Accountants Rayleigh: Do you get little else but a headache when you fill in your yearly self-assessment form? You and countless other self-employed Rayleigh people will have to deal with this every twelve months. Is tracking down a local Rayleigh accountant to accomplish this task for you a better option? If you find that doing your self-assessment tax return is too stressful, this may be the best option. Normally Rayleigh High Street accountants will do this for around £220-£300. You'll be able to get it done a lot cheaper by using one of the numerous online accounting services.

So, what type of accounting service should you look for and how much should you pay? The internet is definitely the "in" place to look nowadays, so that would certainly be an excellent place to begin. Knowing just who you can trust is of course not quite as easy. In the UK there are no legal restrictions on who can and can't offer accounting and bookkeeping services. They do not need to have any specific qualifications. Which is unbelievable to put it mildly.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. It is worth paying a little more for that extra peace of mind. Accounting fees are of course a business expense and can be included as such on your tax return.

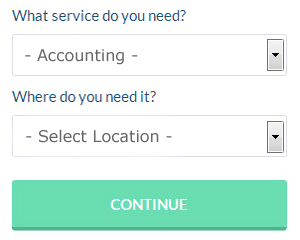

Though you may not have heard of them before there is an online service called Bark who can help you in your search. You'll be presented with a simple form which can be completed in a minute or two. All you have to do then is wait for some responses. When this article was written Bark was free to use.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. For many self-employed people this is a convenient and time-effective solution. Don't simply go with the first company you find on Google, take time to do some research. Carefully read reviews online in order to find the best available. This is something you need to do yourself as we do not wish to favour any particular service here.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example Sage, 123 e-Filing, ACCTAX, Forbes, Taxforward, BTCSoftware, Taxshield, Ajaccts, Ablegatio, Xero, CalCal, GoSimple, Nomisma, Andica, Basetax, Gbooks, TaxCalc, Taxfiler, Absolute Topup, Capium and Keytime. Make sure your tax returns are sent off promptly to avoid getting a penalty fine.

You can Improve Yourself and Your Business by Learning How to Manage Your Money Better

For many people, starting their own business has many advantages. One of the advantages is that they get to be in charge of their income. They're able to control just how much money they make and how much money they spend. Nonetheless, this aspect of business is something that people find overwhelming despite the fact that many of them have successfully used a budget in managing their personal finances. Don't worry, though, because there are a few things you can do to make sure you properly manage the financial side of your business. Continue reading if you'd like to know how you can be a better money manager for your own business.

Keep separate accounts for your business and personal expenses, as trying to run everything through one account just makes everything confusing. You're only going to make it hard on yourself if you insist on running everything through one account. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. It is also difficult to prove, come tax time, how much money you are actually spending on business expenses when those are mixed in with withdrawals for things like groceries etc. Streamline your process with two accounts.

Each week, balance your books. However, if you have a traditional store where you have cash registers or you've got many payments from different people coming in, you may have to do the book balancing at the end of each day. You need to keep track of all the payments you receive and payments you make out and make sure that the cash you have on hand or in your bank account matches with the numbers in your record. This will save you the trouble of tracking down discrepancies each month or each quarter. Balancing regularly will only take a few minutes, while balancing only every so often could take hours.

Save every receipt. If the IRS ever demands proof of your business expenses, receipts will come in handy. They're also records of business related expenses. It's a good idea to have one place where you keep your receipt. This way, if you're wondering why your bank account is showing an expenditure for a certain amount, and you forgot to write it down, you can go through your receipts to find evidence of the purchase. Keep all your receipts in an accordion file in your desk drawer.

Even if you don't have your own business, you'll still benefit from learning how to manage your money properly. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. So make sure you use the tips on proper money management that we mentioned in this article. Truly, when it comes to self improvement in business, properly managing your money is incredibly important.

Forensic Accountant Rayleigh

You might well run into the term "forensic accounting" when you're trying to find an accountant in Rayleigh, and will perhaps be interested to find out about the distinction between forensic accounting and standard accounting. The clue for this is the actual word 'forensic', which essentially means "relating to or denoting the application of scientific techniques and methods for the investigation of criminal activity." Using accounting, auditing and investigative skills to detect inconsistencies in financial accounts that have contributed to theft or fraud, it's also sometimes called 'financial forensics' or 'forensic accountancy'. There are some larger accountants firms throughout Essex who have got specialised sections for forensic accounting, dealing with personal injury claims, insurance claims, money laundering, bankruptcy, tax fraud, professional negligence and insolvency.

Actuaries Rayleigh

Actuaries work within government departments and organisations, to help them predict long-term investment risks and financial costs. Such risks can affect both sides of the balance sheet and require expert valuation, liability management and asset management skills. Actuaries present judgements of fiscal security systems, with an emphasis on their complexity, their mathematics and their mechanisms. (Tags: Actuaries Rayleigh, Financial Actuary Rayleigh, Actuary Rayleigh)

Payroll Services Rayleigh

Payrolls for staff can be a stressful part of running a business in Rayleigh, regardless of its size. The legislation on payrolls and the legal obligations for openness and accuracy means that dealing with a business's payroll can be a daunting task.

Not all small businesses have the help that a dedicated financial expert can provide, and an easy way to handle employee pay is to retain the services of an outside Rayleigh accountant. Your chosen payroll accounting company can provide accurate BACS payments to your personnel, as well as working along with any pension scheme administrators that your business might have, and use current HMRC regulations for NI contributions and tax deductions.

It will also be necessary for a payroll management service in Rayleigh to prepare a P60 tax form for all staff members after the end of the financial year (by May 31st). A P45 form should also be given to any member of staff who stops working for your business, as outlined by current legislation.

Rayleigh accountants will help with inheritance tax in Rayleigh, contractor accounts, company secretarial services, tax returns Rayleigh, mergers and acquisitions in Rayleigh, estate planning, financial statements, corporation tax, accounting services for the construction industry, limited company accounting Rayleigh, capital gains tax in Rayleigh, assurance services in Rayleigh, financial planning, consultancy and systems advice Rayleigh, VAT returns, HMRC submissions in Rayleigh, partnership registration Rayleigh, National Insurance numbers, consulting services Rayleigh, corporate finance, tax preparation, HMRC submissions in Rayleigh, VAT payer registration, accounting services for media companies, sole traders Rayleigh, accounting services for landlords, audit and compliance issues Rayleigh, small business accounting Rayleigh, payroll accounting, taxation accounting services, tax investigations, accounting support services Rayleigh and other types of accounting in Rayleigh, Essex. These are just a few of the tasks that are conducted by local accountants. Rayleigh providers will inform you of their entire range of accountancy services.

When searching for inspiration and ideas for self-assessment help, auditing & accounting, personal tax assistance and small business accounting, you don't need to look any further than the internet to find all the information that you need. With such a diversity of meticulously written blog posts and webpages to choose from, you will pretty quickly be swamped with great ideas for your planned project. Just recently we stumbled across this article covering how to track down a decent accountant.

Rayleigh Accounting Services

- Rayleigh Tax Returns

- Rayleigh Debt Recovery

- Rayleigh PAYE Healthchecks

- Rayleigh Tax Services

- Rayleigh Bookkeeping Healthchecks

- Rayleigh Account Management

- Rayleigh Tax Planning

- Rayleigh Tax Advice

- Rayleigh Specialist Tax

- Rayleigh Forensic Accounting

- Rayleigh Auditing Services

- Rayleigh Personal Taxation

- Rayleigh Payroll Management

- Rayleigh Business Accounting

Also find accountants in: Helions Bumpstead, Hatfield Broad Oak, Littlebury Green, Mill End Green, Tiptree Heath, Duton Hill, Tylers Green, Bulmer, Rettendon Place, Matching Tye, Dovercourt, Foster Street, Nazeing, Ramsden Heath, Thornwood Common, Greenstead Green, Heckfordbridge, Great Hallingbury, High Easter, White Notley, Shrub End, Coggeshall, Steeple, Paglesham Eastend, Great Braxted, Stow Maries, Battlesbridge, Buckhurst Hill, South Benfleet, Grange Hill, Messing, West Thurrock, Bishops Green, Wormingford, Shenfield and more.

Accountant Rayleigh

Accountant Rayleigh Accountants Near Me

Accountants Near Me Accountants Rayleigh

Accountants RayleighMore Essex Accountants: Great Dunmow, Manningtree, Chafford Hundred, Coggeshall, Wivenhoe, Clacton-on-Sea, Laindon, South Woodham Ferrers, Stanford-le-Hope, Purfleet, Langdon Hills, Wickford, Brightlingsea, Loughton, Hadleigh, Walton-on-the-Naze, Parkeston, Canvey Island, Dagenham, Grays, Galleywood, Saffron Walden, Witham, Epping, Rochford, Westcliff-on-Sea, Burnham-on-Crouch, Hullbridge, Braintree, Southend-on-Sea, Upminster, Southminster, North Weald Bassett, Heybridge, Stansted Mountfitchet, Ilford, Harlow, Billericay, Halstead, Buckhurst Hill, Great Baddow, Rainham, West Thurrock, Tilbury, Waltham Abbey, Great Wakering, Southchurch, Brentwood, Hornchurch, Maldon, South Benfleet, Frinton-on-Sea, Chingford, Leigh-on-Sea, Colchester, Chelmsford, Danbury, Chipping Ongar, Hawkwell, West Mersea, Corringham, Pitsea, Romford, Chigwell, Barking, Basildon, Tiptree, Hockley, Shoeburyness, Ingatestone, Harwich, Holland-on-Sea, Stanway, Writtle, Rayleigh and South Ockendon.

TOP - Accountants Rayleigh - Financial Advisers

Tax Preparation Rayleigh - Small Business Accountant Rayleigh - Investment Accounting Rayleigh - Financial Advice Rayleigh - Online Accounting Rayleigh - Bookkeeping Rayleigh - Affordable Accountant Rayleigh - Chartered Accountants Rayleigh - Tax Advice Rayleigh