Accountants Windsor: Is the only "reward" for completing your yearly self-assessment form a massive headache? This is a common problem for lots of others in Windsor, Berkshire. Is the answer perhaps to find yourself a local Windsor professional to do this job on your behalf? If you find self-assessment too taxing, this could be better for you. A regular accountant in Windsor is liable to charge you about £200-£300 for the privilege. By utilizing an online service as opposed to a local Windsor accountant you can save quite a bit of money.

When looking for an accountant in Windsor, you'll discover there are various types. So, it is crucial that you pick an appropriate one for your business. You might choose to pick one who works independently or one within a practice or firm. The benefit of accountancy practices is that they've got many areas of expertise under one roof. You'll probably find the likes of chartered accountants, management accountants, financial accountants, tax accountants, investment accountants, auditors, actuaries, accounting technicians, costing accountants, forensic accountants and bookkeepers in a large accountants practice.

For completing your self-assessment forms in Windsor you should find a properly qualified accountant. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. You can then be sure your tax returns are done correctly. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. A bookkeeper may be qualified enough to do your tax returns unless you are a large Limited Company.

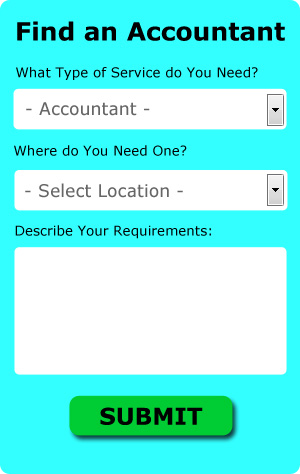

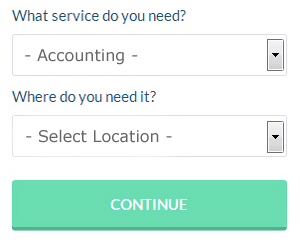

By using an online service such as Bark.com you could be put in touch with a number of local accountants. In no time at all you can fill out the job form and submit it with a single click. Within a few hours you should hear from some local accountants who are willing to help you. Try this free service because you've got nothing to lose.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. For many self-employed people this is a convenient and time-effective solution. Do some homework to single out a company with a good reputation. The better ones can soon be singled out by carefully studying reviews online.

There is always the option of using a chartered accountant, but expect to pay top wack for these high flyers. Their expertise is better suited to high finance and bigger businesses. Hiring the services of a chartered accountant means you will have the best that money can buy.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example Absolute Topup, Taxfiler, Gbooks, Nomisma, Sage, 123 e-Filing, Basetax, TaxCalc, GoSimple, Xero, Keytime, Andica, CalCal, Taxforward, Forbes, BTCSoftware, Capium, Ajaccts, Taxshield, ACCTAX and Ablegatio. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare. You�ll get a penalty of £100 if your tax return is up to 3 months late.

Payroll Services Windsor

For any business in Windsor, from large scale organisations down to independent contractors, staff payrolls can be challenging. Controlling payrolls demands that all legal requirements in relation to their transparency, accuracy and timings are followed to the minutest detail.

A small business might not have the advantage of its own financial expert and a simple way to cope with employee payrolls is to hire an independent payroll company in Windsor. Your chosen payroll accounting company will provide accurate BACS payments to your personnel, as well as working together with any pension schemes your company might have, and use current HMRC regulations for NI contributions and deductions.

Working to the current regulations, a professional payroll management accountant in Windsor will also provide every one of your workers with a P60 after the end of each financial year. At the end of an employee's contract, the payroll service must also supply a current P45 outlining what tax has been paid during the last financial period.

Practicing Better Money Management to Help Your Business Succeed

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. For many new business owners, it's hardest to make their business profitable mainly because of the things that can happen during the process that can adversely impact the business and their self-confidence. For example, failure on your part to properly manage your finances will contribute to this. You might not think that there is much to money management because in the beginning it might be pretty simple. Over time, though, as you earn more money, it can become quite complicated, so use these tips to help you out.

Have an account that's just for your business expenses and another for your personal expenses. You're only going to make it hard on yourself if you insist on running everything through one account. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. Streamline your process with two accounts.

Learn how to keep your books. You need to have a system set up for your money -- both personally and professionally. You can either use basic spreadsheet or software such as QuickBooks. There are also other online tools you can use, like Mint.com. The internet is full of free resources on how you can manage your small business bookkeeping. It's crucial that you keep your books in order because they provide you a clear picture of what your finances (both personal and business) look like. It might even be in your best interest, particularly if you don't have the money to hire a professional to help you, to take a class is basic bookkeeping and accounting.

Take control of your spending. It's certainly very tempting to start buying things you've always wanted when the money is coming in. You should, however, spend money on things that will benefit your business. Put your money in your business savings account so that if unexpected business expenses come up, you'll have the means to deal with it in a prompt manner. Buy your office supplies in bulk. For your office equipment, it's much better if you spend a little more on quality rather than on equipment that you will have to replace often. You'll also need to be careful about how much money you spend on entertainment.

Proper money management is a skill that every adult needs to develop. As a business owner, you're a lot more likely to succeed if you know how much money your business is generating, how much money you're spending, and basically what's happening with your money. Try implementing the above tips in your business. When you take the time to learn how to properly manage money, you'll get the benefit of having a successful business and a higher confidence level.

Windsor accountants will help with self-employed registrations Windsor, tax returns in Windsor, business outsourcing in Windsor, cashflow projections, limited company accounting Windsor, partnership accounts, partnership registrations, pension forecasts, sole traders Windsor, assurance services, financial planning, contractor accounts in Windsor, business advisory, business planning and support in Windsor, HMRC liaison, company secretarial services, employment law, debt recovery, capital gains tax, year end accounts Windsor, accounting services for media companies Windsor, accounting and financial advice, investment reviews in Windsor, small business accounting, compliance and audit reporting Windsor, inheritance tax, VAT registration, accounting services for start-ups Windsor, PAYE, double entry accounting Windsor, company formations in Windsor, payslips and other professional accounting services in Windsor, Berkshire. Listed are just an example of the activities that are undertaken by local accountants. Windsor companies will tell you about their full range of services.

You do, in fact have the very best resource close at hand in the form of the internet. There is such a lot of information and inspiration readily available online for such things as small business accounting, accounting & auditing, personal tax assistance and self-assessment help, that you'll pretty soon be brimming with ideas for your accounting requirements. An example could be this intriguing article about five tips for obtaining a decent accountant.

Windsor Accounting Services

- Windsor Tax Returns

- Windsor Forensic Accounting

- Windsor Self-Assessment

- Windsor Account Management

- Windsor Personal Taxation

- Windsor Chartered Accountants

- Windsor Specialist Tax

- Windsor Tax Investigations

- Windsor Payroll Management

- Windsor Tax Services

- Windsor Audits

- Windsor Bookkeeping Healthchecks

- Windsor Financial Advice

- Windsor PAYE Healthchecks

Also find accountants in: Greenham, Hungerford, Windsor, Peasemore, Pangbourne, Combe, Crazies Hill, Stanmore, Wash Common, Oakley Green, Stratfield Mortimer, Tilehurst, Boxford, Paley Street, Yattendon, East Garston, Sindlesham, Winnersh, Longlane, Enborne, Compton, Hythe End, Wokefield Park, Newell Green, Westbrook, Newbury, Lambourn Woodlands, Theale, Upper Green, Wraysbury, Hare Hatch, Upper Lambourn, Whitley, North Ascot, Langley and more.

Accountant Windsor

Accountant Windsor Accountants Near Me

Accountants Near Me Accountants Windsor

Accountants WindsorMore Berkshire Accountants: Winkfield, Twyford, Woodley, Sandhurst, Wokingham, Windsor, Finchampstead, Bracknell, Crowthorne, Maidenhead, Reading, Newbury, Slough, Ascot, Thatcham, Tilehurst and Sunninghill.

TOP - Accountants Windsor - Financial Advisers

Financial Advice Windsor - Tax Return Preparation Windsor - Online Accounting Windsor - Chartered Accountant Windsor - Financial Accountants Windsor - Small Business Accountant Windsor - Investment Accountant Windsor - Tax Advice Windsor - Auditors Windsor