Accountants Writtle: Anyone operating a business in Writtle, Essex will pretty quickly realise that there are numerous advantages to having an accountant at hand. By handling essential tasks like payroll, tax returns and bookkeeping your accountant can at the very least free up some time for you to concentrate on your core business. Start-ups will find that having access to this kind of expertise is really beneficial.

You'll find various different types of accountants in the Writtle area. Take the time to track down an accountant that meets your specific needs. Yet another decision you'll need to make is whether to go for an accountancy firm or a lone wolf accountant. Accounting firms generally have specialists in each main field of accounting. Most accounting companies will be able to provide: costing accountants, forensic accountants, management accountants, tax preparation accountants, bookkeepers, chartered accountants, actuaries, investment accountants, auditors, financial accountants and accounting technicians.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. Your minimum requirement should be an AAT qualified accountant. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat. Local Writtle bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

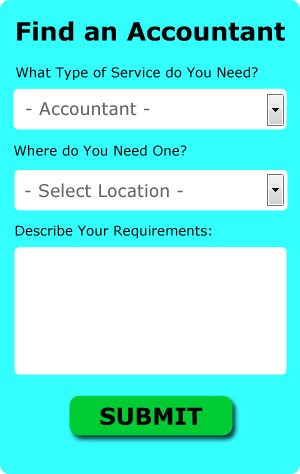

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Writtle accountant. You only need to answer a few basic questions and complete a straightforward form. In the next day or so you should be contacted by potential accountants in your local area.

If you prefer the cheaper option of using an online tax returns service there are several available. More accountants are offering this modern alternative. Make a short list of such companies and do your homework to find the most reputable. A good method for doing this is to check out any available customer reviews and testimonials. We cannot endorse or recommend any of the available services here.

Although filling in your own tax return may seem too complicated, it is not actually that hard. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Sage, Taxforward, Ajaccts, ACCTAX, GoSimple, Absolute Topup, Xero, Nomisma, CalCal, BTCSoftware, Ablegatio, Basetax, TaxCalc, Forbes, Taxshield, Keytime, Andica, Gbooks, Capium, 123 e-Filing and Taxfiler. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare.

Payroll Services Writtle

A vital aspect of any company in Writtle, big or small, is having a reliable payroll system for its employees. The legislation regarding payroll requirements for accuracy and openness mean that running a business's staff payroll can be an intimidating task for the uninitiated.

Using a professional company in Writtle, to deal with your payroll is the easiest way to lessen the workload of your financial team. A payroll accountant will work alongside HMRC, work with pensions schemes and deal with BACS payments to ensure your staff are always paid punctually, and that all required deductions are correct.

Working to current regulations, a qualified payroll accountant in Writtle will also provide each of your employees with a P60 tax form at the conclusion of each fiscal year. Upon the termination of an employee's contract, the payroll company will provide an updated P45 form outlining what tax has been paid in the previous financial period. (Tags: Company Payrolls Writtle, Payroll Services Writtle, Payroll Accountants Writtle).

Be Better at Managing Your Money

Want to put up your own business? Making the decision is quite easy. However, knowing exactly how to start it is a different matter altogether, and actually getting the business up and running can be a huge challenge. During the course of your business, so many things can happen that can erode your business and self-confidence, and this is where many business owners have the hardest time. For example, failure on your part to properly manage your finances will contribute to this. You might not think that there is much to money management because in the beginning it might be pretty simple. Over time, though, as you earn more money, it can become quite complicated, so use these tips to help you out.

You shouldn't wait for the due date to pay your taxes. It may be that you won't have the funds you need to pay your taxes if your money management skills are poor. To prevent yourself from coming up short, set money aside with every payment your receive. When you do this, you're going to have the money needed to pay your taxes for the quarter. It sounds lame, but it can be really satisfying to be able to pay your taxes in full and on time.

Learn bookkeeping. Having a system in place for your business and personal finance is crucial. For this, you can use a basic spreadsheet or go with software like Quicken. There are also other online tools you can use, like Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. You'll know exactly what's happening to your business and personal finances when you've got your books in order. And if you just can't afford to pay for a full-time bookkeeper for your small business, it'll serve you well to take a basic accounting and bookkeeping class at your community college.

Resist the urge to spend. It may be that you've got a lot of things you wished you could buy before and now that you have a steady stream of income coming in, you're tempted to finally buy them. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. You'll also be able to save money on office supplies if you buy in bulk. For computers, it's better if you spend money on a more expensive, but reliable system that will last for many years and won't need replaced every so often. Be smart about entertainment expenses, etc.

When it comes to improving yourself and your business, proper money management is one of the most essential things you can learn. You've read just three money management tips that you can use to help you manage your finances better. Keep your finances under control and you can look forward to a better, more successful personal life and business life.

Writtle accountants will help with HMRC submissions in Writtle, contractor accounts, corporation tax, accounting support services, compliance and audit reporting, investment reviews, bookkeeping, business acquisition and disposal, National Insurance numbers, double entry accounting Writtle, payslips, management accounts in Writtle, personal tax, tax investigations, cashflow projections, charities, capital gains tax in Writtle, corporate finance, pension forecasts Writtle, partnership registration in Writtle, limited company accounting, financial planning, consultancy and systems advice in Writtle, business outsourcing, business support and planning Writtle, accounting services for landlords, self-employed registration, consulting services, annual tax returns, tax preparation in Writtle, business start-ups, bureau payroll services in Writtle and other accounting related services in Writtle, Essex. Listed are just an example of the duties that are carried out by nearby accountants. Writtle specialists will let you know their whole range of accounting services.

Writtle Accounting Services

- Writtle Payroll Services

- Writtle Bookkeepers

- Writtle Audits

- Writtle PAYE Healthchecks

- Writtle Personal Taxation

- Writtle Chartered Accountants

- Writtle Debt Recovery

- Writtle Self-Assessment

- Writtle Tax Planning

- Writtle Tax Services

- Writtle Financial Audits

- Writtle VAT Returns

- Writtle Tax Returns

- Writtle Forensic Accounting

Also find accountants in: Jaywick, Sible Hedingham, Felsted, Laindon, Woodham Walter, Tiptree, Pebmarsh, West Hanningfield, Stagden Cross, Cold Norton, Great Horkesley, Bran End, West Bergholt, Little Bentley, Borley, Nounsley, Maylandsea, Liston, Tollesbury, Little Burstead, Beacon End, Thorpe Le Soken, Hadstock, Churchgate Street, Ballards Gore, Great Bentley, East Mersea, Runsell Green, Roxwell, Rayne, Chipping Ongar, Little Baddow, Great Saling, Tylers Green, Clavering and more.

Accountant Writtle

Accountant Writtle Accountants Near Me

Accountants Near Me Accountants Writtle

Accountants WrittleMore Essex Accountants: Manningtree, Galleywood, Ilford, Braintree, Grays, Walton-on-the-Naze, Hockley, Basildon, Halstead, Barking, Ingatestone, Southchurch, Shoeburyness, Frinton-on-Sea, Witham, Chafford Hundred, North Weald Bassett, Rainham, Chigwell, South Benfleet, Epping, Hadleigh, Leigh-on-Sea, Purfleet, Tilbury, Burnham-on-Crouch, Chipping Ongar, South Woodham Ferrers, Danbury, Romford, Stansted Mountfitchet, Brightlingsea, Tiptree, Billericay, Westcliff-on-Sea, Langdon Hills, Holland-on-Sea, Great Wakering, Hornchurch, Saffron Walden, Corringham, Chelmsford, Brentwood, Upminster, Heybridge, Stanford-le-Hope, Rayleigh, Maldon, Clacton-on-Sea, Laindon, Southend-on-Sea, West Thurrock, Pitsea, Parkeston, Stanway, South Ockendon, Hullbridge, Hawkwell, Wickford, Canvey Island, Wivenhoe, Colchester, Great Baddow, Buckhurst Hill, Loughton, Coggeshall, Dagenham, Harlow, Waltham Abbey, West Mersea, Chingford, Writtle, Southminster, Harwich, Rochford and Great Dunmow.

TOP - Accountants Writtle - Financial Advisers

Small Business Accountant Writtle - Cheap Accountant Writtle - Chartered Accountant Writtle - Auditing Writtle - Online Accounting Writtle - Financial Accountants Writtle - Self-Assessments Writtle - Bookkeeping Writtle - Financial Advice Writtle