Accountants York: Do you find that filling out your annual self-assessment form gives you nightmares? This is a frequent problem for many others in York, North Yorkshire. But how do you track down an accountant in York to do it for you? Is self-assessment just too complicated for you? Expect to pay about two to three hundred pounds for the average small business accountant. Those who consider this too expensive have the added option of using an online tax return service.

There are plenty of accountants around, so you shouldn't have that much difficulty finding a good one. These days the most popular place for tracking down local services is the internet, and accountants are certainly no exception, with plenty of them advertising their services online. However, it is not always that easy to spot the good guys from the bad. The fact that almost anyone in York can set themselves up as an accountant is something you need to keep in mind. They do not even have to hold any qualifications such as BTEC's or A Levels. This can lead to abuse.

You should take care to find a properly qualified accountant in York to complete your self-assessment forms correctly and professionally. The AAT qualification is the minimum you should look for. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. Your accountant's fees are tax deductable. A lot of smaller businesses in York choose to use bookkeepers rather than accountants.

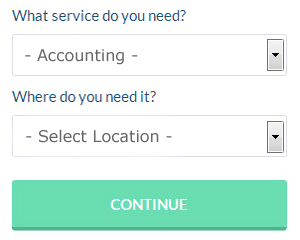

You could use an online service like Bark who will help you find an accountant. All that is required is the ticking of a few boxes so that they can understand your exact needs. All you have to do then is wait for some responses. You might as well try it because it's free.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. Services like this are convenient and cost effective. Do a bit of research to find a reputable company. The easiest way to do this is by studying online reviews. We prefer not to recommend any particular online accounting company here.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? You could even use a software program like Gbooks, Andica, Taxforward, Keytime, Xero, BTCSoftware, 123 e-Filing, Nomisma, GoSimple, Capium, CalCal, Ablegatio, Forbes, Ajaccts, Sage, Taxshield, TaxCalc, Absolute Topup, ACCTAX, Basetax or Taxfiler to make life even easier. You'll receive a fine if your self-assessment is late. The standard fine for being up to three months late is £100.

Learn How to Manage Your Business Budget Properly

If you're a new business owner, you'll discover that managing your money properly is one of those things you will struggle with sooner or later. Your self-confidence could be hard hit and should your business have some cash flow issues, you just might find yourself contemplating about going back to a regular job. This is going to keep you from succeeding in your business. Use the following tips to help you manage your money better.

You may think it's a good idea to wait to pay the taxes you owe until they're due. However, if you have poor money management skills, you may not have the money you need to pay your estimated tax and other related fees. To prevent yourself from coming up short, set money aside with every payment your receive. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. You want to be able to pay taxes promptly and in full and being able to do so every quarter is a great feeling.

Balance your books at least once a week. If you run a traditional store with registers or that brings in multiple payments a day, it is better to balance your books at the end of every day, and this is particularly true if you handle cash. You need to keep track of all the payments you receive and payments you make out and make sure that the cash you have on hand or in your bank account matches with the numbers in your record. This way at the end of each month or every quarter, you lessen your load of having to trace back where the discrepancies are in your accounting. Besides, it will only take you a few minutes if you balance your books regularly, whereas if you balance your books once a month, that would take you hours to do.

Don't throw away your receipt. For one, you'll need to have receipts because they're proof should the IRS want to know exactly what and where you have been spending your money on. These receipts serve as a record of expenses related to your business. Be organized with your receipts and have them together in just one place. If you do this, you can easily track transactions or expenses. You can easily keep track of and access your receipts by putting them in an accordion file and placing that file in your desk drawer.

Proper money management is a skill that every adult needs to develop. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. Try implementing the above tips in your business. Truly, when it comes to self improvement in business, properly managing your money is incredibly important.

Forensic Accounting York

While engaged on your search for a certified accountant in York there is a pretty good chance that you'll stumble on the phrase "forensic accounting" and be curious about what that is, and how it is different from regular accounting. The word 'forensic' is the thing that gives a clue, meaning "suitable for use in a court of law." Sometimes also known as 'financial forensics' or 'forensic accountancy', it uses auditing, accounting and investigative skills to inspect financial accounts in order to detect criminal activity and fraud. Some of the larger accounting companies in the York area may have independent forensic accounting departments with forensic accountants targeting particular sorts of fraud, and could be dealing with tax fraud, bankruptcy, personal injury claims, money laundering, professional negligence, insurance claims and insolvency. (Tags: Forensic Accountant York, Forensic Accountants York, Forensic Accounting York)

Small Business Accountants York

Making certain that your accounts are accurate and up-to-date can be a demanding job for any small business owner in York. A dedicated small business accountant in York will provide you with a hassle-free method to keep your VAT, tax returns and annual accounts in perfect order.

Helping you to develop your business, and giving sound financial advice for your specific situation, are just a couple of the ways that a small business accountant in York can be of benefit to you. An effective accounting firm in York will be able to offer you proactive small business advice to maximise your tax efficiency while lowering costs; crucial in the sometimes shadowy sphere of business taxation.

You also ought to be provided with a dedicated accountancy manager who has a deep understanding of your company's circumstances, the structure of your business and your future plans.

Financial Actuaries York

Actuaries work with companies and government departments, to help them forecast long-term investment risks and financial expenditure. An actuary applies statistical and financial practices to figure out the probability of a specific event occurring and its possible monetary ramifications. An actuary uses statistics and mathematical concepts to assess the financial effect of uncertainty and help customers limit potential risks. (Tags: Actuaries York, Financial Actuaries York, Actuary York)

Auditors York

An auditor is a company or person authorised to review and authenticate the accuracy of financial accounts to make sure that organisations or businesses observe tax legislation. Auditors examine the financial actions of the company which appoints them to make certain of the consistent operation of the organisation. Auditors must be accredited by the regulatory authority for auditing and accounting and have the required accounting qualifications. (Tags: Auditors York, Auditor York, Auditing York)

York accountants will help with HMRC submissions, workplace pensions York, accounting and financial advice York, bookkeeping, tax investigations in York, business disposal and acquisition, business advisory services, tax preparation, general accounting services, payslips York, capital gains tax, financial planning, debt recovery, sole traders, litigation support, accounting services for the construction sector, year end accounts, VAT registration, National Insurance numbers York, accounting services for media companies, PAYE, charities, accounting services for buy to let property rentals, management accounts, taxation accounting services in York, self-employed registration, business outsourcing, VAT returns, company secretarial services, partnership registration in York, mergers and acquisitions, cash flow York and other accounting services in York, North Yorkshire. Listed are just an example of the activities that are undertaken by nearby accountants. York professionals will be delighted to keep you abreast of their entire range of services.

York Accounting Services

- York Tax Services

- York Account Management

- York Bookkeeping Healthchecks

- York Auditing Services

- York Specialist Tax

- York VAT Returns

- York Taxation Advice

- York Financial Advice

- York Self-Assessment

- York PAYE Healthchecks

- York Business Accounting

- York Personal Taxation

- York Payroll Management

- York Chartered Accountants

Also find accountants in: Menethorpe, Thixendale, Streetlam, Salton, Langdale End, Bolton Bridge, Ugglebarnby, Fadmoor, Cockayne, Oaktree Hill, Hardraw, Ellerton, Staxton, Saxton, Croft On Tees, Bishop Thornton, Slingsby, Spennithorne, Thornton, Low Hawkser, Wham, Lockton, Whashton, Towton, Helmsley Sproxton, Forcett, Scalby, Stainforth, Kidstones, Ruswarp, Broughton, Middleton, Burythorpe, Naburn, Battersby and more.

Accountant York

Accountant York Accountants Near Me

Accountants Near Me Accountants York

Accountants YorkMore North Yorkshire Accountants: Ripon, Northallerton, Selby, Knaresborough, Scarborough, Redcar, Middlesbrough, Skipton, Whitby, Harrogate, York, Yarm, Thornaby and Guisborough.

TOP - Accountants York - Financial Advisers

Financial Accountants York - Financial Advice York - Investment Accounting York - Chartered Accountant York - Online Accounting York - Small Business Accountant York - Self-Assessments York - Auditors York - Tax Accountants York