Accountants Sheerness: You can take away a certain amount of of the stress of running a business in Sheerness, by retaining the services of a professional accountant. The very least you can expect is to gain more time to devote to your core business, while financial matters are sorted out by your accountant. This kind of help can be especially crucial to small start-up businesses, and those who have not run a business before. The prosperity and wellbeing of your business in Sheerness could hinge on you getting the proper help and guidance.

Obtaining an accountant in Sheerness is not always that simple with various kinds of accountants available. Your aim is to pick one that meets your exact requirements. You will come to realise that there are accountants who work independently and accountants who work for large accountancy companies. Accountancy companies will have specialists in each particular accounting discipline. The kinds of accountant that you're likely to find within a firm may include: actuaries, financial accountants, tax accountants, cost accountants, accounting technicians, chartered accountants, forensic accountants, investment accountants, management accountants, auditors and bookkeepers.

You should take care to find a properly qualified accountant in Sheerness to complete your self-assessment forms correctly and professionally. Look for an AAT qualified accountant in the Sheerness area. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Your accountant's fees are tax deductable. Sheerness sole traders often opt to use bookkeeper rather than accountants for their tax returns.

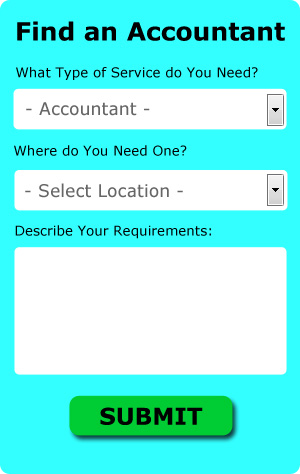

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Sheerness accountant. You'll be presented with a simple form which can be completed in a minute or two. All you have to do then is wait for some responses. Make the most of this service because it is free.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. This may save time and be more cost-effective for self-employed people in Sheerness. Should you decide to go down this route, take care in choosing a legitimate company. The better ones can soon be singled out by carefully studying reviews online. We are unable to advocate any individual accounting services on this site.

Maybe when you have looked all the options you will still decide to do your own tax returns. Available software that will also help includes Sage, Taxshield, BTCSoftware, Xero, Ajaccts, Absolute Topup, GoSimple, 123 e-Filing, Nomisma, Forbes, Keytime, Taxforward, ACCTAX, Gbooks, Basetax, CalCal, Capium, Taxfiler, TaxCalc, Andica and Ablegatio. Whichever service you use your tax returns will need to be in on time to avoid penalties.

Actuary Sheerness

An actuary is a professional person who evaluates the measurement and managing of uncertainty and risk. They apply their knowledge of economics and business, together with their understanding of investment theory, statistics and probability theory, to provide commercial, strategic and financial advice. To work as an actuary it's vital to have an economic, statistical and mathematical knowledge of day to day scenarios in the world of business finance. (Tags: Financial Actuary Sheerness, Actuary Sheerness, Actuaries Sheerness)

Proper Money Management Tips for Small Business Owners

Properly using money management strategies is one of those things that is most difficult to learn when you're just starting a business. It can seem like money management is something anyone should be able to do already by the time they get their business up and running. But managing your business finances is a lot different from managing your personal finances. It will help, though, if you are already experienced in the latter. Your confidence can take a hard hit if you ruin your finances on accident. Continue reading if you want to know how you can better manage your business finances.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. Sure, it may seem easy to manage your finances, personal and business, if you just have one account right now, but when your business really takes off, you're going to wish you had a separate account. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. Streamline your process with two accounts.

Track your personal and business expenditures down to the last cent. There are many benefits to doing this even though it is a pain to track each and every thing you spend money on, no matter how small it is. When you actually write down where you spend your money, it helps you keep track of your spending habits. Many people are earning decent money but they have poor money management skills that they often find themselves wondering where all their money has gone. This can come in handy, especially when you're trying to budget your money because you can see where you can potentially save money. It will also help you streamline things when you need to fill out your tax forms.

Be a responsible business owner by paying your taxes when they're due. In general, small businesses pay taxes on a quarterly basis. It's not that easy to navigate through all the tax laws you need to follow, especially when you're a small business owner, so you're better off getting in touch with the IRS or your local small business center for the most current information. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. The last thing you need is to have the IRS coming after you for tax evasion!

Learning how to manage your finances properly will help not just your business but yourself as well. You've read just three money management tips that you can use to help you manage your finances better. You're in a much better position for business and personal success when you know how to manage your finances better.

Payroll Services Sheerness

Staff payrolls can be a challenging part of running a company in Sheerness, regardless of its size. The laws relating to payroll requirements for accuracy and transparency mean that processing a company's payroll can be a daunting task.

A small business might not have the advantage of a dedicated financial specialist and the simplest way to deal with the issue of employee payrolls is to use an outside accounting company in Sheerness. The payroll management service will work alongside HMRC and pension scheme administrators, and oversee BACS transfers to ensure timely and accurate wage payment to all personnel.

Abiding by the current regulations, a dedicated payroll management accountant in Sheerness will also provide every one of your staff members with a P60 tax form at the end of each fiscal year. They will also be responsible for providing P45 tax forms at the end of an employee's contract. (Tags: Payroll Services Sheerness, Payroll Accountant Sheerness, Payroll Companies Sheerness).

Forensic Accounting Sheerness

During your search for a competent accountant in Sheerness there is a fair chance that you will stumble upon the term "forensic accounting" and be curious about what that is, and how it is different from standard accounting. With the actual word 'forensic' literally meaning "relating to or denoting the application of scientific methods and techniques for the investigation of a crime", you will get a clue as to exactly what is involved. Also often known as 'financial forensics' or 'forensic accountancy', it uses investigative skills, accounting and auditing to discover inconsistencies in financial accounts that have lead to fraud or theft. There are even some larger accountants firms throughout Kent who have specialist sections for forensic accounting, investigating money laundering, insurance claims, bankruptcy, professional negligence, tax fraud, personal injury claims and insolvency. (Tags: Forensic Accountant Sheerness, Forensic Accountants Sheerness, Forensic Accounting Sheerness)

Sheerness accountants will help with company secretarial services, accounting services for start-ups, consultancy and systems advice, PAYE, financial and accounting advice, accounting services for media companies, sole traders in Sheerness, audit and compliance reporting, bookkeeping Sheerness, tax preparation Sheerness, investment reviews, litigation support, VAT returns, accounting and auditing, general accounting services in Sheerness, capital gains tax, bureau payroll services, business advisory, business acquisition and disposal, consulting services, tax investigations, self-employed registrations, VAT registration, payslips, business support and planning, financial planning, accounting services for the construction industry Sheerness, company formations in Sheerness, workplace pensions in Sheerness, corporate finance in Sheerness, assurance services in Sheerness, financial statements in Sheerness and other accounting related services in Sheerness, Kent. Listed are just a selection of the duties that are undertaken by local accountants. Sheerness specialists will be delighted to keep you abreast of their full range of services.

When you are hunting for advice and inspiration for personal tax assistance, accounting & auditing, self-assessment help and accounting for small businesses, you will not really need to look any further than the world wide web to find everything you could need. With so many well researched blog posts and webpages to pick from, you will very shortly be swamped with brilliant ideas for your upcoming project. Last week we spotted this thought provoking article on the subject of choosing an accountant for your business.

Sheerness Accounting Services

- Sheerness Tax Refunds

- Sheerness Account Management

- Sheerness Debt Recovery

- Sheerness Tax Services

- Sheerness Auditing Services

- Sheerness Financial Advice

- Sheerness Specialist Tax

- Sheerness Tax Planning

- Sheerness Personal Taxation

- Sheerness VAT Returns

- Sheerness Chartered Accountants

- Sheerness Tax Returns

- Sheerness Bookkeeping Healthchecks

- Sheerness PAYE Healthchecks

Also find accountants in: Rhodes Minnis, Westwell, Crouch, Dargate, Culverstone Green, Grain, Hadlow, Queen Street, Oversland, Sandling, Breach, Benover, Longfield Hill, Higham, Kemsley, Paddock Wood, Eastry, Mockbeggar, Darenth, Hernhill, Newington, Bough Beech, Chiddingstone, Bramling, Allhallows, Underriver, Maxton, Church Street, Sheerness, Maltmans Hill, Ivy Hatch, Four Elms, Brenzett, Upper Hardres Court, St Peters and more.

Accountant Sheerness

Accountant Sheerness Accountants Near Me

Accountants Near Me Accountants Sheerness

Accountants SheernessMore Kent Accountants: Bearsted, Dartford, Tonbridge, Westerham, Chatham, Edenbridge, Lydd, Wilmington, Paddock Wood, New Romney, Sevenoaks, West Kingsdown, Aylesford, Swanley, Strood, Minster, Dover, Walmer, Herne Bay, Swanscombe, Ramsgate, Hartley, Pembury, East Malling, Southborough, Biggin Hill, Northfleet, Rochester, Tunbridge Wells, Margate, Maidstone, Meopham, Sturry, Gravesend, Boxley, Cranbrook, Canterbury, Folkestone, Gillingham, Westgate-on-Sea, Snodland, Tenterden, Broadstairs, Ashford, Kingsnorth, Sittingbourne, Sheerness, Sandwich, Birchington-on-Sea, Deal, Whitstable, Faversham and Staplehurst.

TOP - Accountants Sheerness - Financial Advisers

Financial Accountants Sheerness - Tax Advice Sheerness - Investment Accountant Sheerness - Tax Preparation Sheerness - Auditing Sheerness - Cheap Accountant Sheerness - Financial Advice Sheerness - Bookkeeping Sheerness - Small Business Accountant Sheerness