Accountants Wareham: If you're running a business, are a sole trader or are otherwise self-employed in Wareham, you will find certain advantages to having access your own accountant. By handling crucial tasks such as payroll, tax returns and bookkeeping your accountant can at the very least free up a bit of time for you to concentrate on your core business. Being able to access professional financial advice is even more vital for newer businesses. You may find that you need this help even more as your Wareham business grows.

So, exactly how should you set about obtaining an accountant in Wareham? The use of your favourite internet search engine should swiftly provide you with a shortlist of possibles. Though, making sure that you single out an accountant that you can trust may not be quite as straightforward. The fact that somebody in Wareham advertises themselves as an accountant is no guarantee of quality. There's no legal requirements that say they must have particular qualifications or certifications. Which is astonishing to say the least.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. You can then be sure your tax returns are done correctly. It should go without saying that accountants fees are tax deductable. Many qualified bookkeepers offer tax returns services for smaller businesses and sole traders.

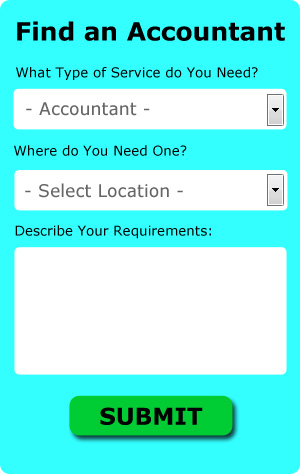

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Wareham accountant. You simply answer a few relevant questions so that they can find the most suitable person for your needs. All you have to do then is wait for some responses.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. Nowadays more and more people are using this kind of service. It would be advisable to investigate that any online company you use is reputable. Carefully read reviews online in order to find the best available.

At the end of the day you could always do it yourself and it will cost you nothing but time. Software programs like Keytime, 123 e-Filing, Taxfiler, Gbooks, Ajaccts, Andica, Nomisma, Basetax, Ablegatio, GoSimple, CalCal, ACCTAX, Capium, Absolute Topup, Forbes, TaxCalc, Taxforward, Xero, BTCSoftware, Taxshield and Sage have been developed to help the self-employed do their own tax returns. Whatever happens you need to get your self-assessment form in on time.

Small Business Accountants Wareham

Running a small business in Wareham is stressful enough, without needing to worry about preparing your accounts and other similar bookkeeping duties. If your accounts are getting you down and tax returns and VAT issues are causing sleepless nights, it is advisable to use a decent small business accountant in Wareham.

Helping you improve your business, and giving sound financial advice relating to your particular circumstances, are just two of the means by which a small business accountant in Wareham can be of benefit to you. The fluctuating and often complicated sphere of business taxation will be cleared and explained to you so as to reduce your business costs, while at the same time improving tax efficiency.

To be able to do their job correctly, a small business accountant in Wareham will need to know accurate details with regards to your current financial situation, business structure and any future investment you may be looking at, or already have set up. (Tags: Small Business Accountant Wareham, Small Business Accounting Wareham, Small Business Accountants Wareham).

Forensic Accounting Wareham

When you are searching for an accountant in Wareham you'll doubtless notice the term "forensic accounting" and be curious about what the differences are between a standard accountant and a forensic accountant. The word 'forensic' is the thing that gives it away, meaning literally "suitable for use in a court of law." Occasionally also called 'financial forensics' or 'forensic accountancy', it uses investigative skills, auditing and accounting to sift through financial accounts in order to identify criminal activity and fraud. Some of the bigger accounting firms in the Wareham area may have independent forensic accounting divisions with forensic accountants concentrating on particular types of fraud, and might be addressing personal injury claims, professional negligence, tax fraud, insolvency, money laundering, false insurance claims and bankruptcy.

Tips to Help You Manage Your Money Better

Deciding to start your own business is easy, but knowing how to start your own business is hard and actually getting your small business up and running is even harder. During the course of your business, so many things can happen that can erode your business and self-confidence, and this is where many business owners have the hardest time. For example, failure on your part to properly manage your finances will contribute to this. In the beginning, you might think that money management isn't something you should focus on because you can easily figure out your earning and expenses. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

It could be that you use your credit card to pay many of your regular expenditures like web hosting, recurring membership fees, advertising accounts, and so on. With this method, you don't need to make multiple payment and risk forgetting to pay any one of them on time. But then again, there's a risk to using credit cards because you'll end up paying interest if you don't pay the balance off in full every month. This isn't to say you shouldn't use your credit card, but if you do, it's best if you pay it all off every month. When you do this, you streamline your process and not have to pay interest. Your credit rating will get a boost in the process.

Make it a habit to balance your books every week. If you run a traditional store with registers or that brings in multiple payments a day, it is better to balance your books at the end of every day, and this is particularly true if you handle cash. You need to keep track of all the payments you receive and payments you make out and make sure that the cash you have on hand or in your bank account matches with the numbers in your record. This way you won't have to track down a bunch of discrepancies at the end of the month (or quarter). Balancing regularly will only take a few minutes, while balancing only every so often could take hours.

Take control of your spending. It may be that you've got a lot of things you wished you could buy before and now that you have a steady stream of income coming in, you're tempted to finally buy them. It's best if you spend money on things that will benefit your business. You'll be better off building your business savings than splurging whenever you get the chance. This way, you're in a better position to deal with unexpected expenses in a timely manner. In addition, buying your office supplies in bulk will save you money. For your office equipment, it's much better if you spend a little more on quality rather than on equipment that you will have to replace often. Be smart about entertainment expenses, etc.

Proper management of your business finances involves a lot of different things. It's more than listing what you spend and when. There are different things to keep track of and different ways to track them. Tracking your money will become a lot easier for you if you apply the tips we've shared in this article. Your business and your self-confidence stand to benefit when you keep on learning how to manage your business finances better.

Wareham accountants will help with assurance services Wareham, personal tax, bookkeeping, sole traders Wareham, tax preparation, compliance and audit issues, taxation accounting services Wareham, litigation support, business disposal and acquisition in Wareham, financial statements in Wareham, payslips, accounting support services Wareham, accounting services for buy to let rentals, corporate finance in Wareham, VAT returns, workplace pensions, consulting services Wareham, auditing and accounting, accounting services for the construction industry Wareham, debt recovery, financial and accounting advice, consultancy and systems advice, contractor accounts, investment reviews Wareham, HMRC liaison, HMRC submissions, business advisory, VAT payer registration in Wareham, mergers and acquisitions Wareham, business planning and support Wareham, limited company accounting Wareham, partnership registrations Wareham and other accounting services in Wareham, Dorset. Listed are just a handful of the activities that are undertaken by nearby accountants. Wareham specialists will be delighted to keep you abreast of their full range of services.

You do, of course have the perfect resource close at hand in the form of the web. There's such a lot of information and inspiration readily available online for stuff like personal tax assistance, accounting for small businesses, auditing & accounting and self-assessment help, that you'll soon be overwhelmed with ideas for your accounting needs. An example could be this enlightening article outlining how to uncover a quality accountant.

Wareham Accounting Services

- Wareham Business Accounting

- Wareham Audits

- Wareham VAT Returns

- Wareham Bookkeepers

- Wareham Tax Returns

- Wareham Specialist Tax

- Wareham Bookkeeping Healthchecks

- Wareham Account Management

- Wareham Payroll Services

- Wareham Business Planning

- Wareham Chartered Accountants

- Wareham Tax Planning

- Wareham Financial Advice

- Wareham Forensic Accounting

Also find accountants in: East Stour, Pulham, Burton Bradstock, Easton, Benville Lane, Worth Matravers, Pokesdown, Colehill, Winkton, Whitchurch Canonicorum, Moor Crichel, Leigh, Upwey, West Orchard, Fontmell Magna, Goathill, Sandford Orcas, Netherbury, Seaborough, Branksome Park, Lillington, Durweston, Chalbury Common, Folke, Stoke Wake, Bedchester, Guys Marsh, Owermoigne, Cheselbourne, Sixpenny Handley, Radipole, Gillingham, Litton Cheney, Motcombe, Longfleet and more.

Accountant Wareham

Accountant Wareham Accountants Near Me

Accountants Near Me Accountants Wareham

Accountants WarehamMore Dorset Accountants: Verwood, Wareham, Bridport, Weymouth, Ferndown, Shaftesbury, Wimborne Minster, Bournemouth, Swanage, Christchurch, Sherborne, Corfe Mullen, Blandford Forum, Poole and Dorchester.

TOP - Accountants Wareham - Financial Advisers

Small Business Accountant Wareham - Bookkeeping Wareham - Financial Accountants Wareham - Investment Accounting Wareham - Affordable Accountant Wareham - Auditors Wareham - Self-Assessments Wareham - Chartered Accountant Wareham - Financial Advice Wareham