Accountants Wallasey: Do you seem to get little else but a headache when you're completing your yearly self-assessment form? You along with innumerable other self-employed Wallasey people will have to tackle this every twelve months. Is it easy to find a local professional in Wallasey to manage this for you? Do you find self-assessment just too time-consuming to tackle on your own? You should expect to pay out about £200-£300 when using the services of a regular Wallasey accountant or bookkeeper. By utilizing an online service instead of a local Wallasey accountant you can save a fair bit of money.

When searching for an accountant in Wallasey, you'll discover there are various types. Locating one that matches your precise needs should be a priority. Certain accountants work as part of an accountancy practice, whilst some work solo. Accountancy practices will have experts in each specific accounting department. Usually accounting firms will employ: actuaries, accounting technicians, management accountants, auditors, chartered accountants, forensic accountants, financial accountants, bookkeepers, cost accountants, tax accountants and investment accountants.

If you want your tax returns to be correct and error free it might be better to opt for a professional Wallasey accountant who is appropriately qualified. For simple self-assessment work an AAT qualification is what you need to look for. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form. Wallasey sole traders often opt to use bookkeeper rather than accountants for their tax returns.

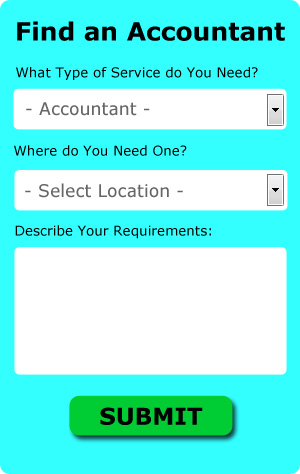

If you don't have the time to do a proper online search for local accountants, try using the Bark website. You just have to fill in a simple form and answer some basic questions. It is then simply a case of waiting for some suitable responses.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. This may save time and be more cost-effective for self-employed people in Wallasey. Make a short list of such companies and do your homework to find the most reputable. Study online reviews so that you can get an overview of the services available.

The cheapest option of all is to do your own self-assessment form. The process can be simplified even further by the use of software such as Andica, 123 e-Filing, GoSimple, Forbes, ACCTAX, Nomisma, Gbooks, Taxshield, Ablegatio, Sage, Taxforward, TaxCalc, Capium, BTCSoftware, Keytime, Ajaccts, Absolute Topup, Xero, CalCal, Basetax or Taxfiler. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time.

Forensic Accounting Wallasey

Whilst conducting your search for a professional accountant in Wallasey there's a good likelihood that you will stumble upon the term "forensic accounting" and be wondering what that is, and how it is different from regular accounting. The actual word 'forensic' is the thing that gives it away, meaning basically "denoting or relating to the application of scientific techniques and methods to the investigation of criminal activity." Sometimes also called 'forensic accountancy' or 'financial forensics', it uses investigative skills, auditing and accounting to delve into financial accounts in order to identify fraud and criminal activity. A few of the bigger accounting companies in the Wallasey area could even have specialist forensic accounting divisions with forensic accountants focusing on particular types of fraud, and may be addressing professional negligence, personal injury claims, bankruptcy, tax fraud, falsified insurance claims, insolvency and money laundering.

Auditors Wallasey

An auditor is an individual or a firm appointed by an organisation or company to execute an audit, which is an official assessment of an organisation's financial accounts, usually by an impartial body. Auditors examine the fiscal behaviour of the company which appoints them and make certain of the unwavering functioning of the organisation. For anyone to become an auditor they should have specific qualifications and be certified by the regulating body for auditing and accounting. (Tags: Auditor Wallasey, Auditing Wallasey, Auditors Wallasey)

Proper Money Management Tips for Small Business Owners

Starting your own business is exciting, and this is true whether you are starting this business online or offline. You are finally in charge of yourself, you are finally in charge of your income -- you are in charge of everything! It's a bit scary, isn't it? In addition to the excitement of being your own boss, it can be a bit intimidating particularly if you have no business experience. This is where knowing some simple self improvement techniques, like learning how to properly manage your money, can be quite helpful. If you'd like to keep your finances in order, continue reading this article.

Get yourself an accountant. Don't neglect the importance of having an accountant managing your books full time. Your accountant will be keeping track of the money that your business is bringing in and the money that goes on your expenditures. She will also help you figure out just how much you should pay yourself as well as how much money you need to pay for taxes. The best part is that you won't have to deal with the paperwork because your accountant will take care of that for you. As a result, you can put your energy towards making your business more profitable, such as creating new products, marketing, and increasing your customer base. The expense of having a business accountant is nothing compared to how much you'll save trying to figure out your finances and keeping everything in order.

Track your personal and business expenditures down to the last cent. Yes, it is a pain to track every little thing you buy, but it is quite helpful. With this money management strategy, you can have a clear picture of just what your spending habits are. Nobody likes that feeling of "I know I'm earning money, where is it going?" When you write all your personal and business expenditures, you won't ever have to wonder where your money is going. And when you're creating a budget, you can pinpoint those places where you're spending unnecessarily, cut back on them, and save yourself money in the process. It will also help you streamline things when you need to fill out your tax forms.

It's a good idea to keep your receipts. These receipts are going to be heaven-sent if the IRS ever come knocking at your door demanding to see proof of what you've been spending and where you've been spending your money on. They're also records of business related expenses. It's a good idea to have one place where you keep your receipt. This way, if you're wondering why your bank account is showing an expenditure for a certain amount, and you forgot to write it down, you can go through your receipts to find evidence of the purchase. The easiest way to keep track of them is with a small accordion file that you keep in your desk drawer.

Proper management of your business finances involves a lot of different things. It's a lot more than simply keeping a list of your expenditures. As a business owner, you've got numerous things you need to keep track of when it comes to your money. Tracking your money will become a lot easier for you if you apply the tips we've shared in this article. As you become more skilled in managing your business finances, you'll be able to implement other things that will help make the process easier for you.

Payroll Services Wallasey

For any company in Wallasey, from independent contractors to large scale organisations, staff payrolls can be stressful. Dealing with payrolls demands that all legal requirements in relation to their transparency, exactness and timing are observed in all cases.

Using a professional accountant in Wallasey, to handle your payroll needs is a easiest way to minimise the workload of your financial department. Working with HMRC and pension schemes, a payroll accountant will also handle BACS payments to personnel, making certain that they're paid promptly each month, and that all required deductions are done correctly.

Working to current regulations, a certified payroll management accountant in Wallasey will also present every one of your staff members with a P60 at the end of each financial year. A P45 form must also be provided for any member of staff who finishes working for your company, in accordance with current legislations. (Tags: Company Payrolls Wallasey, Payroll Services Wallasey, Payroll Accountant Wallasey).

Wallasey accountants will help with accounting services for media companies, year end accounts, self-employed registrations, bureau payroll services, annual tax returns, contractor accounts, business outsourcing in Wallasey, tax preparation in Wallasey, company secretarial services, auditing and accounting, accounting support services, HMRC submissions, employment law in Wallasey, pension forecasts, tax investigations, partnership accounts, investment reviews, company formations, accounting services for buy to let landlords, cashflow projections, mergers and acquisitions, litigation support in Wallasey, inheritance tax, bookkeeping, payslips Wallasey, partnership registration Wallasey, business acquisition and disposal, management accounts, workplace pensions, corporate finance Wallasey, business planning and support in Wallasey, charities and other accounting related services in Wallasey, Merseyside. Listed are just a handful of the duties that are performed by nearby accountants. Wallasey providers will keep you informed about their entire range of services.

Wallasey Accounting Services

- Wallasey Tax Investigations

- Wallasey PAYE Healthchecks

- Wallasey Financial Advice

- Wallasey Bookkeepers

- Wallasey Payroll Services

- Wallasey Business Accounting

- Wallasey Tax Returns

- Wallasey VAT Returns

- Wallasey Tax Planning

- Wallasey Tax Refunds

- Wallasey Personal Taxation

- Wallasey Chartered Accountants

- Wallasey Tax Advice

- Wallasey Audits

Also find accountants in: Marshside, Maghull, Churchtown, Birkdale, Bromborough, Woodchurch, Ford, Speke, Roby, Garswood, Seaforth, Little Crosby, Thornton, Mossley Hill, Prescot, Walton, Bebington, Upton, Childwall, Storeton, Waterloo, West Park, Hoylake, Eastham, Aigburth, Wallasey, Irby, Sefton, Gayton, Allerton, St Helens, Rainford, Garston, Newton Le Willows, Melling Mount and more.

Accountant Wallasey

Accountant Wallasey Accountants Near Wallasey

Accountants Near Wallasey Accountants Wallasey

Accountants WallaseyMore Merseyside Accountants: Southport, Bootle, Maghull, Crosby, Formby, Halewood, Prescot, Liverpool, Birkenhead, Newton-le-Willows, St Helens, Bebington, Litherland, Kirkby, Haydock, Wallasey and Heswall.

TOP - Accountants Wallasey - Financial Advisers

Self-Assessments Wallasey - Affordable Accountant Wallasey - Investment Accountant Wallasey - Financial Advice Wallasey - Tax Preparation Wallasey - Bookkeeping Wallasey - Chartered Accountant Wallasey - Auditors Wallasey - Financial Accountants Wallasey