Accountants Peterlee: For Peterlee individuals who are running a business or self-employed, there are several benefits to be had from retaining the services of a qualified accountant. Bookkeeping takes up precious time that you cannot afford to waste, so having an accountant take care of this allows you to put more effort into your primary business. While if you've just started up in business and feel that your cash could be better spent somewhere else, think again, the assistance of an accountant could be crucial to your success.

But precisely what might you get for your hard earned money, how much will you have to pay and where can you find the best Peterlee accountant for your needs? A list of prospective Peterlee accountants may be identified with just a few minutes searching the internet. But, precisely who can you trust? The fact of the matter is that in the UK anybody can set up a business as a bookkeeper or accountant. They have no legal obligation to obtain any qualifications for this work.

Find yourself a properly qualified one and don't take any chances. An AAT qualified accountant should be adequate for sole traders and small businesses. The extra peace of mind should compensate for any higher costs. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form. Only larger Limited Companies are actually required by law to use a trained accountant.

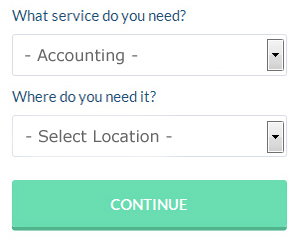

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Peterlee accountant. It is just a case of ticking some boxes on a form. All you have to do then is wait for some responses.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. This type of service is growing in popularity. Do a bit of research to find a reputable company. A quick browse through some reviews online should give you an idea of the best and worse services.

The very best in this profession are chartered accountants, they will also be the most expensive. However, as a sole trader or smaller business in Peterlee using one of these specialists may be a bit of overkill. Some people might say, you should hire the best you can afford.

The cheapest option of all is to do your own self-assessment form. There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example Capium, Nomisma, TaxCalc, Ajaccts, Taxshield, 123 e-Filing, Absolute Topup, Gbooks, GoSimple, Forbes, Taxforward, CalCal, Taxfiler, BTCSoftware, Basetax, Xero, ACCTAX, Sage, Keytime, Andica and Ablegatio. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns.

Staying on Top of Your Finances When You're a Business Owner

Starting your own business is exciting, and this is true whether you are starting this business online or offline. You're your own boss and you're in control of how much you make. Well, you're basically in charge of everything! Now that can be a little scary! While putting up your own business is indeed exciting, it's also intimidating, especially when you're only getting started. This is where knowing some simple self improvement techniques, like learning how to properly manage your money, can be quite helpful. Keep reading this article to learn how to correctly manage your money.

Hire an accountant. This is a business expense that will pay for itself a hundredfold because you know your books will be in order. There are many things that an accountant can help you with, including keeping track of your cash flow, paying yourself, and meeting your tax obligations. The good news is that you don't have to tackle with the paperwork that goes with these things yourself. You can leave all that to your accountant. As a result, you can put your energy towards making your business more profitable, such as creating new products, marketing, and increasing your customer base. When you've got an accountant working for you, you won't end up wasting hours or even days working your finances every week or every month.

Even if you are a sole proprietor, you can still give yourself a salary and a regular paycheck. This makes the process of accounting your personal and business life so much easier. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. Just how much money you pay yourself is completely up to you. You can pay yourself by billable hours or a portion of your business income for that month.

Do not forget to pay your taxes on time. In general, small businesses pay taxes on a quarterly basis. Taxes can be quite confusing so you might want to make an appointment with your local small business center or even at the IRS so you can get accurate information. There are also professionals you can work with who can set you up with payments and plans to make sure you're paying your taxes on time. It's not at all a pleasant experience having the IRS chasing after you for tax evasion.

When you know the right way to manage your finances, you can expect not just your business to improve but yourself overall as well. You'll benefit a great deal if you remember and put these tips we've shared to use. Keep your finances under control and you can look forward to a better, more successful personal life and business life.

Auditors Peterlee

An auditor is a person or company brought in to review and verify the reliability of financial records and make sure that organisations conform to tax laws. They protect businesses from fraud, highlight inconsistencies in accounting techniques and, now and again, work on a consultancy basis, helping organisations to identify ways to improve efficiency. Auditors have to be certified by the regulatory authority for auditing and accounting and have the necessary qualifications. (Tags: Auditing Peterlee, Auditors Peterlee, Auditor Peterlee)

Peterlee accountants will help with general accounting services in Peterlee, accounting services for media companies, partnership accounts, litigation support, HMRC submissions in Peterlee, payslips, financial planning Peterlee, personal tax in Peterlee, consulting services, debt recovery, capital gains tax, charities, business advisory, taxation accounting services, VAT returns Peterlee, self-employed registrations Peterlee, corporate finance, accounting services for the construction industry Peterlee, business support and planning, bookkeeping, management accounts, compliance and audit reporting, tax preparation Peterlee, tax investigations Peterlee, accounting support services Peterlee, HMRC liaison, assurance services, sole traders Peterlee, accounting services for buy to let rentals, inheritance tax in Peterlee, VAT payer registration, cash flow Peterlee and other kinds of accounting in Peterlee, County Durham. Listed are just a small portion of the tasks that are conducted by local accountants. Peterlee providers will tell you about their entire range of accounting services.

Peterlee Accounting Services

- Peterlee Self-Assessment

- Peterlee Taxation Advice

- Peterlee Financial Audits

- Peterlee Account Management

- Peterlee Bookkeeping Healthchecks

- Peterlee Payroll Management

- Peterlee Tax Services

- Peterlee Tax Planning

- Peterlee Personal Taxation

- Peterlee Financial Advice

- Peterlee Bookkeeping

- Peterlee Forensic Accounting

- Peterlee PAYE Healthchecks

- Peterlee Specialist Tax

Also find accountants in: Wycliffe, Tow Law, Middlestone Moor, Greencroft Hall, Hartlepool, Carlton, Evenwood, Darlington, Pity Me, Eastgate, Quebec, Waterhouses, Ebchester, High Throston, Burnt Houses, Little Newsham, Ireshopeburn, Witton Gilbert, Hunstanworth, Easington Colliery, Houghton Le Side, Denton, Dipton, Carrville, Plawsworth, Romaldkirk, Craghead, Cassop, Haughton Le Skerne, Beamish, Littletown, Easington, Startforth, Middleton St George, Ruffside and more.

Accountant Peterlee

Accountant Peterlee Accountants Near Peterlee

Accountants Near Peterlee Accountants Peterlee

Accountants PeterleeMore County Durham Accountants: Stockton-on-Tees, Darlington, Billingham, Newton Aycliffe, Seaham, Consett, Stanley, Hartlepool, Chester-le-Street, Peterlee, Bishop Auckland and Durham.

TOP - Accountants Peterlee - Financial Advisers

Auditors Peterlee - Tax Advice Peterlee - Small Business Accountants Peterlee - Tax Return Preparation Peterlee - Investment Accounting Peterlee - Online Accounting Peterlee - Affordable Accountant Peterlee - Chartered Accountant Peterlee - Self-Assessments Peterlee