired by an organisation or firm to perform an audit, which is the official examination of the financial accounts, normally by an independent body. Auditors evaluate the fiscal behaviour of the firm which hires them and ensure the consistent functioning of the business. Auditors must be accredited by the regulatory authority for accounting and auditing and have the required accounting qualifications. (Tags: Auditing Knutsford, Auditor Knutsford, Auditors Knutsford)

Knutsford accountants will help with business advisory services Knutsford, partnership registrations in Knutsford, accounting services for the construction industry in Knutsford, payslips, sole traders Knutsford, double entry accounting, corporate tax, limited company accounting, bookkeeping, charities in Knutsford, VAT payer registration Knutsford, HMRC liaison, self-employed registration Knutsford, company secretarial services, tax preparation, company formations, cash flow, accounting services for landlords in Knutsford, management accounts Knutsford, payroll accounting, corporate finance Knutsford, employment law Knutsford, personal tax, accounting and financial advice, workplace pensions in Knutsford, audit and compliance issues, debt recovery in Knutsford, tax investigations, consulting services, general accounting services, accounting services for start-ups, accounting services for media companies and other forms of accounting in Knutsford, Cheshire. These are just a selection of the tasks that are carried out by local accountants. Knutsford providers will be delighted to keep you abreast of their entire range of accountancy services.

Knutsford Accounting Services

- Knutsford Financial Advice

- Knutsford Auditing Services

- Knutsford Debt Recovery

- Knutsford VAT Returns

- Knutsford Forensic Accounting

- Knutsford Chartered Accountants

- Knutsford Tax Returns

- Knutsford Taxation Advice

- Knutsford Bookkeeping

- Knutsford Tax Planning

- Knutsford Personal Taxation

- Knutsford Account Management

- Knutsford Payroll Services

- Knutsford Tax Refunds

Also find accountants in: Willaston, Checkley, Mobberley, Handforth, Whitby, Knutsford, Burland, Wardle, Kerridge, Burtonwood, Marston, Spen Green, Gatesheath, Ledsham, Beeston, Alsager, Blackden Heath, Lower Peover, No Mans Heath, Hurdsfield, Hulme Walfield, Rowton, Great Sankey, Tytherington, Jodrell Bank, Duddon, Penketh, Bickley Town, Wincham, Alvanley, Runcorn, Stretton, Wilkesley, Hatton Heath, Hale Bank and more.

Accountant Knutsford

Accountant Knutsford Accountants Near Me

Accountants Near Me Accountants Knutsford

Accountants KnutsfordMore Cheshire Accountants: Knutsford, Warrington, Alsager, Sandbach, Wilmslow, Crewe, Runcorn, Frodsham, Middlewich, Poynton, Congleton, Macclesfield, Neston, Ellesmere Port, Nantwich, Northwich, Winsford, Lymm, Chester and Widnes.

TOP - Accountants Knutsford - Financial Advisers

Financial Advice Knutsford - Tax Preparation Knutsford - Online Accounting Knutsford - Investment Accounting Knutsford - Auditing Knutsford - Self-Assessments Knutsford - Tax Accountants Knutsford - Bookkeeping Knutsford - Small Business Accountant Knutsford