Accountants Selby: Do you get nothing but a headache when you fill out your annual self-assessment form? This is a challenge for you and innumerable other folks in Selby. But how straightforward is it to obtain a local Selby professional who can do this on your behalf? Is self-assessment a tad too complicated for you to do by yourself? The average Selby bookkeeper or accountant will charge around £200-£300 for completing your tax returns. If this sounds like a lot to you, then look at using an online service.

But which accounting service is best for your requirements and how might you go about locating it? Finding a shortlist of local Selby accountants should be fairly simple with a swift search on the net. However, how do you know who you can and can't trust with your annual tax returns? The fact remains that anybody in Selby can set themselves up as an accountant. They don't even have to have any qualifications.

If you want your tax returns to be correct and error free it might be better to opt for a professional Selby accountant who is appropriately qualified. Your minimum requirement should be an AAT qualified accountant. You can then be sure your tax returns are done correctly. You will be able to claim the cost of your accountant as a tax deduction. For smaller businesses in Selby, a qualified bookkeeper may well be adequate.

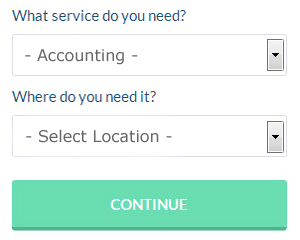

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. Filling in a clear and simple form is all that you need to do to set the process in motion. Within a few hours you should hear from some local accountants who are willing to help you. You can use Bark to find accountants and other similar services.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. The popularity of these services has been increasing in recent years. Choose a company with a history of good service. Have a good look at customer testimonials and reviews both on the company website and on independent review websites.

The real professionals in the field are chartered accountants. Their services are normally required by larger limited companies and big business. Having the best person for the job may appeal to many.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example Keytime, Capium, ACCTAX, Absolute Topup, Taxforward, Nomisma, CalCal, Gbooks, Sage, Taxfiler, BTCSoftware, Ablegatio, Taxshield, 123 e-Filing, TaxCalc, Andica, Forbes, Basetax, Xero, Ajaccts and GoSimple. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns. A £100 fine is levied for late self-assessments up to 3 months, more if later.

Self Improvement for Your Business Through Proper Money Management

Starting your own business is exciting, and this is true whether you are starting this business online or offline. You get to be in charge of practically everything when you've got your own business -- your time, the work you do, and even your income! It's a bit scary, isn't it? However, starting up a business of your own can also be very intimidating, especially during the initial stages when you're just getting your feet wet. This is where you'll find it very helpful to know a few self-improvement techniques such as properly managing your finances. Keep reading this article to learn how to correctly manage your money.

Keep separate accounts for your business and personal expenses, as trying to run everything through one account just makes everything confusing. You're only going to make it hard on yourself if you insist on running everything through one account. If you decide to use your personal account for running your business expenses, it can be a real challenge to prove your income. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. You'll be able to manage your finances better if you separate the business expenses from the personal expenses.

Learning a little bit about bookkeeping helps a lot. Make sure you've got a system set up for your money, whether it's business or personal. You can set up your system using a basic spreadsheet or get yourself a bookkeeping software like QuickBooks or Quicken. There are also personal budgeting tools out there that you can use such as Mint.com. The internet is full of free resources on how you can manage your small business bookkeeping. Your books are the key to you knowing precisely how and where your money (personal and business) is being spent. It won't hurt if you take a class or two on basic bookkeeping and accounting, as this could prove helpful to you especially if you don't think you can afford to hire a professional to manage your books.

Make sure you're prompt in paying your taxes. Typically, small businesses must pay taxes every quarter. It's not that easy to navigate through all the tax laws you need to follow, especially when you're a small business owner, so you're better off getting in touch with the IRS or your local small business center for the most current information. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. Having the IRS at your doorstep isn't something you'd want, believe me!

Proper money management is something that everyone should develop, no matter if they own a business or not. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. Use the tips in this article to help you get started. If you want your business to be a success, it's important that you develop money management skills.

Auditors Selby

Auditors are specialists who assess the accounts of companies and organisations to ascertain the legality and validity of their financial reports. Auditors examine the fiscal activities of the company that hires them and ensure the steady running of the business. Auditors have to be certified by the regulating body for accounting and auditing and have the required accounting qualifications.

Selby accountants will help with audit and auditing, workplace pensions, business disposal and acquisition, double entry accounting in Selby, corporate finance, consultancy and systems advice Selby, small business accounting, VAT returns Selby, accounting services for media companies, financial statements, business support and planning, consulting services, corporation tax, accounting services for buy to let property rentals Selby, debt recovery, financial planning, retirement planning, self-employed registration in Selby, estate planning, capital gains tax, PAYE, litigation support, year end accounts, National Insurance numbers, accounting support services, investment reviews, HMRC submissions Selby, business advisory, bureau payroll services, sole traders Selby, business outsourcing Selby, VAT registrations and other forms of accounting in Selby, North Yorkshire. These are just an example of the tasks that are conducted by local accountants. Selby companies will let you know their whole range of accounting services.

Selby Accounting Services

- Selby Business Accounting

- Selby Audits

- Selby Tax Advice

- Selby Bookkeepers

- Selby Tax Planning

- Selby Tax Services

- Selby VAT Returns

- Selby Tax Refunds

- Selby Self-Assessment

- Selby Financial Audits

- Selby Financial Advice

- Selby PAYE Healthchecks

- Selby Chartered Accountants

- Selby Specialist Tax

Also find accountants in: Hawkswick, Hemingbrough, Helperby, Ramsgill, Weaverthorpe, Tadcaster, East Knapton, Birdsall, Leathley, Rawcliffe, Littlethorpe, Rainton, Wrelton, Lower Dunsforth, Clapham, Austwick, Earswick, Horsehouse, Great Edstone, Rufforth, Arkendale, Yockenthwaite, Osbaldwick, Kilburn, Grosmont, Thornton Le Moor, Newsham, Low Worsall, Kettlesing Bottom, Hirst Courtney, Leeming Bar, Woodhall, Harmby, Helperthorpe, Lebberston and more.

Accountant Selby

Accountant Selby Accountants Near Me

Accountants Near Me Accountants Selby

Accountants SelbyMore North Yorkshire Accountants: Thornaby, York, Selby, Guisborough, Harrogate, Northallerton, Scarborough, Middlesbrough, Redcar, Whitby, Skipton, Yarm, Knaresborough and Ripon.

TOP - Accountants Selby - Financial Advisers

Bookkeeping Selby - Small Business Accountants Selby - Chartered Accountants Selby - Self-Assessments Selby - Auditors Selby - Financial Advice Selby - Tax Accountants Selby - Tax Return Preparation Selby - Financial Accountants Selby