Accountants Swadlincote: There are many benefits to be gained from hiring the expert services of an accountant if you are self-employed or running a business in the Swadlincote area. Most importantly you will have more time to concentrate on your core business operations, while your accountant handles such things as annual tax returns and bookkeeping. Getting this kind of help and advice can be crucial for smaller businesses and even more so for start-ups. Having easy access to this kind of professional assistance should enable you to develop your Swadlincote business.

So, precisely what should you be expecting to pay for this service and what do you get for your cash? A substantial list of possible Swadlincote accountants can be found with one short search on the web. But, how do you know which of these can be trusted with your paperwork? The sad fact is that anyone in Swadlincote can advertise their services as an accountant. They do not even need to have any qualifications.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. Remember that a percentage of your accounting costs can be claimed back on the tax return.

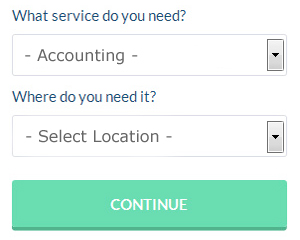

If you want to reach out to a number of local Swadlincote accountants, you could always use a service called Bark. You will quickly be able to complete the form and your search will begin. Just sit back and wait for the responses to roll in.

You could always try an online tax returns service if your needs are fairly simple. More accountants are offering this modern alternative. Some of these companies are more reputable than others. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable. It is beyond the scope of this article to recommend any specific service.

If you want to use the most qualified person to deal with your finances, a chartered accountant would be the choice. Their expertise is better suited to high finance and bigger businesses. Some people might say, you should hire the best you can afford.

Maybe when you have looked all the options you will still decide to do your own tax returns. Software programs like ACCTAX, Taxfiler, Keytime, TaxCalc, Capium, GoSimple, Nomisma, Basetax, BTCSoftware, Forbes, Taxshield, Gbooks, Absolute Topup, Andica, Ablegatio, CalCal, 123 e-Filing, Sage, Xero, Taxforward and Ajaccts have been developed to help the self-employed do their own tax returns. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time.

Auditors Swadlincote

An auditor is a company or person authorised to examine and validate the correctness of financial accounts and ensure that businesses or organisations adhere to tax legislation. They also sometimes undertake a consultative role to suggest potential risk prevention measures and the application of cost reductions. To become an auditor, an individual must be accredited by the regulating authority of accounting and auditing or have specified qualifications.

Actuary Swadlincote

Actuaries and analysts are professionals in the management of risk. An actuary uses financial and statistical theories to measure the likelihood of a specific event occurring and the possible monetary ramifications. Actuaries provide evaluations of fiscal security systems, with an emphasis on their complexity, their mathematics, and their mechanisms.

Forensic Accounting Swadlincote

When you are looking for an accountant in Swadlincote you will doubtless run across the expression "forensic accounting" and be curious about what the difference is between a regular accountant and a forensic accountant. The clue for this is the actual word 'forensic', which essentially means "relating to or denoting the application of scientific methods and techniques for the investigation of criminal activity." Also called 'financial forensics' or 'forensic accountancy', it uses investigative skills, auditing and accounting to detect inconsistencies in financial accounts that have lead to fraud or theft. Some of the larger accountancy firms in and near Swadlincote even have specialised divisions addressing money laundering, insurance claims, bankruptcy, professional negligence, tax fraud, personal injury claims and insolvency.

Tips for Better Money Management

There are many things you can do in life that are exciting, and one of them is starting up your own online or offline business. When you're your own boss, you get to be in charge of basically everything. It can be kind of scary, can't it? Although it's exhilarating, putting up your own business is also an intimidating process, especially if you're a complete novice. This is where you'll find it very helpful to know a few self-improvement techniques such as properly managing your finances. Keep reading this article to learn how to correctly manage your money.

Number your invoices. This is something that a lot of business owners don't really think about but it can save you a lot of hassle down the road. Numbering your invoices helps you keep track of them. You'll be able to easily track who has paid you and who still owes you. You'll have those times when a client will be insistent in saying he has already paid you and if you have your invoices numbered, you can easily look it up and resolve the matter. Remember, it is possible to make errors and numbering your invoices is a simple way to help find them when they happen.

Even if you're the only person running your business, earmark a salary for yourself and then issue yourself a paycheck regularly. This will actually help you organize and manage your business and personal finances better. So how do you do this exactly? First, any payments you get from the sale of your products or services should go to your business account. Next, decide how often you want to receive a salary. Let's say you want to pay yourself once every month, such as on the 15th. When the 15th comes around, write yourself a check. You can decide how much you should pay yourself. You can pay yourself by billable hours or a portion of your business income for that month.

Track every single penny you bring in. Keep a record of every payment you get from customers or clients. Doing this will help you know how much money you've got and know exactly who has already paid you. When you know what your income is, you'll also be able to figure out how much taxes you can expect to pay and even how much money you should pay yourself.

Proper money management is a skill that every adult needs to develop. Knowing what you have coming in, what you have going out, and what exactly is going on with your money can be a huge boost to your confidence and success. So keep in mind the tips we've shared. If you want your business to be a success, it's important that you develop money management skills.

Swadlincote accountants will help with business outsourcing, management accounts, accounting services for the construction sector, debt recovery, partnership registration, sole traders in Swadlincote, mergers and acquisitions Swadlincote, investment reviews, litigation support, company formations, business acquisition and disposal, double entry accounting, monthly payroll, tax investigations Swadlincote, audit and compliance issues, accounting services for buy to let rentals, business planning and support in Swadlincote, VAT returns, small business accounting, HMRC liaison, bureau payroll services Swadlincote, general accounting services, business advisory, pension forecasts, workplace pensions, PAYE, charities, financial and accounting advice, cash flow, accounting services for media companies, National Insurance numbers, HMRC submissions in Swadlincote and other kinds of accounting in Swadlincote, Derbyshire. These are just an example of the tasks that are handled by nearby accountants. Swadlincote specialists will inform you of their entire range of accounting services.

Swadlincote Accounting Services

- Swadlincote Self-Assessment

- Swadlincote Personal Taxation

- Swadlincote Chartered Accountants

- Swadlincote Audits

- Swadlincote Bookkeepers

- Swadlincote Tax Services

- Swadlincote Tax Advice

- Swadlincote Financial Advice

- Swadlincote Financial Audits

- Swadlincote Account Management

- Swadlincote Debt Recovery

- Swadlincote Specialist Tax

- Swadlincote Business Accounting

- Swadlincote VAT Returns

Also find accountants in: Church Gresley, Belper, Heanor, Litton, Chunal, Nether Padley, Unstone, Foston, Alfreton, Scropton, Brimington, Egginton, Hasland, Risley, Hollington, Cross O The Hands, Swarkestone, Over Haddon, Pinxton, Peak Dale, Brough, Alton, Scarcliffe, Eyam, Rowland, Hilton, Coal Aston, Higham, Alsop En Le Dale, Heathcote, Matlock Bank, Brackenfield, Stubley, Holbrook, Ible and more.

Accountant Swadlincote

Accountant Swadlincote Accountants Near Swadlincote

Accountants Near Swadlincote Accountants Swadlincote

Accountants SwadlincoteMore Derbyshire Accountants: Buxton, Belper, Glossop, Dronfield, Long Eaton, Swadlincote, Ilkeston, Chesterfield, Staveley, Ripley and Derby.

TOP - Accountants Swadlincote - Financial Advisers

Investment Accounting Swadlincote - Financial Advice Swadlincote - Affordable Accountant Swadlincote - Self-Assessments Swadlincote - Online Accounting Swadlincote - Tax Accountants Swadlincote - Financial Accountants Swadlincote - Tax Return Preparation Swadlincote - Auditors Swadlincote