Accountants Stoke-on-Trent: If you've got your own business or are a sole trader in Stoke-on-Trent, Staffordshire, you'll soon discover that there are many benefits to be gained from using a qualified accountant. Among the many benefits are the fact that you should have more time to focus on core business activities whilst routine and time consuming bookkeeping can be expertly handled by your accountant. The benefits of this type of professional help far outweighs the additional costs involved. The growth and prosperity of your Stoke-on-Trent business may well depend on this kind of expert advice.

Accountants don't just handle tax returns, there are different sorts of accountant. So, make sure you choose one that matches your requirements perfectly. You will come to realise that there are accountants who work alone and accountants who work for accounting companies. An accounting firm will offer a broader range of services, while a lone accountant may offer a more personal service. Most accountancy companies will be able to provide: accounting technicians, tax accountants, financial accountants, bookkeepers, investment accountants, actuaries, management accountants, chartered accountants, auditors, cost accountants and forensic accountants.

Therefore you should check that your chosen Stoke-on-Trent accountant has the appropriate qualifications to do the job competently. The recommended minimum qualification you should look for is an AAT. A qualified accountant may cost a little more but in return give you peace of mind. It should go without saying that accountants fees are tax deductable.

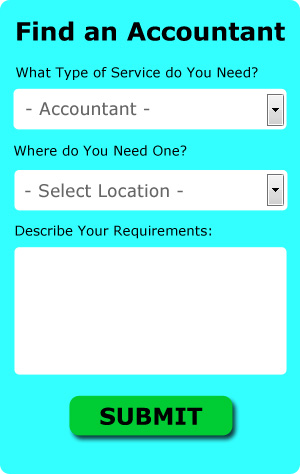

One online service which helps people like you find an accountant is Bark. All that is required is the ticking of a few boxes so that they can understand your exact needs. In the next day or so you should be contacted by potential accountants in your local area.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. It could be that this solution will be more appropriate for you. Choose a company with a history of good service. There are resources online that will help you choose, such as review websites. We cannot endorse or recommend any of the available services here.

The most qualified of all are chartered accountants, they have the most training and the most expertise. These powerhouses know all the ins and out of the financial world and generally represent large large companies and conglomerates. This widens your choice of accountants.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? Using accounting software like Capium, Forbes, Taxfiler, Basetax, Sage, TaxCalc, Ablegatio, CalCal, Nomisma, Ajaccts, 123 e-Filing, Andica, Gbooks, Keytime, Taxforward, ACCTAX, BTCSoftware, Absolute Topup, GoSimple, Xero or Taxshield will make it even simpler to do yourself. Whatever happens you need to get your self-assessment form in on time.

Improve Your Business and Yourself By Learning Better Money Management

Starting your own business is exciting, and this is true whether you are starting this business online or offline. You're your own boss and you're in control of how much you make. Well, you're basically in charge of everything! That sounds a little scary, doesn't it? Truly, while exhilarating, starting your own business is also quite intimidating because it can be quite difficult to find your feet. It then pays to be aware of a few self-improvement strategies like knowing how to manage finances the proper way. Today, we've got a few suggestions on how you can keep your finances in order.

Implement a numbering system for your invoices. This is one of those things that you probably think isn't that big of a deal but it really is. When you've got your invoices numbered, you can easily track your transactions. Not only will it help you find out quickly enough who has already paid their invoices, it will help you find out who still owes you and how much. You'll have those times when a client will be insistent in saying he has already paid you and if you have your invoices numbered, you can easily look it up and resolve the matter. Errors can happen in business too and if you've got your invoices numbered, it makes it easy for you to find those mistakes.

It's a good idea to know where exactly every cent goes in both your business and personal life. There are many benefits to doing this even though it is a pain to track each and every thing you spend money on, no matter how small it is. When you actually write down where you spend your money, it helps you keep track of your spending habits. You wouldn't want to be like those people who wonder where their money went. When you write all your personal and business expenditures, you won't ever have to wonder where your money is going. And when you're creating a budget, you can pinpoint those places where you're spending unnecessarily, cut back on them, and save yourself money in the process. And when you're filling out tax forms, it's less harder to identify your business expenses from your personal expenses and you know exactly how much you spent on business related stuff.

Keep a complete accounting of how much business you generate down to the last penny. Every single time you receive a payment, write down that you have been paid and how much. This way you know the amount of money your business is generating and you can also track the people who has already paid you and identify those whose payments are still pending. When you know what your income is, you'll also be able to figure out how much taxes you can expect to pay and even how much money you should pay yourself.

When it comes to improving yourself and your business, proper money management is one of the most essential things you can learn. You've read just three money management tips that you can use to help you manage your finances better. When you have that under control, the sky is the limit!

Stoke-on-Trent accountants will help with mergers and acquisitions in Stoke-on-Trent, corporate finance, VAT returns Stoke-on-Trent, year end accounts, partnership accounts, workplace pensions in Stoke-on-Trent, assurance services in Stoke-on-Trent, tax investigations, tax preparation Stoke-on-Trent, charities in Stoke-on-Trent, accounting services for media companies, double entry accounting, financial planning in Stoke-on-Trent, PAYE in Stoke-on-Trent, tax returns, retirement advice, partnership registration in Stoke-on-Trent, company formations, accounting services for the construction industry, litigation support in Stoke-on-Trent, small business accounting, monthly payroll in Stoke-on-Trent, debt recovery, business support and planning, VAT registrations, inheritance tax, bookkeeping, business outsourcing, bureau payroll services, business start-ups in Stoke-on-Trent, self-employed registration in Stoke-on-Trent, general accounting services and other accounting related services in Stoke-on-Trent, Staffordshire. These are just a selection of the duties that are accomplished by nearby accountants. Stoke-on-Trent companies will be delighted to keep you abreast of their entire range of accountancy services.

Stoke-on-Trent Accounting Services

- Stoke-on-Trent Forensic Accounting

- Stoke-on-Trent Financial Advice

- Stoke-on-Trent Tax Returns

- Stoke-on-Trent Financial Audits

- Stoke-on-Trent Taxation Advice

- Stoke-on-Trent Auditing Services

- Stoke-on-Trent Specialist Tax

- Stoke-on-Trent Debt Recovery

- Stoke-on-Trent Bookkeepers

- Stoke-on-Trent Personal Taxation

- Stoke-on-Trent Payroll Management

- Stoke-on-Trent Tax Refunds

- Stoke-on-Trent Self-Assessment

- Stoke-on-Trent PAYE Healthchecks

Also find accountants in: Sutton, Blackbrook, Kidsgrove, Cheslyn Hay, Ellenhall, Hanging Bridge, Great Chatwell, Oulton, Hollinsclough, Wall, Talke, Kiddemore Green, Gentleshaw, Weston Under Lizard, Norton Canes, Norton In The Moors, Waterhouses, Chasetown, Withington, Derrington, Kingsley, Trysull, Harriseahead, Shenstone Woodend, Calton, Chesterton, Halmer End, Werrington, Dunston, Stableford, Bobbington, Stramshall, Dosthill, Knypersley, Salt and more.

Accountant Stoke-on-Trent

Accountant Stoke-on-Trent Accountants Near Me

Accountants Near Me Accountants Stoke-on-Trent

Accountants Stoke-on-TrentMore Staffordshire Accountants: Burton-upon-Trent, Biddulph, Fenton, Longton, Heath Hayes, Burntwood, Stafford, Hednesford, Lichfield, Wombourne, Hanley, Uttoxeter, Cannock, Kidsgrove, Stone, Burslem, Tamworth, Rugeley, Newcastle-under-Lyme, Leek and Stoke-on-Trent.

TOP - Accountants Stoke-on-Trent - Financial Advisers

Self-Assessments Stoke-on-Trent - Auditing Stoke-on-Trent - Financial Advice Stoke-on-Trent - Affordable Accountant Stoke-on-Trent - Tax Preparation Stoke-on-Trent - Online Accounting Stoke-on-Trent - Tax Accountants Stoke-on-Trent - Small Business Accountant Stoke-on-Trent - Investment Accountant Stoke-on-Trent