Mortgage Advice Leeds West Yorkshire (LS1): If you are in the market to purchase or sell a home in Leeds or if you wish to refinance or renew your existing mortgage then you need mortgage advice. Often, your first thought is to go to your local bank to get the advice you are looking for, but this may not be the best option for you.

Arranging mortgage financing used to be simple, but has become more and more complicated as the Government has changed rules and regulations governing the lenders who provide mortgage financing. When you need mortgage advice in Leeds you need a professional who deals with mortgages and mortgage lenders full time.

Mortgage advisors are basically financial advisers specialised in the mortgage market. The market has undergone so much change in recent years and is likely to see more to come, means that getting specialist advice may well be more important than ever before. Currently there seems only way that interest rates can go - up.

With this in mind picking the right mortgage is hugely important. The advantage of using the services of a mortgage advisor is simply that you have access to a professional who can search the market for you and find a deal that suits your circumstances now, as well as offering advice on how affordable the mortgage is likely to remain.

To choose the best mortgage broker in Leeds you must ask these three questions:

1. How many lending institutions does the mortgage advisor work with & who are his/her top three? - You can choose to work with an individual who works with only one bank (or lender) or you can choose to work with a mortgage broker who deals with many banks (or lenders). The more lenders a mortgage advisor works with, the more choice that he can offer to you and the more likely you will find a mortgage that best suites your specific needs. The best Leeds mortgage broker will deal with and have a strong relationship with at least 5-7 different banks or lenders. Many brokers advertise that they work with 30+ banks, however, most only send their clients to 2 or 3 of the 30 lenders available to them.

2. Does the mortgage advisor that you want to work with do this full time, or part time? - Though a simple question, the answer is very important. The best mortgage broker in Leeds is working for you on a full time basis. He is a professional who is knowledgable about all aspects of mortgage financing and is aware of changes in legislation and lender guidelines as they happen. He will be available to work for you when you need him.

3. Ask your mortgage adviser how long he has been in business, and how much business he does each month. - If you are looking for mortgage advice in Leeds, then you are going to want to ask a professional who has been in the business for at least 5 years and has had experience with many different situations. The best mortgage advisor will be funding more than 8 - 10 mortgages each month.

The best mortgage brokers in Leeds develop relationships with each bank and they build these relationship by referring their clients to each bank. The more referrals that the mortgage broker sends to the bank the stronger the relationship that the mortgage broker develops. The better relationship a broker has with a bank, then the lower the rate the broker can often offer to his clients at that bank. Your best Leeds mortgage brokers will also have more flexibility to get mortgages approved if his clients need exceptions to the lender's policies.

The more business volume a mortgage brokerage sends to a bank the more flexibility he has with the rates and policies. Mortgage brokerage offices that don't have a huge volume of business can't develop enough relationships with banks to offer clients adequate choice.

To receive good mortgage advice you need to choose the best possible mortgage broker in Leeds. A full time professional who has a strong relationship with at least 5 to 7 lenders and who has the experience to help you with your specific and individual needs.

Whichever route you choose - dealing direct with the bank or using the services of a mortgage advisor getting the decision right is crucial. Despite great deals on offer from the banks - attempting to stimulate growth in the housing market - the best deals can most readily be sourced through mortgage advisors. Anyone stepping on to the property ladder or moving up a rung or two is well advised to consider finding a mortgage advisor who can give you the best overview of the products available. Getting the right mortgage advice on one of the biggest financial decisions you will make should be a priority for everybody in this uncertain financial climate.

Independent mortgage brokers in Leeds have specialist software that can scan the entire mortgage market in minutes, helping them to provide quality mortgage advice that will help you choose the right mortgage product for your individual circumstances.

The right mortgage advice can help you save money over the term of the mortgage, whether it is for a buy-to-let property or your own home.

In this day and age no two people have the same set of financial circumstances. This is one of the reasons why there is a wide range of mortgage products available on the market today.

This is why it is more important than ever before to receive expert mortgage advice before buying your first home or remortgaging an existing one.

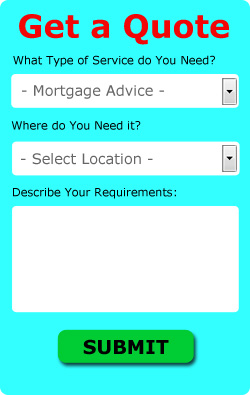

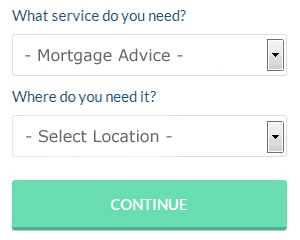

Finding a mortgage broker that can offer you mortgage advice has never been easier. There are thousands of registered mortgage brokers in the UK, many of whom advertise on the internet and in the local press.

There is also a wide range of online and offline directories that contain listings of mortgage brokers in most local areas. However, with the ease of communicating over long distances these days, it is not necessary to receive mortgage advice from a local mortgage broker.

Mortgage advice can be accessed in Leeds and also nearby in: Woodhouse, Potternewton, Lower Wortley, Burley, Armley, Saxton Gardens, Hunslet Cars, Green Side, Belle Isle, Beeston, Churwell, Harehills, Gledhow, Headingley, Colton, Sheepscar, Seacroft, as well as in these postcodes LS1 2DE, LS1 3AQ, LS1 2HJ, LS1 3DA, LS1 1HQ, LS1 3BY, LS1 2LE, LS1 2JJ, LS1 2EE, LS1 3AX. Local Leeds mortgage advisers will likely have the telephone code 0113 and the postcode LS1.

Mortgage Advice West Yorkshire

In West Yorkshire you'll also discover: Mytholmroyd mortgage advisers, Mirfield mortgage advisors, South Elmsall mortgage brokers, Scarcroft mortgage brokers, Farsley mortgage advice, Shelley mortgage advisers, Carlton mortgage broker, Eastburn mortgage advice, Heptonstall mortgage broker, Cornholme mortgage broker, Mickletown mortgage brokers, Cross Gates mortgage advice, Horbury mortgage advisers, Kirkhamgate mortgage brokers, Stanley mortgage brokers, Upper Cumberworth mortgage advisers, Hanging Heaton mortgage brokers, Altofts mortgage advice, Stanley mortgage broker, Emley mortgage advisers, Micklefield mortgage advisers, Thongsbridge mortgage advisers, Cross Roads mortgage advisors, Silsden mortgage advisers, mortgage advice, Ferrybridge mortgage broker, Scarcroft mortgage advice, Skelmanthorpe mortgage advice, Havercroft mortgage brokers, Greetland mortgage broker.

Leeds Mortgage Advice Tasks

Local Leeds mortgage advice companies will be able to help you with self-employed mortgages, first time buyer advice, mortgage advice for young adults Leeds, bridging finance, advice for getting a mortgage in Leeds, mortgage advice for older adults, professional mortgage advice, mortgage advice for the over 60s, buy to rent mortgage advice, remortgages, mortgage advice for single mums, poor credit mortgages, mortgage help for the disabled Leeds, financial advice, mortgage advice for separated couples in Leeds, remortgage advice in Leeds, independent mortgage advice, new build mortgages, cheap mortgage advice in Leeds, moving home mortgage advice Leeds, and plenty more.

Mortgage Advice Enquiries West Yorkshire

Recent West Yorkshire mortgage advice requirements: Kyran Grey was looking for a mortgage adviser near Honley, West Yorkshire. Ella-Rose Maguire from Illingworth needed bad credit mortgage advice. Guy Ferguson in Stainland needed first time buyer mortgage advice. Ameera Eastwood in Farsley asked "are there any mortgage brokers near me?". Phillip Reeve in Liversedge needed poor credit mortgage advice. Abdullah Lopez from Middleton West Yorkshire needed buy to let buyer mortgage advice. Laura Wade was trying to find a mortgage broker near Bramham, West Yorkshire. Matei Macmillan from Sowerby Bridge, West Yorkshire asked the question "where can I get mortgage advice near me?".

Mortgage Advice Near Leeds

Also find: Saxton Gardens mortgage advice, Beeston mortgage advice, Armley mortgage advice, Gledhow mortgage advice, Colton mortgage advice, Seacroft mortgage advice, Green Side mortgage advice, Sheepscar mortgage advice, Burley mortgage advice, Lower Wortley mortgage advice, Belle Isle mortgage advice, Potternewton mortgage advice, Hunslet Cars mortgage advice, Churwell mortgage advice, Headingley mortgage advice, Woodhouse mortgage advice, Harehills mortgage advice and more.

Mortgage Advice Leeds

- Leeds First Time Buyer Mortgage Advice

- Leeds Remortgages

- Leeds Buy to Let Advice

- Leeds Buy to Rent Mortgages

- Leeds Moving Home Mortgage Advice

- Leeds Self-Employed Mortgage Advice

- Leeds Secured Loans

- Leeds Mortgage Advice for Over 60s

- Leeds Right to Buy Advice

- Leeds Poor Credit Mortgages

- Leeds Bad Credit Mortgage Advice

- Leeds Self-Employed Mortgages

- Leeds Cheap Mortgage Advice

- Leeds Mortgage Advice

Okay, at this time you are trying to find mortgage advice in Leeds, however you may also require social media marketing in Leeds, logo design in Leeds, business financial planning in Leeds, a financial adviser in Leeds, telephone system services in Leeds, payroll services in Leeds, business accounting services in Leeds, advertising in Leeds, debt recovery in Leeds, web development in Leeds, tax preparation in Leeds, an accountant in Leeds, website design in Leeds, a bookkeeper in Leeds, a marketing agency in Leeds, a contracts lawyer in Leeds, HR consulting in Leeds, at some point.

Mortgage Advice Around Leeds: People living in the following streets and areas have just recently asked for mortgage advice - Allerton Grange Croft, Bawn Approach, Carr Manor Road, Scotchman Lane, Dale Park Walk, Bawn Chase, Carrholm Drive, Bayswater Crescent, Bawn Drive, Dawlish Grove, Telford Terrace, Barley Hill Lane, Baileys Towers, Barley Hill Crescent, Sayers Close, Talbot Mount, Banks Row, Baldovan Terrace, Alwoodley Court Gardens, Cavalier Mews, Amberton Gardens, Dunhill Crescent, Back Ruthven View, The Ginnel, Ancaster Road, Cautley Road, Chapel Court, Angel Court, Teal Mews, The Calls, as well as these local Leeds postcodes: LS1 2DE, LS1 3AQ, LS1 2HJ, LS1 3DA, LS1 1HQ, LS1 3BY, LS1 2LE, LS1 2JJ, LS1 2EE, LS1 3AX.

Mortgage Advice Leeds

Mortgage Advice Leeds Mortgage Advice Near Leeds

Mortgage Advice Near Leeds Mortgage Brokers Leeds

Mortgage Brokers LeedsLeeds, West Yorkshire: Located in West Yorkshire (W Yorks), England, Leeds with a population of over 470,000 people, is the biggest urban centre in that county. That figure rises to 793,139 (2019 est.), if combined with its more expansive metropolitan borough, which is now notable as England's 2nd most populous district. Leeds is to the east of Bradford, north-east of Manchester, south-west of York and north of Sheffield. It is around 11 miles from Bradford, 36 miles from Sheffield, 24 miles from York, 44 miles from Manchester and 196 miles from London. Together with the W Yorks towns of Otley, Pudsey, Rothwell, Horsforth, Wetherby, Morley and Yeadon, the city forms the heart of the City of Leeds metropolitan borough. By the 17th and 18th centuries Leeds had grown into a leading centre for the manufacturing and trading of wool, though a few hundred years earlier in the 13th century, it was a largely insignificant manor. With the dawning of the Industrial Revolution, Leeds became a leading mill town with industries such as flax, engineering, iron foundries, linen and printing, becoming increasingly important, although wool was still predominant. From the 16th century, when it was only a lowly market town on the River Aire, Leeds grew to become a populous urban city by the mid-20th century, and absorbed the encircling villages and settlements. Leeds got its town charter in 1626, and attained City status in 1893. Surrounding towns and villages include; Woodhouse, Potternewton, Lower Wortley, Burley, Armley, Saxton Gardens, Hunslet Cars, Green Side, Belle Isle, Beeston, Churwell, Harehills, Gledhow, Headingley, Colton, Sheepscar, Seacroft. To read local Leeds info check here.

More West Yorkshire Mortgage Brokers: More West Yorkshire mortgage advice: Pontefract, Keighley, Ilkley, Wakefield, Featherstone, Shipley, Garforth, Wetherby, Huddersfield, Castleford, Bingley, Horsforth, Ossett, Holmfirth, Elland, Halifax, Heckmondwike, Morley, Normanton, Knottingley, Liversedge, Todmorden, Dewsbury, Otley, Bradford, Batley, Pudsey, Yeadon, Guiseley, Mirfield, Rothwell, Leeds, Baildon, Brighouse and Cleckheaton.

Mortgage advice in LS1 area, telephone code 0113.

LS1 - Mortgage Broker Leeds - Mortgage Advice Near Leeds - Remortgages Leeds - Buy to Let Advice Leeds - First Time Buyer Advice Leeds - 0113 - Mortgage Advisers Leeds - Cheap Mortgage Advice Leeds