Accountants Perth: Does filling out your annual self-assessment form cause you a lot of frustration? This is a common issue for lots of others in Perth, Scotland. Is it a much better idea to get someone else to do this job for you? If you find that doing your self-assessment tax return is too stressful, this might be the best solution. £200-£300 is the average cost for such a service when using regular Perth accountants. By making use of one of the numerous online services you will be able to get a cheaper deal.

There are many different branches of accounting. Your aim is to choose one that meets your exact requirements. You will come to realise that there are accountants who work independently and accountants who work for large accounting companies. The advantage of accountancy companies is that they've got many areas of expertise under one roof. The major positions that will be covered by an accountancy firm include: investment accountants, financial accountants, costing accountants, bookkeepers, forensic accountants, chartered accountants, actuaries, auditors, tax preparation accountants, management accountants and accounting technicians.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. For basic tax returns an AAT qualified accountant should be sufficient. The extra peace of mind should compensate for any higher costs. You will be able to claim the cost of your accountant as a tax deduction. It is perfectly acceptable to use a qualified bookkeeper in Perth if you are a sole trader or a smaller business.

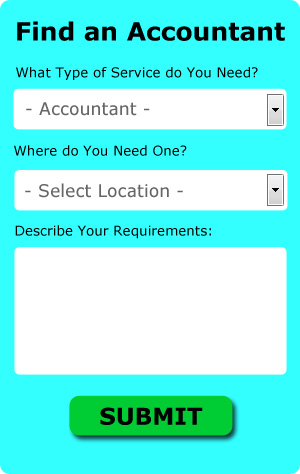

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. You only need to answer a few basic questions and complete a straightforward form. In the next day or so you should be contacted by potential accountants in your local area.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. This kind of service may not suit everyone but could be the answer for your needs. It would be advisable to investigate that any online company you use is reputable. A quick browse through some reviews online should give you an idea of the best and worse services.

The real professionals in the field are chartered accountants. These powerhouses know all the ins and out of the financial world and generally represent large large companies and conglomerates. You will certainly be hiring the best if you do choose one of these.

The most cost effective method of all is to do it yourself. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of Taxfiler, Keytime, CalCal, Taxshield, Capium, Gbooks, GoSimple, 123 e-Filing, Forbes, Basetax, Sage, Nomisma, Xero, Absolute Topup, Ajaccts, ACCTAX, BTCSoftware, Ablegatio, Taxforward, Andica and TaxCalc. If you don't get your self-assessment in on time you will get fined by HMRC.

Practicing Better Money Management to Help Your Business Succeed

Many new business owners have a hard time managing money the right away, especially when they're still trying to figure out most of the things they need to do to run a business. These struggles can affect your confidence and if you're having financial problems with your business, the idea of quitting and going back to your old 9-to-5 job becomes more appealing. When this happens, it stops you from achieving the kind of success you want for yourself and your business. You can be a good money manager with the help of the following tips.

Have an account that's just for your business expenses and another for your personal expenses. It may be simple to keep track of everything in the beginning, but over time, you'll find it's so much easier to track your expenses if you have separate accounts. And here's the thing -- if you run your business expenses through your personal account, it'll be a lot harder to prove your income. When it's time for you to file your taxes, it'll be a nightmare to sort through your financial records and identifying just which expenses went to your business and which ones went for personal things like groceries, utilities, and such. It's better if you streamline your finances by separating your business expenses from your personal expenses.

Offer your clients payment plans. Doing this will encourage more people to do business with you and ensure that you've got money coming in on a regular basis. This is a lot better than having payments come in sporadically. Basically, you can easily make a budget and pay your bills promptly if you've got reliable income. If you're in control of your business finances, you'll feel more self-confident.

f your business deals with cash all the time, you're better off depositing money to your bank account at the end of each business day. Doing so will help you avoid being tempted to use any cash you have on hand for unnecessary expenses. For example, if you're out for lunch and you're short on cash, you might be tempted to dip in to the cash in your register and tell yourself you'll return the money the next day or two. But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. You'll be better off putting your money in the bank at the end of each work day.

Proper money management is a skill that every adult needs to develop. Knowing what you have coming in, what you have going out, and what exactly is going on with your money can be a huge boost to your confidence and success. So keep in mind the tips we've shared. When you take the time to learn how to properly manage money, you'll get the benefit of having a successful business and a higher confidence level.

Small Business Accountants Perth

Doing the yearly accounts can be a fairly stress-filled experience for any owner of a small business in Perth. A decent small business accountant in Perth will offer you a stress free method to keep your annual accounts, VAT and tax returns in the best possible order.

A competent small business accountant in Perth will regard it as their responsibility to help develop your business, and offer you reliable financial advice for peace of mind and security in your particular situation. The fluctuating and sometimes complicated field of business taxation will be clearly laid out for you in order to reduce your business costs, while improving tax efficiency.

In order to do their job effectively, a small business accountant in Perth will need to know complete details with regards to your present financial standing, business structure and any possible investment that you might be considering, or have set up.

Actuaries Perth

An actuary manages, evaluates and offers advice on financial and monetary risks. They employ their mathematical skills to calculate the risk and probability of future occurrences and to calculate their impact on a business and it's customers. Actuaries deliver judgements of fiscal security systems, with a focus on their complexity, their mathematics, and their mechanisms. (Tags: Actuary Perth, Actuaries Perth, Financial Actuary Perth)

Auditors Perth

Auditors are experts who assess the fiscal accounts of companies and organisations to substantiate the legality and validity of their current financial reports. They offer businesses from fraud, highlight discrepancies in accounting methods and, now and again, work as consultants, helping organisations to find ways to boost operational efficiency. Auditors need to be accredited by the regulatory authority for accounting and auditing and also have the necessary accounting qualifications. (Tags: Auditing Perth, Auditors Perth, Auditor Perth)

Perth accountants will help with annual tax returns, accounting services for buy to let property rentals Perth, capital gains tax, consulting services, tax investigations, HMRC submissions, debt recovery Perth, inheritance tax, accounting support services in Perth, HMRC liaison, accounting services for media companies, audit and compliance reporting, employment law, year end accounts, partnership registration, litigation support, sole traders in Perth, estate planning, charities, business acquisition and disposal Perth, bureau payroll services in Perth, accounting services for start-ups Perth, taxation accounting services Perth, cashflow projections, bookkeeping, payslips in Perth, monthly payroll, business outsourcing Perth, business support and planning, corporate tax Perth, company formations in Perth, limited company accounting Perth and other accounting services in Perth, Scotland. These are just some of the duties that are accomplished by nearby accountants. Perth companies will be delighted to keep you abreast of their full range of services.

When you are looking for ideas and inspiration for accounting for small businesses, personal tax assistance, accounting & auditing and self-assessment help, you do not really need to look any further than the internet to find pretty much everything that you need. With such a wide variety of skillfully written blog posts and webpages to choose from, you will very shortly be knee-deep in ideas and concepts for your planned project. Just recently we stumbled across this thought provoking article about choosing the right accountant for your business.

Perth Accounting Services

- Perth Tax Refunds

- Perth Specialist Tax

- Perth Tax Planning

- Perth Payroll Management

- Perth Audits

- Perth PAYE Healthchecks

- Perth Business Accounting

- Perth Debt Recovery

- Perth Tax Advice

- Perth Personal Taxation

- Perth Chartered Accountants

- Perth VAT Returns

- Perth Tax Returns

- Perth Account Management

Also find accountants in: Glenrothes, Irvine, Aberdeen, Larkhall, Coatbridge, Bearsden, Dunfermline, Bellshill, Westhill, Banchory, Selkirk, Greenock, Johnstone, Motherwell, Falkirk, Kintore, Broxburn, Stirling, Turriff, Arbroath, Peterhead, Paisley, Ellon, Bonnybridge, Glasgow, Renfrew, Fraserburgh, Inverness, Kilmarnock, Alloa, Barrhead, Inverurie, Ayr, Elgin, Clydebank and more.

Accountant Perth

Accountant Perth Accountants Near Perth

Accountants Near Perth Accountants Perth

Accountants PerthMore Scotland Accountants: Glenrothes, Motherwell, Stirling, Glasgow, Paisley, East Kilbride, Edinburgh, Inverness, Kilmarnock, Perth, Airdrie, Irvine, Ayr, Dundee, Cumbernauld, Aberdeen, Coatbridge, Falkirk, Dunfermline, Hamilton, Dumfries, Greenock, Kirkcaldy and Livingston.

TOP - Accountants Perth - Financial Advisers

Online Accounting Perth - Tax Advice Perth - Financial Accountants Perth - Tax Return Preparation Perth - Cheap Accountant Perth - Small Business Accountants Perth - Auditors Perth - Self-Assessments Perth - Chartered Accountants Perth