Accountants Workington: For Workington individuals who are self-employed or running a business, there are many benefits to be had from retaining the services of a qualified accountant. Bookkeeping takes up precious time that you can ill afford to waste, therefore having an accountant deal with this allows you to put more effort into the primary business. For those who have just started up it will be vitally important to have someone at hand who can provide financial advice. In order for your Workington business to prosper and expand, you're definitely going to require some help.

So, what type of accounting service should you look for and how much should you pay? The internet is undoubtedly the most popular place to look these days, so that would be a good place to start. However, which of these Workington accountants is best for you and which ones can be trusted? You must realise that there are no legal restrictions regarding who in Workington can advertise accounting services. They don't need to have any specific qualifications.

Find yourself a properly qualified one and don't take any chances. An AAT qualified accountant should be adequate for sole traders and small businesses. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. Remember that a percentage of your accounting costs can be claimed back on the tax return. A qualified bookkeeper will probably be just as suitable for sole traders and smaller businesses in Workington.

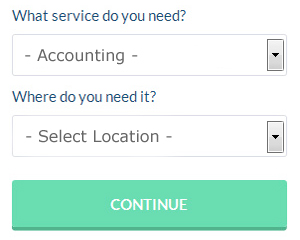

By using an online service such as Bark.com you could be put in touch with a number of local accountants. You simply answer a few relevant questions so that they can find the most suitable person for your needs. As soon as this form is submitted, your requirements will be forwarded to local accountants. There are absolutely no charges for using this service.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. More accountants are offering this modern alternative. Don't simply go with the first company you find on Google, take time to do some research. Carefully read reviews online in order to find the best available. We are unable to advocate any individual accounting services on this site.

If you really want the best you could go with a chartered accountant. Their usual clients are big businesses and large limited companies. You will certainly be hiring the best if you do choose one of these.

The cheapest option of all is to do your own self-assessment form. Software programs like Taxforward, BTCSoftware, CalCal, Capium, Ablegatio, Nomisma, 123 e-Filing, Taxfiler, Andica, TaxCalc, Sage, Ajaccts, GoSimple, Forbes, Absolute Topup, Basetax, Keytime, Gbooks, ACCTAX, Taxshield and Xero have been developed to help the self-employed do their own tax returns. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Learning the Top Money Management Strategies for Business Success

Many people find that putting up a business is very exciting. When you're a business owner, you're your own boss and in control of your income. How scary is that? Although it's exhilarating, putting up your own business is also an intimidating process, especially if you're a complete novice. This is where knowing some simple self improvement techniques, like learning how to properly manage your money, can be quite helpful. If you'd like to keep your finances in order, continue reading this article.

Retain an accountant. An accountant is well worth the business expense because she can manage your books for you full time. She will help you keep track of the money you have coming in and the money you are sending out, help you pay yourself, and help you meet your tax obligations. What's more, she'll deal with all of the paperwork that is associated with those things. You can then focus your attention towards the more profitable aspects of your business, such as increasing your customer base, creating new products, and such. An accountant can save you days of time and quite a lot of headaches.

You can help yourself by finding out how to keep your books. Having a system in place for your business and personal finance is crucial. For this, you can use a basic spreadsheet or go with software like Quicken. Budgeting tools like Mint.com are also an option. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. It's crucial that you keep your books in order because they provide you a clear picture of what your finances (both personal and business) look like. It won't hurt if you take a class or two on basic bookkeeping and accounting, as this could prove helpful to you especially if you don't think you can afford to hire a professional to manage your books.

f your business deals with cash all the time, you're better off depositing money to your bank account at the end of each business day. Doing so will help you avoid being tempted to use any cash you have on hand for unnecessary expenses. It's so easy to take a couple of dollars here and there when you're short on cash and just say you'll put back in however much you took. You're bound to forget about it, though, and this will only mess your accounting and bookkeeping. So avoid this problem altogether by depositing your cash in the bank at the end of each business day.

There are so many little things that go into properly managing your money. It's not only about keeping a record of when you spent what. When you're in business, you have several things you need to keep track of. With the tips above, you'll have an easier time tracking your money. Your business and your self-confidence stand to benefit when you keep on learning how to manage your business finances better.

Auditors Workington

An auditor is a company or person appointed to review and verify the accuracy of accounts and make sure that organisations comply with tax legislation. Auditors analyze the monetary procedures of the company which appoints them to ensure the steady operation of the business. Auditors need to be licensed by the regulatory authority for accounting and auditing and have the required qualifications.

Financial Actuaries Workington

Actuaries and analysts are experts in risk management. An actuary uses financial and statistical theories to measure the chances of a certain event taking place and its possible monetary costs. Actuaries supply evaluations of financial security systems, with an emphasis on their mathematics, their complexity and their mechanisms.

Payroll Services Workington

Dealing with staff payrolls can be a stressful part of running a business in Workington, regardless of its size. The legislation relating to payroll for accuracy and transparency mean that processing a business's payroll can be a formidable task for those not trained in this discipline.

Not all small businesses have their own in-house financial specialists, and the best way to deal with employee payrolls is to use an outside Workington accounting firm. Your payroll accounting company will manage accurate BACS payments to your personnel, as well as working with any pension providers your business may have, and follow the latest HMRC legislation for NI contributions and deductions.

Abiding by the current regulations, a professional payroll management accountant in Workington will also provide each of your workers with a P60 at the conclusion of each financial year. They'll also be responsible for providing P45 tax forms at the end of an employee's working contract. (Tags: Payroll Accountants Workington, Payroll Services Workington, Payroll Administrator Workington).

Workington accountants will help with year end accounts, consulting services, business advisory, employment law Workington, accounting and financial advice in Workington, cashflow projections, corporate finance, small business accounting Workington, HMRC submissions, business outsourcing, auditing and accounting, company secretarial services, HMRC submissions Workington, accounting services for start-ups, bureau payroll services Workington, charities, National Insurance numbers, limited company accounting, taxation accounting services Workington, financial statements, accounting services for media companies, capital gains tax, mergers and acquisitions in Workington, general accounting services in Workington, management accounts Workington, personal tax, payroll accounting in Workington, PAYE Workington, workplace pensions Workington, company formations, accounting support services in Workington, VAT registration and other types of accounting in Workington, Cumbria. Listed are just an example of the duties that are accomplished by local accountants. Workington companies will keep you informed about their whole range of services.

When you are searching for inspiration and ideas for accounting for small businesses, accounting & auditing, self-assessment help and personal tax assistance, you don't really need to look any further than the world wide web to find all the information that you need. With so many meticulously written webpages and blog posts to pick from, you will pretty quickly be brimming with new ideas for your upcoming project. We recently came across this article about 5 tips for obtaining a first-rate accountant.

Workington Accounting Services

- Workington Business Accounting

- Workington Specialist Tax

- Workington Tax Planning

- Workington Personal Taxation

- Workington Financial Advice

- Workington Forensic Accounting

- Workington Tax Refunds

- Workington Business Planning

- Workington Bookkeeping Healthchecks

- Workington VAT Returns

- Workington Tax Services

- Workington Tax Returns

- Workington Debt Recovery

- Workington Account Management

Also find accountants in: Crosby Ravensworth, Croglin, Haile, Carlisle, Bowland Bridge, Bouth, Kirkland, Marton, Halls Tenement, Parkend, Catterlen, Askham, Witherslack, Rowrah, Deepdale, Ponsonby, Arnside, Blitterlees, Helton, Heversham, Sand Side, Cark, Watermillock, Hutton Roof, Crosby, Cumwhitton, Drybeck, Mealsgate, Town End, Endmoor, Rottington, Newton Reigny, Beckfoot, Winster, Storth and more.

Accountant Workington

Accountant Workington Accountants Near Me

Accountants Near Me Accountants Workington

Accountants WorkingtonMore Cumbria Accountants: Penrith, Workington, Barrow-in-Furness, Carlisle, Maryport, Whitehaven, Kendal and Ulverston.

TOP - Accountants Workington - Financial Advisers

Tax Advice Workington - Auditors Workington - Chartered Accountant Workington - Bookkeeping Workington - Self-Assessments Workington - Small Business Accountants Workington - Financial Advice Workington - Financial Accountants Workington - Affordable Accountant Workington