Accountants Lancing: Having an accountant on board can be very beneficial to anybody running a business or being self-employed in Lancing. Among the many benefits are the fact that you will have more time to focus your attention on core business operations whilst time consuming and routine bookkeeping can be confidently handled by your accountant. For those new to business it can be useful to do some bookwork yourself but don't be afraid to ask for some help. If your Lancing business is to grow and prosper you'll find this expertise more and more beneficial.

But exactly what will you have to pay, what level of service should you expect to receive and where can you locate the right individual? An internet search engine will pretty soon highlight a list of possible candidates in Lancing. But, how do you know which ones can be trusted with your paperwork? Always bear in mind that just about any individual in Lancing can go into business as an accountant. Qualifications and accreditations aren't required by law. Peculiar as this may seem.

Therefore you should check that your chosen Lancing accountant has the appropriate qualifications to do the job competently. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form. Sole traders in Lancing may find that qualified bookkeepers are just as able to do their tax returns.

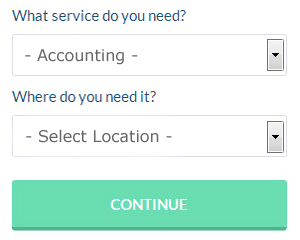

There is an online company called Bark who will do much of the work for you in finding an accountant in Lancing. All that is required is the ticking of a few boxes so that they can understand your exact needs. You should start getting responses from local Lancing accountants within the next 24 hours. At the time of writing this service was totally free.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. This may save time and be more cost-effective for self-employed people in Lancing. It would be advisable to investigate that any online company you use is reputable. The better ones can soon be singled out by carefully studying reviews online.

The cheapest option of all is to do your own self-assessment form. Available software that will also help includes Ablegatio, BTCSoftware, Ajaccts, Capium, Absolute Topup, 123 e-Filing, Andica, TaxCalc, ACCTAX, CalCal, Xero, Taxforward, Taxfiler, GoSimple, Basetax, Sage, Taxshield, Gbooks, Forbes, Nomisma and Keytime. In any event the most important thing is to get your self-assessment set in before the deadline.

How Managing Your Money Better Makes You a Better Business Owner

Proper money management is something that many small business owners have to struggle with, especially when they are still trying to get their feet wet as a business owner. Poor money management can be a real drag on your confidence, and when you are having money problems, you are more willing to take on any old job. You won't reach the level of success you're aiming to reach when this happens. Use the following tips to help you manage your money better.

Do you have many expenditures (e.g., membership dues, hosting, subscriptions)? If you do, you may be putting them all on your credit card. This can make your life easier because each month, you just make one payment to your credit card company instead of making out payments to several different companies. Still, there's the risk that with a credit card, you'll be paying interest if you carry a balance each month. If this happens regularly, you'll be better off paying each of your monthly expenditures directly from your business bank account. This isn't to say you shouldn't use your credit card, but if you do, it's best if you pay it all off every month. This way you get one payment, you won't pay interest and you build your credit rating.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. This can make it easier to keep track of your accounting both in your personal life and your professional life. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. You can decide how much you should pay yourself. It can be a percentage of your business income or it can be an hourly rate.

Do not forget to pay your taxes on time. In general, small businesses pay taxes on a quarterly basis. When it comes to taxes, you want to make sure you have accurate information, so it's a good idea to consult with someone at the small business center in your town, city, or county or even with someone from the IRS. There are also professionals you can work with who can set you up with payments and plans to make sure you're paying your taxes on time. It's not at all a pleasant experience having the IRS chasing after you for tax evasion.

When it comes to properly managing your business finances, you'll find that there are a lot of things that go into doing so. Managing your money is not a basic skill or easy thing to learn. It's really a complicated process that requires constant learning and practicing, especially by small business owners. Use the tips in this article to help you keep track of everything. One of the secrets to having a successful business is learning proper money management.

Small Business Accountants Lancing

Running a small business in Lancing is stressful enough, without needing to worry about your accounts and other similar bookkeeping chores. If your accounts are getting the better of you and VAT and tax return issues are causing sleepless nights, it would be wise to hire a focused small business accountant in Lancing.

A good small business accountant will regard it as their duty to help your business to improve, encouraging you with good advice, and giving you peace of mind and security concerning your financial situation at all times. An accountancy firm in Lancing will provide an assigned small business accountant and adviser who will clear away the haze that veils the field of business taxation, so as to enhance your tax efficiency.

It is crucial that you explain your plans for the future, your business structure and your company's situation accurately to your small business accountant.

Auditors Lancing

Auditors are professionals who examine the fiscal accounts of businesses and organisations to substantiate the validity and legality of their current financial reports. They protect businesses from fraud, illustrate inaccuracies in accounting techniques and, occasionally, work as consultants, helping organisations to determine ways to maximize operational efficiency. To act as an auditor, a person should be accredited by the regulatory authority for accounting and auditing and have certain specified qualifications.

Actuaries Lancing

An actuary is a professional person who assesses the measurement and managing of risk and uncertainty. They use their in-depth knowledge of business and economics, in conjunction with their skills in statistics, investment theory and probability theory, to provide commercial, financial and strategic guidance. An actuary uses statistics and mathematical concepts to estimate the financial effect of uncertainty and help their clients limit possible risks.

Lancing accountants will help with year end accounts, contractor accounts in Lancing, monthly payroll, partnership registration in Lancing, business outsourcing Lancing, bookkeeping, VAT returns Lancing, PAYE Lancing, pension planning Lancing, financial planning, business start-ups Lancing, management accounts, business support and planning Lancing, corporate finance, company formations, estate planning, investment reviews, accounting support services, employment law, accounting services for the construction sector Lancing, accounting services for media companies in Lancing, HMRC submissions, accounting services for property rentals Lancing, capital gains tax, business advisory services in Lancing, self-employed registration in Lancing, tax investigations, taxation accounting services in Lancing, HMRC submissions, auditing and accounting in Lancing, sole traders, compliance and audit reporting in Lancing and other forms of accounting in Lancing, West Sussex. These are just a small portion of the activities that are accomplished by local accountants. Lancing companies will keep you informed about their entire range of accountancy services.

You actually have the best resource right at your fingertips in the shape of the net. There's such a lot of information and inspiration readily available online for such things as self-assessment help, auditing & accounting, personal tax assistance and accounting for small businesses, that you'll pretty quickly be bursting with ideas for your accounting requirements. An example could be this intriguing article covering five tips for choosing a first-rate accountant.

Lancing Accounting Services

- Lancing Self-Assessment

- Lancing Business Accounting

- Lancing Financial Audits

- Lancing Bookkeeping

- Lancing Financial Advice

- Lancing Debt Recovery

- Lancing Tax Planning

- Lancing Taxation Advice

- Lancing PAYE Healthchecks

- Lancing Bookkeeping Healthchecks

- Lancing Specialist Tax

- Lancing Tax Refunds

- Lancing Auditing Services

- Lancing Personal Taxation

Also find accountants in: Houghton, North Marden, Yapton, Hammerpot, Clayton, Lowfield Heath, Mid Lavant, Hurstpierpoint, Botolphs, Fishbourne, Ferring, Rackham, Bines Green, East Harting, Durrington, Upperton, Kirdford, Coolham, Broomers Corner, Coates, Upwaltham, Walderton, Redford, Broadford Bridge, Worthing, Fontwell, Small Dole, Muddleswood, Easebourne, Plaistow, Hardham, Forestside, West Chiltington, Gay Street, Norton and more.

Accountant Lancing

Accountant Lancing Accountants Near Me

Accountants Near Me Accountants Lancing

Accountants LancingMore West Sussex Accountants: Littlehampton, Worthing, Hurstpierpoint, Crawley, Southwater, Shoreham-by-Sea, Chichester, Bognor Regis, Horsham, East Grinstead, Lancing, Rustington, Haywards Heath, Southwick and Burgess Hill.

TOP - Accountants Lancing - Financial Advisers

Financial Advice Lancing - Financial Accountants Lancing - Self-Assessments Lancing - Small Business Accountants Lancing - Tax Preparation Lancing - Tax Accountants Lancing - Chartered Accountants Lancing - Auditing Lancing - Cheap Accountant Lancing