Accountants Grays: Do you get little else but a spinning head when completing your yearly tax self-assessment form? Other small businesses and sole traders in the Grays area are faced with the same challenge. You might instead elect to hire a trusted Grays accountant to take this load off your back. Do you find self-assessment just too taxing to tackle on your own? The cost of completing and sending in your self-assessment form is approximately £200-£300 if done by a typical Grays accountant. If you're looking for a cheaper alternative you might find the solution online.

There are plenty of accountants around, so you should not have too much trouble finding a decent one. An internet search engine will pretty quickly highlight a shortlist of likely candidates in Grays. However, it is hard to spot the gems from the scoundrels. Don't forget that anybody that is so inclined can set themselves up as an accountant in Grays. They don't even have to hold any qualifications such as BTEC's or A Levels. Which, like me, you may find astounding.

You should take care to find a properly qualified accountant in Grays to complete your self-assessment forms correctly and professionally. Your minimum requirement should be an AAT qualified accountant. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. The cost of preparing your self-assessment form can be claimed back as a business expense.

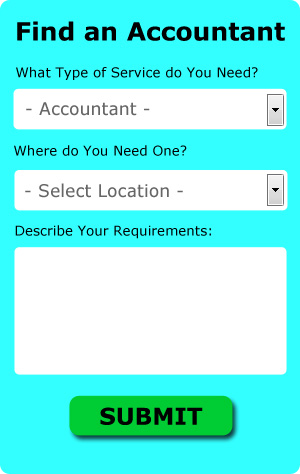

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. All that is required is the ticking of a few boxes so that they can understand your exact needs. Within a few hours you should hear from some local accountants who are willing to help you.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. Over the last few years many more of these services have been appearing. Some of these companies are more reputable than others. It should be a simple task to find some online reviews to help you make your choice.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! Software programs like Basetax, Ajaccts, Keytime, Ablegatio, Taxforward, Sage, BTCSoftware, Taxfiler, Nomisma, ACCTAX, GoSimple, Capium, TaxCalc, Forbes, CalCal, Gbooks, Andica, Xero, Taxshield, Absolute Topup and 123 e-Filing have been developed to help the self-employed do their own tax returns. Don't leave your self-assessment until the last minute, allow yourself plenty of time.

Tips for Better Money Management

Properly using money management strategies is one of those things that is most difficult to learn when you're just starting a business. It can seem like money management is something anyone should be able to do already by the time they get their business up and running. The reality, however, is that budgeting and financial planning for your business is a lot different from budgeting and financial planning for your personal life. It does help a lot if you have some experience in the latter. Your self-confidence could very well take a huge dive should you accidentally ruin your business finances. Continue reading if you want to know how you can better manage your business finances.

Don't wait for the due date to pay your taxes because you may not have the funds to pay by then, especially if you're not a good money manager. To avoid this problem, it's a good idea to set aside a portion of every payment you get into a savings count. Do this and you'll never have to worry where to get the money to pay your taxes every quarter because you've already got it saved. It sounds lame, but it can be really satisfying to be able to pay your taxes in full and on time.

Consider offering clients payment plans. Not only will this drum up more business for you, this will ensure that money is coming in regularly. Steady, regular payments, even if they're small, is a lot better than big payments that come in sporadically and you don't know when exactly they're going to come. Reliable income makes it a lot easier for you to budget, makes it easier to keep your bills paid, and makes it much simpler to properly manage your money. You'll be a lot more confident about yourself if the financial side of your business is running smoothly.

Make sure you account for every penny your business brings in. Keep a record of every payment you get from customers or clients. You know who has already paid and who hasn't. In addition, you know exactly how much money you've got at any given time. Tracking your income helps you figure out your taxes, how much to pay yourself, etc.

Proper money management is a skill that every adult needs to develop. Knowing what you have coming in, what you have going out, and what exactly is going on with your money can be a huge boost to your confidence and success. Use the tips in this article to help you get started. Truly, when it comes to self improvement in business, properly managing your money is incredibly important.

Forensic Accounting Grays

You might well notice the phrase "forensic accounting" when you're on the lookout for an accountant in Grays, and will undoubtedly be interested to learn about the difference between regular accounting and forensic accounting. The word 'forensic' is the thing that gives it away, meaning basically "relating to or denoting the application of scientific techniques and methods for the investigation of crime." Also called 'forensic accountancy' or 'financial forensics', it uses auditing, accounting and investigative skills to discover inconsistencies in financial accounts that have lead to fraud or theft. There are even a few larger accountants firms in Essex who have specialist divisions for forensic accounting, addressing money laundering, falsified insurance claims, professional negligence, insolvency, bankruptcy, tax fraud and personal injury claims. (Tags: Forensic Accounting Grays, Forensic Accountants Grays, Forensic Accountant Grays)

Financial Actuaries Grays

Actuaries and analysts are specialists in risk management. An actuary uses statistical and financial theories to figure out the chances of a particular event taking place and the possible monetary implications. Actuaries present judgements of fiscal security systems, with an emphasis on their mechanisms, complexity and mathematics. (Tags: Actuary Grays, Financial Actuary Grays, Actuaries Grays)

Grays accountants will help with VAT returns, financial statements Grays, taxation accounting services, management accounts, auditing and accounting, tax preparation in Grays, pension forecasts, financial planning Grays, self-employed registration in Grays, business planning and support, annual tax returns, small business accounting, double entry accounting, accounting services for the construction industry, contractor accounts Grays, bureau payroll services, general accounting services, company secretarial services in Grays, business start-ups, corporate finance in Grays, accounting services for property rentals, business advisory services, payroll accounting Grays, year end accounts, personal tax, limited company accounting in Grays, company formations in Grays, mergers and acquisitions Grays, debt recovery Grays, National Insurance numbers, accounting services for media companies Grays, employment law Grays and other accounting services in Grays, Essex. These are just a handful of the tasks that are accomplished by nearby accountants. Grays professionals will be happy to inform you of their full range of services.

You do, of course have the best resource at your fingertips in the shape of the web. There's such a lot of information and inspiration available online for such things as accounting & auditing, self-assessment help, personal tax assistance and accounting for small businesses, that you will pretty quickly be knee-deep in ideas for your accounting requirements. One example could be this fascinating article on choosing an accountant.

Grays Accounting Services

- Grays Account Management

- Grays Self-Assessment

- Grays Bookkeeping Healthchecks

- Grays Bookkeepers

- Grays Payroll Services

- Grays Tax Returns

- Grays VAT Returns

- Grays Forensic Accounting

- Grays Chartered Accountants

- Grays Specialist Tax

- Grays Tax Planning

- Grays Personal Taxation

- Grays Auditing

- Grays PAYE Healthchecks

Also find accountants in: Coryton, Fordham, Beacon End, Barling, Colne Engaine, Little Burstead, Great Holland, Baker Street, Knowl Green, Halstead, Feering, Beaumont, Bardfield Saling, Little Bentley, Fox Street, Sandon, Bocking, Tye Common, Nevendon, Lawford, Great Canney, Prittlewell, Weeley, Alphamstone, Great Oakley, Stisted, Chappel, Takeley, Ugley Green, Great Braxted, Great Easton, Rose Green, High Ongar, Hazeleigh, Terling and more.

Accountant Grays

Accountant Grays Accountants Near Grays

Accountants Near Grays Accountants Grays

Accountants GraysMore Essex Accountants: Romford, Langdon Hills, Tilbury, Maldon, Pitsea, Burnham-on-Crouch, Ilford, Walton-on-the-Naze, Chelmsford, Brentwood, Canvey Island, Shoeburyness, Rochford, North Weald Bassett, Saffron Walden, South Woodham Ferrers, Hockley, Brightlingsea, Upminster, Hadleigh, Witham, Writtle, Laindon, Clacton-on-Sea, Halstead, Danbury, Colchester, Heybridge, Manningtree, Stansted Mountfitchet, Purfleet, Great Baddow, West Mersea, Chafford Hundred, South Benfleet, Stanford-le-Hope, South Ockendon, West Thurrock, Grays, Wickford, Harlow, Holland-on-Sea, Frinton-on-Sea, Tiptree, Epping, Chigwell, Great Wakering, Southend-on-Sea, Corringham, Galleywood, Coggeshall, Leigh-on-Sea, Harwich, Westcliff-on-Sea, Waltham Abbey, Loughton, Parkeston, Rainham, Dagenham, Buckhurst Hill, Stanway, Wivenhoe, Barking, Great Dunmow, Billericay, Ingatestone, Basildon, Southminster, Hawkwell, Hornchurch, Rayleigh, Braintree, Chingford, Hullbridge, Southchurch and Chipping Ongar.

TOP - Accountants Grays - Financial Advisers

Financial Accountants Grays - Small Business Accountant Grays - Investment Accountant Grays - Financial Advice Grays - Tax Return Preparation Grays - Cheap Accountant Grays - Tax Advice Grays - Self-Assessments Grays - Online Accounting Grays