Accountants Tamworth: Is the only reward for completing your annual self-assessment form a huge headache? You and many other folks in Tamworth have to face this each and every year. But how do you track down an accountant in Tamworth to do it for you? This might be the best option if you consider self-assessment just too time-consuming. The cost of completing and sending in your self-assessment form is around £200-£300 if done by a regular Tamworth accountant. By making use of one of the numerous online services you will be able to get a cheaper deal.

There are many different branches of accounting. Choosing one that dovetails neatly with your business is vital. Some accountants in the Tamworth area work on their own, whilst others could be part of an accountancy practice. Accounting firms will have experts in each specific accounting sector. Expect to find management accountants, actuaries, chartered accountants, accounting technicians, investment accountants, tax accountants, auditors, bookkeepers, forensic accountants, financial accountants and costing accountants within an average sized accounting practice.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. For simple self-assessment work an AAT qualification is what you need to look for. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. You will be able to claim the cost of your accountant as a tax deduction. A lot of smaller businesses in Tamworth choose to use bookkeepers rather than accountants.

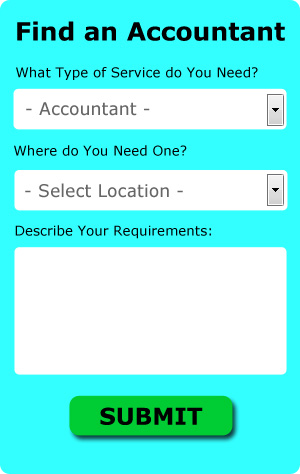

If you want to reach out to a number of local Tamworth accountants, you could always use a service called Bark. It is just a case of ticking some boxes on a form. Accountants in your local area will be sent your details, and if they are interested in doing the work will contact you shortly.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. More accountants are offering this modern alternative. Do a bit of research to find a reputable company. Be sure to study customer reviews and testimonials.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. It is also a good idea to make use of some self-assessment software such as Forbes, TaxCalc, Ablegatio, Keytime, Basetax, Taxforward, CalCal, Absolute Topup, BTCSoftware, Andica, Sage, Gbooks, Taxshield, ACCTAX, Nomisma, 123 e-Filing, Xero, Capium, Ajaccts, GoSimple or Taxfiler to simplify the process. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns.

Actuary Tamworth

An actuary measures, manages and gives advice on financial risks. Actuaries use their mathematical knowledge to quantify the risk and probability of future happenings and to estimate their effect (financially) on a business and their clients. Actuaries deliver assessments of financial security systems, with a focus on their mechanisms, their mathematics and their complexity.

Forensic Accounting Tamworth

Whilst conducting your search for an experienced accountant in Tamworth there is a pretty good chance that you'll stumble upon the expression "forensic accounting" and be curious about what that is, and how it is different from regular accounting. The word 'forensic' is the thing that gives you an idea, meaning literally "appropriate for use in a law court." Also often known as 'financial forensics' or 'forensic accountancy', it uses auditing, accounting and investigative skills to detect inaccuracies in financial accounts that have contributed to theft or fraud. There are even several bigger accountants firms in Staffordshire who've got dedicated departments for forensic accounting, investigating insolvency, false insurance claims, professional negligence, tax fraud, personal injury claims, money laundering and bankruptcy. (Tags: Forensic Accounting Tamworth, Forensic Accountant Tamworth, Forensic Accountants Tamworth)

Practicing Better Money Management to Help Your Business Succeed

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. During the course of your business, so many things can happen that can erode your business and self-confidence, and this is where many business owners have the hardest time. For example, failure on your part to properly manage your finances will contribute to this. Many business owners disregard the important of money management because it's an easy and simple task during the beginning stages of a business. Be aware, however, that managing your business money isn't going to get any simpler as your business grows; it'll simply become more complicated. This is where the following tips will prove to be helpful.

You shouldn't wait for the due date to pay your taxes. It may be that you won't have the funds you need to pay your taxes if your money management skills are poor. To prevent yourself from coming up short, set money aside with every payment your receive. Do this and you'll never have to worry where to get the money to pay your taxes every quarter because you've already got it saved. You never want to be late in paying your taxes and this simple money management strategy will help you avoid paying late because you don't have the funds to make the payment on time.

You may be your own boss, but it's still a good idea to give yourself a regular paycheck. This way, you won't have a hard time keeping track of your business and personal finances. So how do you do this exactly? First, any payments you get from the sale of your products or services should go to your business account. Next, decide how often you want to receive a salary. Let's say you want to pay yourself once every month, such as on the 15th. When the 15th comes around, write yourself a check. How much should you pay yourself? It's up to you. You can pay yourself by billable hours or a portion of your business income for that month.

Make sure you're prompt in paying your taxes. Typically, small businesses must pay taxes every quarter. It's not that easy to navigate through all the tax laws you need to follow, especially when you're a small business owner, so you're better off getting in touch with the IRS or your local small business center for the most current information. You can also work with a professional to set up payments and plans for ensuring that you are meeting all of your obligations and following the letter of the law. Having the IRS at your doorstep isn't something you'd want, believe me!

Learning how to manage your finances properly will help not just your business but yourself as well. You'll benefit a great deal if you remember and put these tips we've shared to use. When you have that under control, the sky is the limit!

Auditors Tamworth

An auditor is a person or company hired by an organisation or firm to complete an audit, which is the official examination of the accounts, usually by an impartial entity. They also often take on a consultative role to encourage potential risk prevention measures and the introduction of cost reductions. Auditors need to be accredited by the regulating body for accounting and auditing and also have the necessary accounting qualifications.

Small Business Accountants Tamworth

Doing the yearly accounts can be a stressful experience for anybody running a small business in Tamworth. A dedicated small business accountant in Tamworth will provide you with a stress free approach to keep your VAT, tax returns and annual accounts in perfect order.

A professional small business accountant in Tamworth will regard it as their responsibility to develop your business, and offer you reliable financial guidance for peace of mind and security in your specific situation. An accountancy firm in Tamworth should provide you with an assigned small business accountant and consultant who will clear the haze that shrouds business taxation, in order to improve your tax efficiency.

In order to do their job correctly, a small business accountant in Tamworth will have to know precise details with regards to your present financial standing, business structure and any potential investment you may be looking at, or already have set up. (Tags: Small Business Accountant Tamworth, Small Business Accountants Tamworth, Small Business Accounting Tamworth).

Payroll Services Tamworth

Dealing with staff payrolls can be a stressful part of running a business in Tamworth, irrespective of its size. Managing company payrolls requires that all legal obligations in relation to their timing, accuracy and openness are followed to the minutest detail.

A small business may not have the advantage of a dedicated financial specialist and the best way to cope with staff payrolls is to retain the services of an independent payroll company in Tamworth. The payroll service will work alongside HMRC and pension schemes, and deal with BACS payments to ensure accurate and timely payment to all staff.

A dedicated payroll management accountant in Tamworth will also, in accordance with current legislations, organise P60's after the end of the financial year for every employee. A P45 tax form should also be provided for any employee who finishes working for your company, according to the current regulations. (Tags: Payroll Accountants Tamworth, Payroll Services Tamworth, Payroll Companies Tamworth).

Tamworth accountants will help with accounting services for media companies, payroll accounting, contractor accounts in Tamworth, HMRC submissions in Tamworth, accounting and financial advice Tamworth, year end accounts, estate planning, HMRC submissions, VAT returns in Tamworth, audit and compliance issues, assurance services in Tamworth, tax investigations in Tamworth, financial statements Tamworth, bookkeeping Tamworth, VAT registration, corporate finance, capital gains tax, cashflow projections Tamworth, management accounts Tamworth, consulting services, charities, tax preparation in Tamworth, sole traders, accounting services for the construction sector, mergers and acquisitions, double entry accounting, pension forecasts, financial planning, self-employed registration, general accounting services Tamworth, inheritance tax, partnership accounts and other forms of accounting in Tamworth, Staffordshire. These are just some of the activities that are performed by nearby accountants. Tamworth providers will be happy to inform you of their whole range of accountancy services.

Tamworth Accounting Services

- Tamworth Bookkeepers

- Tamworth Auditing Services

- Tamworth Personal Taxation

- Tamworth Payroll Services

- Tamworth Taxation Advice

- Tamworth Financial Advice

- Tamworth Business Accounting

- Tamworth Bookkeeping Healthchecks

- Tamworth Debt Recovery

- Tamworth Forensic Accounting

- Tamworth Tax Investigations

- Tamworth Account Management

- Tamworth Tax Planning

- Tamworth Tax Refunds

Also find accountants in: Bonehill, Woodseaves, Burntwood Green, Himley, Bromstead Heath, Stone, Great Haywood, Longsdon, Ilam, Fairoak, Norton In The Moors, Hoar Cross, Croxtonbank, Penkridge, Almington, Winshill, Wetley Rocks, Waterhouses, Perton, Newtown, Weston Under Lizard, Leek, Eccleshall, Oakamoor, Wrinehill, Rangemore, Burnhill Green, Marchington Woodlands, Dosthill, Alton, Horton, Forsbrook, Alrewas, Tixall, Gnosall Heath and more.

Accountant Tamworth

Accountant Tamworth Accountants Near Tamworth

Accountants Near Tamworth Accountants Tamworth

Accountants TamworthMore Staffordshire Accountants: Stoke-on-Trent, Uttoxeter, Hanley, Biddulph, Newcastle-under-Lyme, Leek, Cannock, Kidsgrove, Wombourne, Heath Hayes, Stafford, Tamworth, Burslem, Burntwood, Burton-upon-Trent, Stone, Rugeley, Lichfield, Fenton, Hednesford and Longton.

TOP - Accountants Tamworth - Financial Advisers

Small Business Accountant Tamworth - Financial Accountants Tamworth - Chartered Accountant Tamworth - Tax Advice Tamworth - Online Accounting Tamworth - Investment Accounting Tamworth - Tax Return Preparation Tamworth - Auditors Tamworth - Cheap Accountant Tamworth