Accountants Wombourne: Does filling out your yearly self-assessment form put your head in a spin? This is an issue for you and countless others in Wombourne. Tracking down a local Wombourne professional to do it for you could be the solution. This might be the best alternative if you consider self-assessment just too taxing. Typically Wombourne High Street accountants will do this for around £220-£300. You can definitely get it done cheaper by using online services.

You'll quickly discover that there are various different categories of accountant. Finding one that matches your specific needs should be a priority. You'll come to realise that there are accountants who work solo and accountants who work for accountancy firms. The different accounting disciplines can be better covered by an accountancy company with several experts on hand. The types of accountant that you are likely to find within a company could include: chartered accountants, tax preparation accountants, management accountants, accounting technicians, auditors, forensic accountants, investment accountants, financial accountants, actuaries, bookkeepers and costing accountants.

It is advisable for you to find an accountant in Wombourne who is properly qualified. At the very least you should look for somebody with an AAT qualification. A qualified accountant may cost a little more but in return give you peace of mind. Your accountant will add his/her fees as tax deductable. A bookkeeper may be qualified enough to do your tax returns unless you are a large Limited Company.

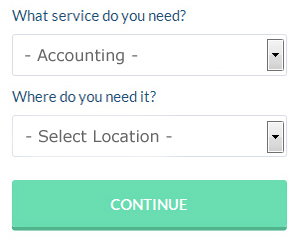

If you don't have the time to do a proper online search for local accountants, try using the Bark website. A couple of minutes is all that is needed to complete their simple and straighforward search form. In the next day or so you should be contacted by potential accountants in your local area.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. This may save time and be more cost-effective for self-employed people in Wombourne. Even if you do decide to go down this route, take some time in singling out a trustworthy company. The better ones can soon be singled out by carefully studying reviews online.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. The process can be simplified even further by the use of software such as Andica, Basetax, GoSimple, 123 e-Filing, Gbooks, Taxshield, Forbes, Ablegatio, ACCTAX, Taxfiler, Capium, Taxforward, Ajaccts, Keytime, Sage, Absolute Topup, BTCSoftware, Xero, CalCal, TaxCalc or Nomisma. Make sure your tax returns are sent off promptly to avoid getting a penalty fine. You can expect a fine of £100 if your assessment is in even 1 day late.

Auditors Wombourne

An auditor is an individual authorised to evaluate and validate the reliability of financial accounts to ensure that organisations or businesses adhere to tax legislation. They sometimes also act as consultants to suggest possible the prevention of risk and the application of cost efficiency. For anybody to start working as an auditor they should have certain specific qualifications and be certified by the regulating body for accounting and auditing. (Tags: Auditors Wombourne, Auditing Wombourne, Auditor Wombourne)

How Proper Money Management Helps Your Business and Yourself

For many people, starting their own business has many advantages. One of the advantages is that they get to be in charge of their income. They're able to control just how much money they make and how much money they spend. At the same time, however, many people get overwhelmed when it comes to managing the funds for their business. Lucky for you, there are several things that can help you with this. If you'd like to be able to manage your business funds, keep reading.

Retain an accountant. Don't neglect the importance of having an accountant managing your books full time. She will help you keep track of the money you have coming in and the money you are sending out, help you pay yourself, and help you meet your tax obligations. The best part is that you won't have to deal with the paperwork because your accountant will take care of that for you. You can then focus your attention towards the more profitable aspects of your business, such as increasing your customer base, creating new products, and such. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

You can help yourself by finding out how to keep your books. Having a system in place for your business and personal finance is crucial. You can set up your system using a basic spreadsheet or get yourself a bookkeeping software like QuickBooks or Quicken. There are also personal budgeting tools out there that you can use such as Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. Your books are the key to you knowing precisely how and where your money (personal and business) is being spent. And if you simply can't afford to hire a bookkeeper at this time, you'll benefit from taking a basic bookkeeping and accounting class.

Don't be late in paying your taxes. Typically, small businesses must pay taxes every quarter. Taxes can be quite confusing so you might want to make an appointment with your local small business center or even at the IRS so you can get accurate information. There are also professionals you can work with who can set you up with payments and plans to make sure you're paying your taxes on time. Having the IRS at your doorstep isn't something you'd want, believe me!

There are so many little things that go into properly managing your money. It's a lot more than simply keeping a list of your expenditures. When you're in business, you have several things you need to keep track of. With the tips above, you'll have an easier time tracking your money. Continue learning proper money management and you can expect improvement in yourself and in your business.

Payroll Services Wombourne

Dealing with staff payrolls can be a challenging aspect of running a business in Wombourne, irrespective of its size. The laws relating to payroll requirements for openness and accuracy mean that running a business's staff payroll can be a formidable task for those untrained in this discipline.

Using a reliable accountant in Wombourne, to deal with your payroll needs is the easiest way to lessen the workload of yourself or your financial department. The accountant dealing with payrolls will work along with HMRC and pension schemes, and take care of BACS payments to guarantee accurate and timely payment to all employees.

A dedicated payroll management accountant in Wombourne will also, in accordance with current legislations, organise P60's at the conclusion of the financial year for each of your staff members. A P45 must also be presented to any staff member who finishes working for your company, in accordance with current legislations.

Wombourne accountants will help with inheritance tax, company secretarial services, accounting services for the construction sector, accounting and financial advice, cashflow projections Wombourne, self-employed registrations, double entry accounting, consultancy and systems advice, PAYE Wombourne, accounting support services, tax preparation, corporate tax, employment law in Wombourne, accounting services for buy to let rentals Wombourne, VAT registrations, VAT returns, annual tax returns Wombourne, debt recovery, small business accounting, partnership accounts, contractor accounts, corporate finance, company formations, financial planning in Wombourne, National Insurance numbers in Wombourne, estate planning, mergers and acquisitions Wombourne, litigation support, accounting services for media companies in Wombourne, workplace pensions, compliance and audit reporting, bookkeeping in Wombourne and other professional accounting services in Wombourne, Staffordshire. These are just a few of the duties that are accomplished by local accountants. Wombourne companies will tell you about their full range of accounting services.

You actually have the perfect resource right at your fingertips in the form of the internet. There is so much inspiration and information available online for such things as accounting for small businesses, auditing & accounting, self-assessment help and personal tax assistance, that you'll pretty soon be bursting with suggestions for your accounting requirements. One example may be this illuminating article on choosing an accountant.

Wombourne Accounting Services

- Wombourne Audits

- Wombourne VAT Returns

- Wombourne Tax Returns

- Wombourne Self-Assessment

- Wombourne Tax Planning

- Wombourne Tax Services

- Wombourne Chartered Accountants

- Wombourne Bookkeeping Healthchecks

- Wombourne Debt Recovery

- Wombourne Personal Taxation

- Wombourne Business Accounting

- Wombourne PAYE Healthchecks

- Wombourne Forensic Accounting

- Wombourne Payroll Management

Also find accountants in: Coven, Baldwins Gate, Near Cotton, Whitmore, Stanton, Derrington, Little Haywood, Chorley, Silverdale, Hoar Cross, Cannock Wood, Chesterfield, Perton, Alton, Aston, Stoke On Trent, Blore, Kingsley, Hanley, Streethay, Mavesyn Ridware, Balterley, Brown Lees, Hopton, Checkley, Tunstall, Church Leigh, Hanchurch, Bridgtown, Ecton, Weeford, Fazeley, Long Compton, Warslow, Madeley and more.

Accountant Wombourne

Accountant Wombourne Accountants Near Me

Accountants Near Me Accountants Wombourne

Accountants WombourneMore Staffordshire Accountants: Tamworth, Leek, Uttoxeter, Stafford, Burntwood, Biddulph, Newcastle-under-Lyme, Hanley, Rugeley, Hednesford, Kidsgrove, Fenton, Stone, Burton-upon-Trent, Heath Hayes, Cannock, Burslem, Wombourne, Lichfield, Stoke-on-Trent and Longton.

TOP - Accountants Wombourne - Financial Advisers

Bookkeeping Wombourne - Chartered Accountant Wombourne - Financial Advice Wombourne - Online Accounting Wombourne - Financial Accountants Wombourne - Tax Advice Wombourne - Investment Accountant Wombourne - Small Business Accountants Wombourne - Cheap Accountant Wombourne