Accountants Westhoughton: If you are a sole trader, are running a small business or are otherwise self-employed in Westhoughton, you'll find great advantages to having access your own accountant. One of the principal advantages will be that with your accountant taking care of the routine paperwork and bookkeeping, you should have a lot more free time to commit to what you do best, the actual operation of your core business. While if you have just started up in business and feel your cash could be better spent elsewhere, think again, the help of an accountant could be critical to your success.

You will quickly discover that there are various categories of accountant. Check that any potential Westhoughton accountant is suitable for what you need. You may have the choice of an accountant who works within a bigger accountancy practice or one who works alone. Accounting firms will normally have different departments each handling a particular field of accounting. You will possibly find tax preparation accountants, auditors, actuaries, forensic accountants, bookkeepers, chartered accountants, management accountants, accounting technicians, investment accountants, financial accountants and cost accountants in a large accountancy practice.

If you want your tax returns to be correct and error free it might be better to opt for a professional Westhoughton accountant who is appropriately qualified. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. Qualified Westhoughton accountants might charge a bit more but they may also get you the maximum tax savings. Your accountant will add his/her fees as tax deductable. Small businesses and sole traders can use a bookkeeper rather than an accountant.

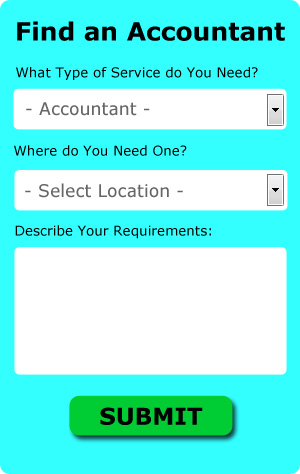

There is now a service available known as Bark, where you can look for local professionals including accountants. You simply answer a few relevant questions so that they can find the most suitable person for your needs. In the next day or so you should be contacted by potential accountants in your local area. Bark offer this service free of charge.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. It could be that this solution will be more appropriate for you. Picking a reputable company is important if you choose to go with this option. It should be a simple task to find some online reviews to help you make your choice. It is beyond the scope of this article to recommend any specific service.

The most qualified of all are chartered accountants, they have the most training and the most expertise. Their usual clients are big businesses and large limited companies. If you can afford one why not hire the best?

If you choose to do your own tax returns there is plenty of help available on the HMRC website. Available software that will also help includes Absolute Topup, Gbooks, ACCTAX, Xero, Forbes, Taxfiler, Ajaccts, Taxforward, Sage, GoSimple, Basetax, Andica, 123 e-Filing, Keytime, CalCal, BTCSoftware, Ablegatio, Capium, Nomisma, TaxCalc and Taxshield. Make sure your tax returns are sent off promptly to avoid getting a penalty fine.

Forensic Accounting Westhoughton

You might well come across the phrase "forensic accounting" when you're hunting for an accountant in Westhoughton, and will no doubt be interested to know about the distinction between normal accounting and forensic accounting. With the word 'forensic' literally meaning "relating to or denoting the application of scientific techniques and methods for the investigation of crime", you should get a clue as to what is involved. Using accounting, auditing and investigative skills to identify discrepancies in financial accounts which have been involved in theft or fraud, it is also often known as 'financial forensics' or 'forensic accountancy'. There are several larger accountants firms throughout Greater Manchester who have specialised departments for forensic accounting, dealing with tax fraud, professional negligence, insurance claims, bankruptcy, personal injury claims, money laundering and insolvency.

Small Business Accountants Westhoughton

Making certain your accounts are accurate and up-to-date can be a challenging job for any small business owner in Westhoughton. A focused small business accountant in Westhoughton will provide you with a stress free means to keep your VAT, annual accounts and tax returns in perfect order.

A good small business accountant will see it as their duty to help your business to expand, supporting you with good guidance, and providing you with peace of mind and security about your financial situation at all times. The fluctuating and sometimes complex field of business taxation will be cleared and explained to you in order to minimise your business costs, while at the same time improving tax efficiency.

In order to do their job correctly, a small business accountant in Westhoughton will want to know complete details regarding your current financial standing, company structure and any potential investments that you might be looking at, or have put in place. (Tags: Small Business Accountant Westhoughton, Small Business Accounting Westhoughton, Small Business Accountants Westhoughton).

Financial Actuaries Westhoughton

Actuaries work with businesses, organisations and government departments, to help them predict long-term fiscal expenditure and investment risks. Such risks can impact on both sides of a company balance sheet and require asset management, liability management and valuation skills. An actuary uses math and statistical concepts to appraise the financial impact of uncertainties and help their customers minimise risks.

Tips to Help You Manage Your Business Finances Better

Many business owners have discovered early on that it can be difficult to learn how to properly use money management techniques. Money management seems like one of those things that you should have the ability to do already. Personal money management, however, is completely different from business money management, although being experienced in the former can be handy when you go into business. Your confidence can take a hard hit if you ruin your finances on accident. In this article, we'll share a few tips you can apply to help you be a better money manager for your business.

Putting your regular expenditures like recurring dues for membership sites, web hosting, and so on, on your credit card can be a good idea. Instead of having to pay many separate bills, you only have to pay your credit card bill each month. But then again, there's a risk to using credit cards because you'll end up paying interest if you don't pay the balance off in full every month. To avoid this, make sure you pay your credit card balance in full every month. When you do this, you streamline your process and not have to pay interest. Your credit rating will get a boost in the process.

Track your personal and business expenditures down to the last cent. There are many benefits to doing this even though it is a pain to track each and every thing you spend money on, no matter how small it is. When you meticulously record every expenditure you make, whether personal or business related, you can keep an eye on your spending habits. You wouldn't want to be like those people who wonder where their money went. This is helpful when you're on a tight budget because you'll be able to see exactly which expenditures you can cut back on so you can save money. And of course, when you're filling out tax forms, you'll find it so much easier when you have a record of where, what, and how much you spent on business related things.

Make sure you deposit any money you receive at the end of the day if your business deals with cash on a fairly regular basis. This will help you eliminate the temptation of using money for non-business related things. If you know you have cash available, you're a lot more likely to dip into your money pool for unexpected expenses and just promise yourself you'll return the money back in a couple of days. It's actually very easy to forget to put the money back in and if you keep doing this, you'll soon screw up your books. So avoid this problem altogether by depositing your cash in the bank at the end of each business day.

A lot of things go into proper money management. You might assume that proper money management is a skill that isn't hard to acquire, but the reality is that it's a complicated process, especially when you're a small business owner. Hopefully, the tips we've shared in this article will help you get started in managing your finances better. If you want your business to be profitable, you need to stay on top of your finances.

Westhoughton accountants will help with estate planning Westhoughton, sole traders, accounting services for landlords Westhoughton, accounting support services, accounting services for the construction industry Westhoughton, small business accounting, workplace pensions, bookkeeping, partnership registration, corporation tax, PAYE, debt recovery, investment reviews, HMRC submissions, accounting services for media companies in Westhoughton, tax preparation in Westhoughton, consultancy and systems advice Westhoughton, payroll accounting, payslips Westhoughton, management accounts in Westhoughton, company secretarial services Westhoughton, accounting services for start-ups, HMRC liaison, partnership accounts, accounting and financial advice in Westhoughton, financial planning, business advisory services in Westhoughton, assurance services, inheritance tax in Westhoughton, audit and compliance reporting Westhoughton, financial statements Westhoughton, limited company accounting and other professional accounting services in Westhoughton, Greater Manchester. Listed are just a selection of the duties that are carried out by local accountants. Westhoughton companies will be happy to inform you of their entire range of accountancy services.

Westhoughton Accounting Services

- Westhoughton Debt Recovery

- Westhoughton PAYE Healthchecks

- Westhoughton Bookkeeping Healthchecks

- Westhoughton Tax Planning

- Westhoughton Chartered Accountants

- Westhoughton Specialist Tax

- Westhoughton Business Planning

- Westhoughton Tax Services

- Westhoughton Account Management

- Westhoughton Forensic Accounting

- Westhoughton Payroll Services

- Westhoughton Financial Advice

- Westhoughton Tax Advice

- Westhoughton Personal Taxation

Also find accountants in: Smallbridge, Astley Bridge, Withington, Eagley, Ince In Makerfield, Bradshaw, Farnworth, Marple, Wigan, Walkden, Micklehurst, Droylsden, Reddish, Burnage, Gatley, Denton, Stockport, Worsley, Astley Green, Calderbrook, Salford, Ramsbottom, Dunham Town, Bryn Gates, Bramhall, Carrington, Egerton, Fishpool, Prestwich, Broadbottom, Tyldesley, Romiley, Slattocks, Failsworth, Golborne and more.

Accountant Westhoughton

Accountant Westhoughton Accountants Near Me

Accountants Near Me Accountants Westhoughton

Accountants WesthoughtonMore Greater Manchester Accountants: Salford, Radcliffe, Atherton, Eccles, Hindley, Golborne, Romiley, Rochdale, Whitefield, Gatley, Manchester, Heywood, Horwich, Denton, Westhoughton, Stalybridge, Droylsden, Altrincham, Middleton, Stockport, Leigh, Royton, Swinton, Hyde, Sale, Oldham, Stretford, Dukinfield, Bolton, Irlam, Bury, Chadderton, Farnworth, Ashton-in-Makerfield, Wigan, Urmston, Walkden, Ashton-under-Lyne and Cheadle Hulme.

TOP - Accountants Westhoughton - Financial Advisers

Cheap Accountant Westhoughton - Bookkeeping Westhoughton - Chartered Accountants Westhoughton - Self-Assessments Westhoughton - Tax Return Preparation Westhoughton - Small Business Accountants Westhoughton - Financial Advice Westhoughton - Tax Accountants Westhoughton - Financial Accountants Westhoughton