Accountants Swinton: Does filling in your yearly self-assessment form put your head in a spin? Lots of folks in Swinton and throughout the British Isles have to contend with this every year. The obvious solution would be to pay a decent Swinton accountant to tackle this task instead. It could be the case that doing your own self-assessment is simply too challenging. A run of the mill bookkeeper or accountant in Swinton is likely to charge you in the region of £200-£300 for the completion of your self-assessment. You should be able to get this done considerably cheaper by using one of the various online services.

Accountants don't merely deal with tax returns, there are different kinds of accountant. A local accountant who perfectly matches your requirements is what you should be looking for. Many accountants work on their own, while others are part of a larger business. With an accounting practice there should always be somebody on hand to deal with any field of accounting. You'll probably find investment accountants, chartered accountants, actuaries, auditors, accounting technicians, forensic accountants, cost accountants, financial accountants, management accountants, bookkeepers and tax accountants in a sizable accountants practice.

You would be best advised to find a fully qualified Swinton accountant to do your tax returns. For simple self-assessment work an AAT qualification is what you need to look for. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. The cost of preparing your self-assessment form can be claimed back as a business expense. Small businesses and sole traders can use a bookkeeper rather than an accountant.

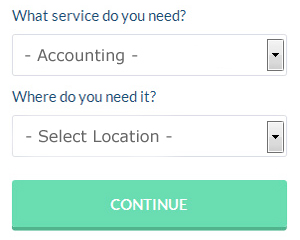

Though you may not have heard of them before there is an online service called Bark who can help you in your search. Tick a few boxes on their form and submit it in minutes. Just sit back and wait for the responses to roll in. And the great thing about Bark is that it is completely free to use.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. For many self-employed people this is a convenient and time-effective solution. Even if you do decide to go down this route, take some time in singling out a trustworthy company. The better ones can soon be singled out by carefully studying reviews online.

If you really want the best you could go with a chartered accountant. The services these specialists provide are perhaps beyond the needs of the smaller business in Swinton. Some people might say, you should hire the best you can afford.

The cheapest option of all is to do your own self-assessment form. There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example Absolute Topup, Ablegatio, Gbooks, Keytime, GoSimple, TaxCalc, Ajaccts, Basetax, Taxforward, Andica, 123 e-Filing, BTCSoftware, Nomisma, Taxfiler, CalCal, Xero, Forbes, Capium, ACCTAX, Taxshield and Sage. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare. Penalties are £100 for being 3 months late and an extra £10 per day after that, so don't be late.

Payroll Services Swinton

For any company in Swinton, from large scale organisations down to independent contractors, payrolls for staff can be complicated. Coping with payrolls requires that all legal obligations in relation to their accuracy, openness and timing are observed to the finest detail.

Not all small businesses have their own in-house financial specialists, and the simplest way to handle employee payrolls is to use an outside Swinton accountant. A managed payroll service accountant will work along with HMRC, work with pensions providers and deal with BACS payments to ensure your staff are paid punctually, and all mandatory deductions are accurate.

It will also be necessary for a payroll management service in Swinton to provide an accurate P60 tax form for each member of staff after the end of the financial year (by 31st May). A P45 form should also be provided for any member of staff who finishes working for the company, according to the current legislation.

Actuaries Swinton

An actuary is a business professional who studies the measurement and management of risk and uncertainty. These risks can affect both sides of the balance sheet and call for professional valuation, asset management and liability management skills. To be an actuary it's essential to have a statistical, economic and mathematical awareness of day to day scenarios in the world of business finance.

Auditors Swinton

An auditor is a person or a firm appointed by an organisation or company to conduct an audit, which is the official examination of the financial accounts, usually by an independent body. Auditors examine the fiscal actions of the company which appoints them to ensure the steady running of the business. Auditors must be authorised by the regulatory authority for auditing and accounting and also have the necessary qualifications.

Swinton accountants will help with consultancy and systems advice in Swinton, business planning and support in Swinton, VAT returns Swinton, personal tax, inheritance tax, consulting services in Swinton, bookkeeping, capital gains tax, limited company accounting, general accounting services, taxation accounting services, bureau payroll services, accounting services for buy to let rentals, sole traders Swinton, PAYE, accounting services for the construction sector, debt recovery Swinton, assurance services, payslips, business outsourcing, estate planning in Swinton, payroll accounting, company secretarial services, partnership accounts in Swinton, financial statements in Swinton, HMRC submissions, company formations, cash flow, business acquisition and disposal, compliance and audit reporting, tax preparation, accounting services for media companies in Swinton and other accounting services in Swinton, Greater Manchester. These are just a small portion of the activities that are undertaken by nearby accountants. Swinton specialists will be delighted to keep you abreast of their full range of services.

Swinton Accounting Services

- Swinton Debt Recovery

- Swinton Self-Assessment

- Swinton Forensic Accounting

- Swinton Tax Advice

- Swinton PAYE Healthchecks

- Swinton Bookkeeping

- Swinton Business Accounting

- Swinton Chartered Accountants

- Swinton Personal Taxation

- Swinton Tax Services

- Swinton Tax Planning

- Swinton Financial Advice

- Swinton Financial Audits

- Swinton Account Management

Also find accountants in: Cheadle, Limefield, Firgrove, Eccles, Burnage, Harwood, Boothstown, Kenyon, Swinton, Hale, Heaviley, Stretford, Horwich, Moorside, Eagley, Dunham Town, Ashton Under Lyne, Shaw, Atherton, Bolton, Levenshulme, Mottram In Longdendale, Lees, Mossley, Denton, Droylsden, Diggle, Woodford, Urmston, Leigh, Radcliffe, Bryn, Haughton Green, Newhey, Bury and more.

Accountant Swinton

Accountant Swinton Accountants Near Me

Accountants Near Me Accountants Swinton

Accountants SwintonMore Greater Manchester Accountants: Hyde, Farnworth, Walkden, Denton, Oldham, Stretford, Romiley, Swinton, Whitefield, Stockport, Wigan, Droylsden, Eccles, Bolton, Middleton, Salford, Chadderton, Rochdale, Bury, Gatley, Ashton-under-Lyne, Cheadle Hulme, Altrincham, Royton, Ashton-in-Makerfield, Sale, Atherton, Dukinfield, Radcliffe, Horwich, Leigh, Urmston, Manchester, Irlam, Hindley, Westhoughton, Golborne, Heywood and Stalybridge.

TOP - Accountants Swinton - Financial Advisers

Investment Accountant Swinton - Financial Advice Swinton - Self-Assessments Swinton - Tax Accountants Swinton - Small Business Accountant Swinton - Cheap Accountant Swinton - Auditing Swinton - Chartered Accountant Swinton - Bookkeeping Swinton