Accountants West Bromwich: Anybody operating a small business in West Bromwich, West Midlands will soon realise that there are lots of advantages to having an accountant at the end of the phone. More importantly you will have more time to concentrate on your core business operations, while your accountant deals with such things as annual tax returns and bookkeeping. Start-ups will discover that having access to this type of expertise is extremely beneficial. West Bromwich businesses in general have been able to thrive by seeking the help and advice of professional accountants.

There are different types of accountants working in West Bromwich. Finding one that meets your specific needs should be a priority. Certain accountants work as part of an accountancy business, while some work solo. An accounting firm will comprise accountants with different fields of expertise. Some of the principal accountancy positions include the likes of: bookkeepers, accounting technicians, cost accountants, chartered accountants, management accountants, investment accountants, tax preparation accountants, auditors, actuaries, financial accountants and forensic accountants.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. Look for an AAT qualified accountant in the West Bromwich area. You can then have peace of mind knowing that your tax affairs are being handled professionally. Your accountant will add his/her fees as tax deductable.

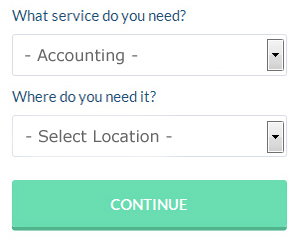

You could use an online service like Bark who will help you find an accountant. Tick a few boxes on their form and submit it in minutes. All you have to do then is wait for some responses.

Utilizing an online tax returns service will be your other option. You might find that this is simpler and more convenient for you. Don't simply go with the first company you find on Google, take time to do some research. It should be a simple task to find some online reviews to help you make your choice.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. Software programs like Taxforward, Absolute Topup, GoSimple, BTCSoftware, Gbooks, Nomisma, Andica, Basetax, TaxCalc, Forbes, Ablegatio, Taxfiler, Sage, Ajaccts, 123 e-Filing, Capium, Taxshield, ACCTAX, Keytime, Xero and CalCal have been developed to help the self-employed do their own tax returns. You'll receive a fine if your self-assessment is late.

Payroll Services West Bromwich

An important part of any business in West Bromwich, large or small, is having an effective payroll system for its personnel. The laws regarding payrolls and the legal requirements for transparency and accuracy means that dealing with a company's payroll can be an intimidating task.

Small businesses may not have their own in-house financial experts, and the simplest way to manage employee payrolls is to employ an outside West Bromwich accounting firm. Your payroll accounting company will provide accurate BACS payments to your personnel, as well as working with any pension schemes that your company may have, and use current HMRC legislation for deductions and NI contributions.

A dedicated payroll management accountant in West Bromwich will also, in accordance with the current legislation, provide P60's after the end of the financial year for every staff member. Upon the termination of an employee's contract with your company, the payroll company should also supply an updated P45 relating to the tax paid in the previous financial period. (Tags: Payroll Administrator West Bromwich, Payroll Services West Bromwich, Payroll Accountants West Bromwich).

Small Business Accountants West Bromwich

Running a small business in West Bromwich is fairly stressful, without having to fret about your accounts and other similar bookkeeping tasks. If your accounts are getting you down and tax returns and VAT issues are causing sleepless nights, it would be wise to use a decent small business accountant in West Bromwich.

A competent small business accountant in West Bromwich will regard it as their responsibility to help develop your business, and offer you reliable financial guidance for peace of mind and security in your specific situation. A quality accounting firm in West Bromwich will offer proactive small business guidance to maximise your tax efficiency while at the same time lowering expense; critical in the sometimes shady field of business taxation.

You should also be supplied with an assigned accountancy manager who has a good understanding of your company's situation, your plans for the future and your business structure.

Actuaries West Bromwich

Actuaries work alongside companies and government departments, to help them anticipate long-term investment risks and financial expenditure. They employ their knowledge of economics and business, together with their expertise in probability theory, statistics and investment theory, to provide strategic, commercial and financial guidance. To work as an actuary it is important to have a mathematical, statistical and economic understanding of real-life situations in the world of finance. (Tags: Financial Actuaries West Bromwich, Actuaries West Bromwich, Actuary West Bromwich)

How to Be a Better Money Manager for Your Business

One of the hardest aspects of starting a business is learning the proper use of money management strategies. Some people think that money management is a skill that should be already learned or mastered. The reality, however, is that budgeting and financial planning for your business is a lot different from budgeting and financial planning for your personal life. It does help a lot if you have some experience in the latter. Your confidence can take a hard hit if you ruin your finances on accident. In this article, we'll share a few tips you can apply to help you be a better money manager for your business.

Putting your regular expenditures like recurring dues for membership sites, web hosting, and so on, on your credit card can be a good idea. This can certainly help your memory because you only have one payment to make each month instead of several. However, it can be tricky to use credit cards for your business expenses because interest charges can accrue and you may end up paying more if you carry a balance each month. You can continue using your credit card to make it easier on you to pay your bills, but make sure you don't carry a balance on your card to avoid accruing interest charges. Not only will this help you deal with just one payment and not have to pay interest charges, this will help boost your credit score as well.

Even if you're the only person running your business, earmark a salary for yourself and then issue yourself a paycheck regularly. This way, you won't have a hard time keeping track of your business and personal finances. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. You can decide how much you should pay yourself. You can pay yourself by billable hours or a portion of your business income for that month.

Of course, if you're keeping track of every penny you're spending, you should keep track of every penny you're getting as well. Each time you're paid by a client or customer for a service you provided or a product you sold them, record that amount. You know who has already paid and who hasn't. In addition, you know exactly how much money you've got at any given time. This also helps you determine how much taxes you should pay, what salary you should pay yourself, and so on.

When it comes to improving yourself and your business, proper money management is one of the most essential things you can learn. You'll benefit a great deal if you remember and put these tips we've shared to use. When you've got your finances under control, you can expect your business and personal life to be a success.

West Bromwich accountants will help with charities in West Bromwich, pension forecasts, payslips West Bromwich, debt recovery, cash flow, assurance services, litigation support, tax investigations, business start-ups, business acquisition and disposal West Bromwich, financial statements, taxation accounting services West Bromwich, personal tax, sole traders, double entry accounting, management accounts, company formations, estate planning in West Bromwich, bureau payroll services, self-assessment tax returns West Bromwich, PAYE West Bromwich, general accounting services, financial and accounting advice West Bromwich, partnership registrations, consulting services, self-employed registration, small business accounting in West Bromwich, contractor accounts in West Bromwich, employment law, financial planning in West Bromwich, consultancy and systems advice in West Bromwich, partnership accounts and other professional accounting services in West Bromwich, West Midlands. These are just a small portion of the activities that are undertaken by nearby accountants. West Bromwich professionals will be happy to inform you of their whole range of services.

West Bromwich Accounting Services

- West Bromwich Business Accounting

- West Bromwich Bookkeeping Healthchecks

- West Bromwich Financial Advice

- West Bromwich Forensic Accounting

- West Bromwich Bookkeepers

- West Bromwich Tax Planning

- West Bromwich Account Management

- West Bromwich Tax Advice

- West Bromwich Tax Refunds

- West Bromwich Self-Assessment

- West Bromwich VAT Returns

- West Bromwich PAYE Healthchecks

- West Bromwich Business Planning

- West Bromwich Tax Returns

Also find accountants in: Clayhanger, Tile Hill, Olton, Short Heath, Oxley, Woodgate, Blakenhall, Foleshill, Bradmore, Hawkes End, Amblecote, Brownhills, Old Swinford, Acocks Green, Wordsley, Gornalwood, Erdington, Shire Oak, Wednesbury, Tipton, Walsall Wood, Chapel Fields, West Heath, Rushall, Vigo, Solihull Lodge, Castle Bromwich, Elmdon Heath, Meer End, Oldbury, Princes End, Little Heath, Moseley, Copt Heath, Hasbury and more.

Accountant West Bromwich

Accountant West Bromwich Accountants Near Me

Accountants Near Me Accountants West Bromwich

Accountants West BromwichMore West Midlands Accountants: Wednesfield, Willenhall, Oldbury, Brierley Hill, Kingswinford, Darlaston, Blackheath, Dudley, West Bromwich, Brownhills, Sutton Coldfield, Coventry, Halesowen, Solihull, Bilston, Walsall, Aldridge, Stourbridge, Birmingham, Wolverhampton, Rowley Regis, Bloxwich, Smethwick, Coseley, Wednesbury, Tipton and Sedgley.

TOP - Accountants West Bromwich - Financial Advisers

Affordable Accountant West Bromwich - Tax Accountants West Bromwich - Auditors West Bromwich - Self-Assessments West Bromwich - Online Accounting West Bromwich - Tax Preparation West Bromwich - Chartered Accountant West Bromwich - Bookkeeping West Bromwich - Financial Advice West Bromwich