Accountants Bebington: Does filling in your annual self-assessment form give you a headache? This is a common predicament for lots of others in Bebington, Merseyside. Perhaps calling on the assistance of a local Bebington professional is the solution? Perhaps it is simply the case that self-assessment is too complicated for you to do on your own. £200-£300 is the normal cost for such a service when using regular Bebington accountants. Online accounting services are available for considerably less than this.

Different kinds of accountant will be advertising their services in Bebington. So, be certain to choose one that suits your requirements perfectly. It is possible that you might prefer to work with an accountant who is working within a local Bebington accountancy firm, as opposed to one who works by himself/herself. Accountancy companies generally have specialists in each primary field of accounting. You should be able to find an accounting company offering chartered accountants, tax preparation accountants, forensic accountants, actuaries, accounting technicians, investment accountants, cost accountants, management accountants, bookkeepers, auditors and financial accountants.

You should take care to find a properly qualified accountant in Bebington to complete your self-assessment forms correctly and professionally. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. Qualified accountants may come with higher costs but may also save you more tax. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form.

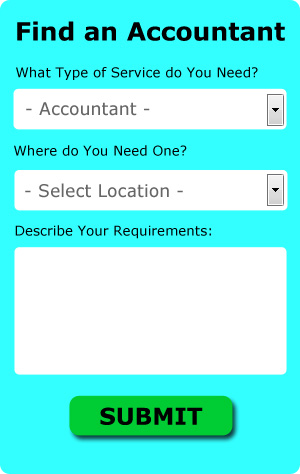

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. You'll be presented with a simple form which can be completed in a minute or two. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment. You might as well try it because it's free.

You could always try an online tax returns service if your needs are fairly simple. More accountants are offering this modern alternative. Should you decide to go down this route, take care in choosing a legitimate company. A good method for doing this is to check out any available customer reviews and testimonials.

The most qualified of all are chartered accountants, they have the most training and the most expertise. These high achievers will hold qualifications like an ACA or an ICAEW. Some people might say, you should hire the best you can afford.

If you decide to bite the bullet and tackle the process by yourself there is lots of help on offer. To make life even easier there is some intuitive software that you can use. Including Absolute Topup, Taxshield, GoSimple, Keytime, Ajaccts, Gbooks, TaxCalc, Taxfiler, Forbes, CalCal, Xero, Andica, Ablegatio, Sage, 123 e-Filing, Basetax, BTCSoftware, Capium, Taxforward, ACCTAX and Nomisma. Whatever happens you need to get your self-assessment form in on time.

Forensic Accountant Bebington

When you happen to be on the lookout for an accountant in Bebington you will perhaps come across the phrase "forensic accounting" and be curious about what the differences are between a standard accountant and a forensic accountant. The actual word 'forensic' is the thing that gives you an idea, meaning basically "denoting or relating to the application of scientific techniques and methods for the investigation of crime." Also called 'financial forensics' or 'forensic accountancy', it uses auditing, investigative skills and accounting to discover inaccuracies in financial accounts which have contributed to fraud or theft. There are even several bigger accountants firms in Merseyside who have specialist sections for forensic accounting, addressing professional negligence, money laundering, personal injury claims, insolvency, bankruptcy, insurance claims and tax fraud. (Tags: Forensic Accountant Bebington, Forensic Accountants Bebington, Forensic Accounting Bebington)

Tips for Better Money Management

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. It isn't that simple nor painless to get your business at a profitable level because there are things that will affect both your business and self-confidence. Take for example your finances. If you don't learn proper money management, you and your business will be facing tough times. You might not think that there is much to money management because in the beginning it might be pretty simple. We're sharing a few proper money management tips to help you out because the financial aspect of your business is only going to get more complicated as your business grows.

Get yourself an accountant. This is a business expense that's really worth it because an accountant can help keep your books straight on a full time basis. She will help you keep track of the money you have coming in and the money you are sending out, help you pay yourself, and help you meet your tax obligations. The great thing is that all the paperwork will be handled by your accountant. As a result, you can put your energy towards making your business more profitable, such as creating new products, marketing, and increasing your customer base. An accountant can save you days of time and quite a lot of headaches.

Give your clients the choice to pay in installments. Doing this will encourage more people to do business with you and ensure that you've got money coming in on a regular basis. Steady, regular payments, even if they're small, is a lot better than big payments that come in sporadically and you don't know when exactly they're going to come. Basically, you can easily make a budget and pay your bills promptly if you've got reliable income. You'll be a lot more confident about yourself if the financial side of your business is running smoothly.

Make sure you're prompt in paying your taxes. Small business generally have to pay taxes every three months. It's crucial that you have the most current and accurate information when it comes to small business taxes. For this, it's best that you get your information from the IRS or from the local small business center. There are also professionals you can work with who can set you up with payments and plans to make sure you're paying your taxes on time. The last thing you need is to have the IRS coming after you for tax evasion!

When you're in business, there are plenty of opportunities for you to improve yourself in the process. You can be better at managing your business, for example. There are very few people who wouldn't want to have better skills at managing their finances. Your self-confidence can be given a huge boost when you learn how to manage your money properly. In addition, it becomes easier to organize most areas of your professional and personal life. We've shared some tips for better money management for your small business in this article, and as you work and learn, you'll come up with plenty of others.

Bebington accountants will help with limited company accounting, consulting services, bookkeeping in Bebington, corporation tax Bebington, self-employed registrations, bureau payroll services Bebington, accounting support services Bebington, company formations, investment reviews Bebington, capital gains tax, National Insurance numbers, tax preparation, charities Bebington, cash flow, employment law in Bebington, sole traders, business planning and support, payslips, self-assessment tax returns, PAYE in Bebington, HMRC submissions, partnership registrations in Bebington, accounting services for start-ups, financial planning Bebington, management accounts, pension forecasts, financial and accounting advice, accounting services for the construction industry in Bebington, contractor accounts, auditing and accounting, taxation accounting services, payroll accounting Bebington and other accounting related services in Bebington, Merseyside. These are just an example of the activities that are handled by local accountants. Bebington companies will inform you of their entire range of accounting services.

You do, of course have the perfect resource close at hand in the form of the internet. There's so much inspiration and information available online for such things as self-assessment help, personal tax assistance, small business accounting and auditing & accounting, that you will soon be brimming with suggestions for your accounting needs. A good example may be this fascinating article on 5 tips for obtaining a reliable accountant.

Bebington Accounting Services

- Bebington Personal Taxation

- Bebington Self-Assessment

- Bebington Audits

- Bebington VAT Returns

- Bebington Tax Advice

- Bebington Chartered Accountants

- Bebington Bookkeeping Healthchecks

- Bebington Tax Returns

- Bebington Debt Recovery

- Bebington Specialist Tax

- Bebington Business Accounting

- Bebington Business Planning

- Bebington Financial Advice

- Bebington Account Management

Also find accountants in: St Helens, West Park, Halewood, Saughall Massie, Maghull, Netherton, Freshfield, Billinge, Newton Le Willows, Seacombe, West Derby, Gateacre, Seaforth, Prescot, Irby, Ainsdale, Raby, Wirral, Frankby, Childwall, Bidston, Formby, Crosby, Hoylake, Rainhill, Greasby, Churchtown, Birkdale, Crossens, Great Crosby, Prenton, Cronton, Oxton, Woodchurch, Clock Face and more.

Accountant Bebington

Accountant Bebington Accountants Near Bebington

Accountants Near Bebington Accountants Bebington

Accountants BebingtonMore Merseyside Accountants: Maghull, Litherland, Haydock, St Helens, Birkenhead, Formby, Bootle, Crosby, Halewood, Newton-le-Willows, Southport, Kirkby, Prescot, Liverpool, Heswall, Bebington and Wallasey.

TOP - Accountants Bebington - Financial Advisers

Online Accounting Bebington - Financial Advice Bebington - Self-Assessments Bebington - Financial Accountants Bebington - Tax Accountants Bebington - Chartered Accountants Bebington - Affordable Accountant Bebington - Small Business Accountant Bebington - Auditors Bebington