Accountants Letchworth: Anybody operating a small business in Letchworth, Hertfordshire will pretty quickly realise that there are numerous advantages to having an accountant at the end of the phone. Among the many benefits are the fact that you will have extra time to concentrate on core business activities whilst routine and time consuming bookkeeping can be confidently dealt with by your accountant. For those new to business it can be a good idea to do some bookwork for yourself however don't be afraid to ask for some extra assistance. If you've got plans to expand your Letchworth business you will find an increasing need for good advice.

In the Letchworth area you'll find that there are various sorts of accountant. A local accountant who perfectly meets your requirements is what you should be looking for. Another decision you will have to make is whether to go for an accounting firm or an independent accountant. An accountancy firm will comprise accountants with different fields of expertise. Among the primary accounting positions are: investment accountants, forensic accountants, tax accountants, management accountants, auditors, cost accountants, chartered accountants, bookkeepers, actuaries, financial accountants and accounting technicians.

To get the job done correctly you should search for a local accountant in Letchworth who has the right qualifications. Your minimum requirement should be an AAT qualified accountant. The extra peace of mind should compensate for any higher costs. Your accountant's fees are tax deductable.

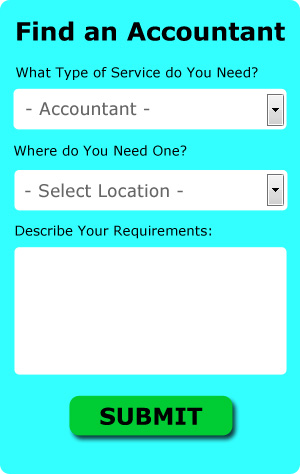

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. All that is required is the ticking of a few boxes so that they can understand your exact needs. Then you just have to wait for some prospective accountants to contact you.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. You might find that this is simpler and more convenient for you. Don't simply go with the first company you find on Google, take time to do some research. Study reviews and customer feedback. We feel it is not appropriate to list any individual services here.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. You can take much of the hard graft out of this procedure by using a software program such as CalCal, Absolute Topup, Capium, Xero, Ajaccts, Taxshield, Gbooks, Andica, Taxforward, 123 e-Filing, Ablegatio, TaxCalc, Forbes, Basetax, Nomisma, GoSimple, Taxfiler, ACCTAX, Keytime, Sage or BTCSoftware. The most important thing is to make sure your self-assessment is sent in promptly.

How Managing Your Money Better Makes You a Better Business Owner

The fact that you get to be completely in charge of your income is one of the good reasons to put up your own business. Of course, this can also be quite overwhelming, and even people who have managed to live by a budget in their personal lives have a difficult time managing their business finances. Luckily there are plenty of things that you can do to make it easier on yourself. Continue reading if you'd like to know how you can be a better money manager for your own business.

It's certainly tempting to wait until the last minute to pay your taxes, but you're actually playing with fire here, especially if you're not good at money management. When your taxes are due, you may not have any money to actually pay them. Here's what you can do: every day or every week, take a portion of the payments you receive and then put that in a separate account. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. You never want to be late in paying your taxes and this simple money management strategy will help you avoid paying late because you don't have the funds to make the payment on time.

It's a good idea to do a weekly balancing of your books. If you run a traditional store with registers or that brings in multiple payments a day, it is better to balance your books at the end of every day, and this is particularly true if you handle cash. It's important that you keep track of the money coming in and the money you're spending. At the end of each business day or business week, tally it all up and the amount you come up with should match the amount you should have in the bank or on hand. When you do this, at the end of the month or every quarter, you're going to save yourself a lot of time and trouble trying to find where the discrepancies are if the numbers don't match up. Besides, it will only take you a few minutes if you balance your books regularly, whereas if you balance your books once a month, that would take you hours to do.

If you receive cash payments, it's a good idea to deposit it to your bank account daily or as soon as you can to eliminate the temptation. For example, if you're out for lunch and you're short on cash, you might be tempted to dip in to the cash in your register and tell yourself you'll return the money the next day or two. It's actually very easy to forget to put the money back in and if you keep doing this, you'll soon screw up your books. You can avoid this problem by putting your cash in your bank account at the end of the day.

You may not have thought about it, but having your own business offers you lots of self-improvement opportunities. For one, you can improve how you manage your money. Everybody wishes that they could be better with money. Your confidence stands to gain a lot when you get better at managing your finances. You'll also be able to organize many aspects of your business and personal life. Keep in mind the money management tips we shared in this article. Keep applying them to your business and you'll soon see much success.

Letchworth accountants will help with HMRC submissions, debt recovery, charities, year end accounts, PAYE, assurance services, business start-ups, sole traders, estate planning, general accounting services Letchworth, accounting services for buy to let property rentals in Letchworth, accounting and auditing Letchworth, consulting services, company formations, limited company accounting Letchworth, litigation support in Letchworth, partnership registration, inheritance tax Letchworth, personal tax Letchworth, corporate tax in Letchworth, accounting services for media companies Letchworth, business outsourcing, financial and accounting advice, management accounts Letchworth, business planning and support, company secretarial services, investment reviews, accounting services for the construction industry, bookkeeping, National Insurance numbers, capital gains tax, self-employed registrations and other types of accounting in Letchworth, Hertfordshire. These are just a small portion of the tasks that are handled by local accountants. Letchworth companies will be happy to inform you of their entire range of accounting services.

You do, of course have the very best resource at your fingertips in the shape of the world wide web. There is such a lot of inspiration and information available online for stuff like self-assessment help, small business accounting, accounting & auditing and personal tax assistance, that you'll very soon be knee-deep in suggestions for your accounting requirements. An illustration may be this engaging article describing five tips for acquiring a good accountant.

Letchworth Accounting Services

- Letchworth Tax Investigations

- Letchworth Tax Returns

- Letchworth Forensic Accounting

- Letchworth Tax Planning

- Letchworth Specialist Tax

- Letchworth Bookkeeping

- Letchworth Account Management

- Letchworth Debt Recovery

- Letchworth Tax Refunds

- Letchworth Tax Advice

- Letchworth Business Accounting

- Letchworth Tax Services

- Letchworth PAYE Healthchecks

- Letchworth VAT Returns

Also find accountants in: Colliers End, London Colney, Stevenage, Frogmore, South Mimms, Puttenham, South Oxhey, Cheshunt, Whitwell, Roe Green, Oaklands, Barley, New Mill, Batchworth Heath, Stapleford, Throcking, Colney Heath, Little Hormead, Wheathampstead, Burnham Green, Stocking Pelham, Wigginton, Hitchin, Broadwater, Bell Bar, Chandlers Cross, Letty Green, Ickleford, Buckland, Aston, Heronsgate, Radlett, Goffs Oak, Letchmore Heath, Spellbrook and more.

Accountant Letchworth

Accountant Letchworth Accountants Near Me

Accountants Near Me Accountants Letchworth

Accountants LetchworthMore Hertfordshire Accountants: Bishops Stortford, Berkhamsted, Watford, Royston, Hemel Hempstead, Hertford, Borehamwood, Broxbourne, Ware, Bushey, Rickmansworth, Hoddesdon, Welwyn Garden City, Stevenage, Letchworth, St Albans, Hitchin, Abbots Langley, Harpenden, Hatfield, Tring, Potters Bar and Cheshunt.

TOP - Accountants Letchworth - Financial Advisers

Small Business Accountant Letchworth - Investment Accounting Letchworth - Online Accounting Letchworth - Self-Assessments Letchworth - Bookkeeping Letchworth - Auditing Letchworth - Chartered Accountant Letchworth - Financial Advice Letchworth - Financial Accountants Letchworth