Accountants Uckfield: If you run a small business or are a sole trader in Uckfield, you will find there are many benefits to be gained from having an accountant on board. By handling key tasks such as payroll, tax returns and bookkeeping your accountant can at the very least free up a bit of time for you to concentrate on your core business. While if you've just started up in business and feel your money could be better spent elsewhere, you'd better think again, the help of an accountant could be critical to your success.

So, what is the best way to locate an accountant in Uckfield, and what sort of service should you expect? Tracking down a few local Uckfield accountants ought to be quite simple by doing a a quick search on the net. However, it is not always easy to spot the good guys from the bad. The truth of the matter is that in the United Kingdom anybody can start up in business as a bookkeeper or accountant. It isn't even neccessary for them to have any qualifications.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. For simple self-assessment work an AAT qualification is what you need to look for. The extra peace of mind should compensate for any higher costs. Make sure that you include the accountants fees in your expenses, because these are tax deductable. A lot of smaller businesses in Uckfield choose to use bookkeepers rather than accountants.

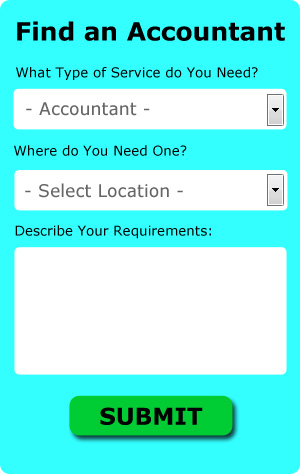

If you want to reach out to a number of local Uckfield accountants, you could always use a service called Bark. You just have to fill in a simple form and answer some basic questions. All you have to do then is wait for some responses.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. Services like this are convenient and cost effective. If you decide to go with this method, pick a company with a decent reputation. Reading through reviews for any potential online services is a good way to get a feel for what is out there. It is beyond the scope of this article to recommend any specific service.

While you shouldn't totally discount the idea of using a chartered accountant, the high level of charges might put you off. These people are financial experts and are more commonly used by bigger companies. So, these are your possible options.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Xero, 123 e-Filing, TaxCalc, ACCTAX, Taxfiler, Absolute Topup, Sage, Nomisma, Taxshield, Capium, Ajaccts, Gbooks, BTCSoftware, Forbes, Keytime, GoSimple, Basetax, Ablegatio, Andica, CalCal and Taxforward. You will get a penalty if your tax return isn't in on time.

Forensic Accountant Uckfield

You could well run into the term "forensic accounting" when you're searching for an accountant in Uckfield, and will undoubtedly be wondering what is the distinction between normal accounting and forensic accounting. The hint for this is the actual word 'forensic', which essentially means "suitable for use in a court of law." Occasionally also known as 'forensic accountancy' or 'financial forensics', it uses auditing, accounting and investigative skills to sift through financial accounts so as to identify fraud and criminal activity. There are some bigger accountants firms throughout East Sussex who have got specialised sections for forensic accounting, dealing with false insurance claims, professional negligence, bankruptcy, personal injury claims, insolvency, tax fraud and money laundering.

Proper Money Management Tips for Small Business Owners

Business owners, especially the new ones, will find it a struggle to manage their money properly in the early stages of their business. When you're managing your finances poorly, your confidence in yourself might go down, especially when your business isn't being as profitable as you'd hope. This could actually make you feel like giving up and returning to your old job. You won't reach the level of success you're aiming to reach when this happens. Keep reading to learn a few tips you can use to help you manage your finances better.

Don't wait for the due date to pay your taxes because you may not have the funds to pay by then, especially if you're not a good money manager. You can save yourself the headache by putting a portion of each payment you get in a separate account. This is a good strategy because when your taxes come due every quarter, you've already got money set aside and you won't be forced to take money out from your current earnings. It sounds lame, but it can be really satisfying to be able to pay your taxes in full and on time.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. Paying yourself like you would a regular employee would make your business accounting so much easier. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. It's up to you how much salary you want to give yourself. You can set an hourly rate and then pay yourself the amount equivalent to how many hours you put into your business each month. You can also pay yourself based on how much income your business generated for that month.

Take control of your spending. It's certainly very tempting to start buying things you've always wanted when the money is coming in. Rather than going on a buying spree, spend wisely, which means spend only on those things that will help your business. Put your money in your business savings account so that if unexpected business expenses come up, you'll have the means to deal with it in a prompt manner. When you need to purchase office supplies, purchase in bulk. For computers, it's better if you spend money on a more expensive, but reliable system that will last for many years and won't need replaced every so often. Avoid spending too much on your entertainment as well; be moderate instead.

A lot of things go into proper money management. You might think that this is a basic skill and it shouldn't be that complicated, but the truth is that as a small business owner, proper money management is an intricate and often complicated process. Hopefully, the tips we've shared in this article will help you get started in managing your finances better. If you want your business to be profitable, you need to stay on top of your finances.

Small Business Accountants Uckfield

Doing the accounts can be a pretty stressful experience for anybody running a small business in Uckfield. If your accounts are getting on top of you and VAT and tax return issues are causing sleepless nights, it is wise to employ a dedicated small business accountant in Uckfield.

A seasoned small business accountant in Uckfield will consider that it is their responsibility to help develop your business, and provide you with sound financial guidance for peace of mind and security in your specific circumstances. A quality accounting firm in Uckfield should be able to give proactive small business advice to optimise your tax efficiency while at the same time lowering business expenditure; essential in the sometimes murky world of business taxation.

You also ought to be supplied with a dedicated accountancy manager who understands your plans for the future, your company's situation and your business structure.

Uckfield accountants will help with bookkeeping Uckfield, taxation accounting services, partnership accounts, debt recovery, self-assessment tax returns, partnership registrations, tax preparation, accounting services for media companies in Uckfield, self-employed registrations, business advisory, payroll accounting Uckfield, HMRC submissions Uckfield, corporate finance Uckfield, financial planning, HMRC liaison, PAYE, sole traders, business start-ups, audit and auditing, accounting and financial advice, compliance and audit reporting, assurance services Uckfield, litigation support, payslips, VAT returns Uckfield, accounting support services, small business accounting, company formations, company secretarial services Uckfield, accounting services for property rentals, personal tax Uckfield, inheritance tax in Uckfield and other types of accounting in Uckfield, East Sussex. Listed are just a small portion of the activities that are performed by local accountants. Uckfield professionals will be delighted to keep you abreast of their entire range of services.

Uckfield Accounting Services

- Uckfield VAT Returns

- Uckfield Auditing Services

- Uckfield Payroll Management

- Uckfield Forensic Accounting

- Uckfield Self-Assessment

- Uckfield Chartered Accountants

- Uckfield Specialist Tax

- Uckfield Financial Audits

- Uckfield Tax Planning

- Uckfield Personal Taxation

- Uckfield Tax Returns

- Uckfield Tax Refunds

- Uckfield Bookkeepers

- Uckfield PAYE Healthchecks

Also find accountants in: Hollingbury, Upper Dicker, Sheffield Green, Boarshead, Burwash Common, St Leonards, Alfriston, Stunts Green, Moulsecoomb, West Firle, Cackle Street, Udimore, Uckfield, Stonebridge, Five Ash Down, Millcorner, Baldslow, Little Horsted, Cousley Wood, Hankham, Ripe, Burwash Weald, Hellingly, South Common, Netherfield, Mark Cross, Iford, North Chailey, Hooe, Halland, Birling Gap, Friars Gate, Piddinghoe, Westfield Moor, Camber and more.

Accountant Uckfield

Accountant Uckfield Accountants Near Me

Accountants Near Me Accountants Uckfield

Accountants UckfieldMore East Sussex Accountants: Forest Row, Hailsham, Hove, Wadhurst, Rye, Ringmer, Polegate, Peacehaven, Telscombe, Newhaven, Ore, Brighton, Heathfield, Portslade, Willingdon, Battle, Crowborough, Eastbourne, Westham, Lewes, Bexhill-on-Sea, Uckfield, Hastings and Seaford.

TOP - Accountants Uckfield - Financial Advisers

Tax Return Preparation Uckfield - Tax Accountants Uckfield - Financial Advice Uckfield - Financial Accountants Uckfield - Auditing Uckfield - Online Accounting Uckfield - Investment Accounting Uckfield - Self-Assessments Uckfield - Small Business Accountant Uckfield