Accountants Newbury: Anybody operating a business in Newbury, Berkshire will soon realise that there are lots of advantages to having an accountant at hand. You should at the very least have much more time to concentrate on your key business operations while your accountant deals with the routine financial paperwork and bookkeeping. Start-ups will discover that having access to this sort of expertise is very beneficial.

Newbury accountants are available in many forms and types. Choosing one that dovetails perfectly with your business is crucial. You'll come to realise that there are accountants who work alone and accountants who work for accounting firms. Accountancy firms generally have specialists in each major field of accounting. Some of the key accountancy positions include the likes of: forensic accountants, actuaries, auditors, investment accountants, tax preparation accountants, chartered accountants, cost accountants, bookkeepers, management accountants, accounting technicians and financial accountants.

You should take care to find a properly qualified accountant in Newbury to complete your self-assessment forms correctly and professionally. Ask if they at least have an AAT qualification or higher. Qualified accountants may come with higher costs but may also save you more tax. Your accountant will add his/her fees as tax deductable. If your business is small or you are a sole trader you could consider using a bookkeeper instead.

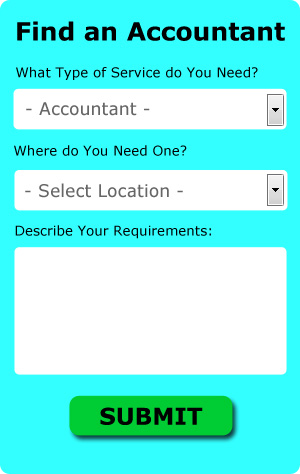

One online service which helps people like you find an accountant is Bark. You'll be presented with a simple form which can be completed in a minute or two. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment. You will not be charged for this service.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. This may save time and be more cost-effective for self-employed people in Newbury. You still need to pick out a company offering a reliable and professional service. There are resources online that will help you choose, such as review websites. If you are looking for individual recommendations, this website is not the place to find them.

The cheapest option of all is to do your own self-assessment form. There is also lots of software available to help you with your returns. These include Taxfiler, Basetax, Ablegatio, Keytime, Sage, Forbes, Nomisma, Ajaccts, Taxforward, GoSimple, Absolute Topup, 123 e-Filing, Gbooks, Capium, ACCTAX, Andica, CalCal, TaxCalc, Taxshield, Xero and BTCSoftware. If you don't get your self-assessment in on time you will get fined by HMRC.

You can Improve Yourself and Your Business by Learning How to Manage Your Money Better

Making a decision to put up your business is not hard, but knowing exactly how to start it is, and actually getting it up and running is much harder. Making your business a profitable success is the most difficult thing of all because a lot can happen along the way to hurt your business and your confidence level. Failing to manage your money properly is one of the things that can contribute to this. In the beginning, you might think that money management isn't something you should focus on because you can easily figure out your earning and expenses. However, as the business grows, its finances will become complicated, so keep these tips in mind for when you need them.

Get yourself an accountant. An accountant is well worth the business expense because she can manage your books for you full time. She will help you keep track of the money you have coming in and the money you are sending out, help you pay yourself, and help you meet your tax obligations. You won't need to deal with the paperwork associated with these things; your accountant will deal with that for you. What happens is that you can focus more on building your business, including marketing and getting more clients. An accountant can save you days of time and quite a lot of headaches.

Learn bookkeeping. Having a system in place for your business and personal finance is crucial. For this, you can use a basic spreadsheet or go with software like Quicken. In addition, you can make use of personal budgeting tools such as Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. Keeping your books organized and up to date will help you understand your finances better. And if you simply can't afford to hire a bookkeeper at this time, you'll benefit from taking a basic bookkeeping and accounting class.

Make sure you're prompt in paying your taxes. Small businesses typically pay file taxes quarterly. Taxes are among the most confusing things, so it's best if you check with the IRS or the small business center in your area to get accurate information. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. It's not at all a pleasant experience having the IRS chasing after you for tax evasion.

When it comes to improving yourself and your business, proper money management is one of the most essential things you can learn. Try to implement these tips we've shared because you stand to benefit in the long run. You're much more likely to experience business and personal success when you have your finances under control.

Auditors Newbury

An auditor is a company or person brought in to review and validate the correctness of financial records to make sure that businesses adhere to tax legislation. Auditors evaluate the fiscal actions of the firm that employs them and ensure the constant operation of the organisation. To act as an auditor, an individual must be approved by the regulating authority of auditing and accounting and have specific qualifications.

Newbury accountants will help with payslips, business advisory, VAT registrations Newbury, self-employed registration, inheritance tax, pension forecasts, contractor accounts, workplace pensions Newbury, tax investigations, estate planning, personal tax, audit and auditing, HMRC submissions, accounting services for buy to let property rentals, business outsourcing, limited company accounting, corporation tax, financial statements, investment reviews Newbury, business acquisition and disposal, sole traders Newbury, annual tax returns, accounting services for media companies, consultancy and systems advice, business start-ups, cashflow projections Newbury, small business accounting Newbury, year end accounts, double entry accounting in Newbury, PAYE, accounting services for the construction industry Newbury, National Insurance numbers and other accounting related services in Newbury, Berkshire. Listed are just a selection of the activities that are undertaken by local accountants. Newbury companies will be delighted to keep you abreast of their full range of services.

Newbury Accounting Services

- Newbury Personal Taxation

- Newbury Chartered Accountants

- Newbury Specialist Tax

- Newbury Tax Advice

- Newbury Payroll Management

- Newbury Tax Investigations

- Newbury Tax Returns

- Newbury Financial Advice

- Newbury Debt Recovery

- Newbury Audits

- Newbury Tax Refunds

- Newbury PAYE Healthchecks

- Newbury Bookkeeping Healthchecks

- Newbury Tax Planning

Also find accountants in: Crowthorne, Little Hungerford, Leckhampstead, Stockcross, Bucklebury, Chapel Row, Furze Platt, Bray Wick, Avington, Cookham, Swallowfield, Bradfield, North Street, Brimpton, Arborfield, Chaddleworth, Holyport, Burleigh, Halfway, Wargrave, Reading, Finchampstead, Shurlock Row, Sandhurst, Midgham, Beedon, Sindlesham, Downend, Oakley Green, Shinfield, Burghfield Common, Hare Hatch, Speen, Wokefield Park, Shaw and more.

Accountant Newbury

Accountant Newbury Accountants Near Me

Accountants Near Me Accountants Newbury

Accountants NewburyMore Berkshire Accountants: Newbury, Reading, Wokingham, Ascot, Bracknell, Winkfield, Sunninghill, Tilehurst, Slough, Woodley, Maidenhead, Crowthorne, Windsor, Thatcham, Sandhurst, Finchampstead and Twyford.

TOP - Accountants Newbury - Financial Advisers

Financial Accountants Newbury - Tax Return Preparation Newbury - Financial Advice Newbury - Tax Accountants Newbury - Small Business Accountant Newbury - Chartered Accountants Newbury - Bookkeeping Newbury - Affordable Accountant Newbury - Investment Accountant Newbury