Accountants Madeley: There are many advantages to be had from hiring the services of a qualified accountant if you're self-employed or run a business in Madeley, Shropshire. Time consuming accounts paperwork and bookkeeping can be passed on to your accountant, while you are left to focus on your main business activities. Businesses of all sizes and types can benefit from an accountant's expertise but for newer businesses it could be even more vital. The prosperity and wellbeing of your business in Madeley may hinge on you getting the correct help and advice.

When hunting for a nearby Madeley accountant, you'll find that there are numerous different types on offer. Picking the best one for your company is crucial. Some accountants in the Madeley area work on their own, while others may be part of an accountancy company. An accountancy firm may offer a wider range of services, while an independent accountant will offer a more personal service. You should be able to locate an accountancy company offering accounting technicians, actuaries, financial accountants, management accountants, investment accountants, auditors, tax preparation accountants, costing accountants, chartered accountants, forensic accountants and bookkeepers.

Finding a properly qualified Madeley accountant should be your priority. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent.

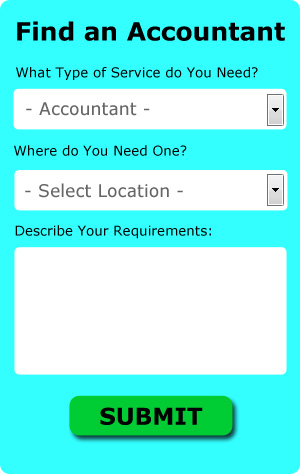

One online service which helps people like you find an accountant is Bark. It is just a case of ticking some boxes on a form. Sometimes in as little as a couple of hours you will hear from prospective Madeley accountants who are keen to get to work for you.

You could always try an online tax returns service if your needs are fairly simple. For many self-employed people this is a convenient and time-effective solution. Picking a reputable company is important if you choose to go with this option. Have a good look at customer testimonials and reviews both on the company website and on independent review websites. Sorry but we cannot recommend any individual service on this website.

Maybe when you have looked all the options you will still decide to do your own tax returns. You can take much of the hard graft out of this procedure by using a software program such as Basetax, 123 e-Filing, TaxCalc, Taxfiler, Nomisma, Taxshield, Gbooks, BTCSoftware, Capium, Forbes, Ajaccts, Keytime, ACCTAX, Andica, Taxforward, GoSimple, Xero, Ablegatio, CalCal, Absolute Topup or Sage. In any event the most important thing is to get your self-assessment set in before the deadline. You can expect to pay a minimum penalty of £100 for being late.

Actuaries Madeley

Actuaries work within government departments and businesses, to help them anticipate long-term fiscal costs and investment risks. They use their in-depth knowledge of economics and business, along with their skills in probability theory, investment theory and statistics, to provide commercial, financial and strategic guidance. An actuary uses statistics and mathematical concepts to estimate the fiscal effect of uncertainty and help customers minimize risks. (Tags: Actuary Madeley, Financial Actuary Madeley, Actuaries Madeley)

Payroll Services Madeley

For any business in Madeley, from independent contractors to large scale organisations, dealing with staff payrolls can be challenging. The laws regarding payroll for transparency and accuracy mean that processing a company's payroll can be an intimidating task for those untrained in this discipline.

Using a reputable accountant in Madeley, to take care of your payroll is the simple way to minimise the workload of yourself or your financial department. The payroll management service will work along with HMRC and pension scheme administrators, and oversee BACS transfers to guarantee accurate and timely payment to all personnel.

It will also be necessary for a qualified payroll accountant in Madeley to provide a P60 declaration for all workers at the end of the financial year (by 31st May). A P45 form should also be presented to any member of staff who stops working for your company, according to the current regulations. (Tags: Payroll Accountant Madeley, Payroll Outsourcing Madeley, Payroll Services Madeley).

How to Manage Your Finances Better If Your a Small Business Owner

For many people, starting their own business has many advantages. One of the advantages is that they get to be in charge of their income. They're able to control just how much money they make and how much money they spend. At the same time, however, many people get overwhelmed when it comes to managing the funds for their business. Lucky for you, there are several things that can help you with this. If you'd like to be able to manage your business funds, keep reading.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. You may not have problems in the beginning, but you can expect to have a hard time down the road. If you decide to use your personal account for running your business expenses, it can be a real challenge to prove your income. When it's time for you to file your taxes, it'll be a nightmare to sort through your financial records and identifying just which expenses went to your business and which ones went for personal things like groceries, utilities, and such. Streamline your process with two accounts.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. Paying yourself like you would a regular employee would make your business accounting so much easier. Send all of the payments you receive for your goods and services into your business account then every week or every two weeks or even every month, pay yourself out of that account. It's up to you how much salary you want to give yourself. It can be a percentage of your business income or it can be an hourly rate.

Control your spending. When your business is steadily pulling in a nice income, you may be tempted to go on a buying spree and buy all those things you've always wanted to buy but couldn't afford. It's best if you spend money on things that will benefit your business. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. You should also try buying your business supplies in bulk. For computers, it's better if you spend money on a more expensive, but reliable system that will last for many years and won't need replaced every so often. While it's a good idea to spend on your entertainment, be careful that you spend too much on it.

There are many things involved in the proper management of your money. It's not only about keeping a record of when you spent what. You have other things to track and many ways to do so. Tracking your money will become a lot easier for you if you apply the tips we've shared in this article. And as you continue to hone your skills in proper money management, you'll be able to find ways of streamlining your financial activities.

Madeley accountants will help with corporate finance in Madeley, accounting support services, company secretarial services, personal tax, consultancy and systems advice, business advisory, business outsourcing Madeley, assurance services, PAYE, year end accounts in Madeley, HMRC submissions Madeley, investment reviews, bookkeeping in Madeley, employment law Madeley, monthly payroll, accounting services for the construction sector in Madeley, management accounts, auditing and accounting, audit and compliance reports Madeley, VAT payer registration in Madeley, double entry accounting, limited company accounting, self-employed registration, business start-ups, litigation support in Madeley, HMRC submissions, corporate tax, business support and planning in Madeley, general accounting services, charities Madeley, tax preparation, financial statements and other professional accounting services in Madeley, Shropshire. Listed are just a handful of the activities that are accomplished by local accountants. Madeley companies will let you know their full range of services.

With the internet as a powerful resource it is amazingly easy to uncover a whole host of useful inspiration and ideas concerning auditing & accounting, small business accounting, self-assessment help and personal tax assistance. For example, with a quick search we discovered this super article on choosing an accountant for your business.

Madeley Accounting Services

- Madeley Bookkeeping

- Madeley Tax Services

- Madeley Financial Audits

- Madeley Account Management

- Madeley Self-Assessment

- Madeley Financial Advice

- Madeley Specialist Tax

- Madeley PAYE Healthchecks

- Madeley Personal Taxation

- Madeley Payroll Services

- Madeley Forensic Accounting

- Madeley Tax Refunds

- Madeley Taxation Advice

- Madeley Bookkeeping Healthchecks

Also find accountants in: Ollerton, Farlow, Sheriffhales, Rushton, Minton, Clunbury, Treflach, Newport, Telford, English Frankton, Panpunton, Marchamley, Brockton, Badger, Booley, Eyton Upon The Weald Moors, Ludford, Rushbury, Montford, Monkhopton, Leebotwood, Alcaston, Shelton, Coalport, Catherton, Stoney Stretton, Ellerton, Condover, Whitcott Keysett, Cardington, Kinnerley, Edge, Tilley, Ellerdine Heath, Much Wenlock and more.

Accountant Madeley

Accountant Madeley Accountants Near Madeley

Accountants Near Madeley Accountants Madeley

Accountants MadeleyMore Shropshire Accountants: Wellington, Shrewsbury, Telford, Madeley and Oswestry.

TOP - Accountants Madeley - Financial Advisers

Auditors Madeley - Investment Accountant Madeley - Bookkeeping Madeley - Financial Advice Madeley - Affordable Accountant Madeley - Online Accounting Madeley - Self-Assessments Madeley - Chartered Accountant Madeley - Small Business Accountant Madeley